AI Growth Sparks Surge in Power Infrastructure - 2 Stocks to Watch Closely

July 21, 5:55 am

The rise of artificial intelligence isn’t just about chips, GPUs, and big tech - it’s also about something more grounded: electricity. As major tech companies like Microsoft, Google, Meta, and Amazon continue building massive data centers to support AI, they’re running into a major bottleneck: power. More specifically, the infrastructure and skilled labor needed to install, connect, and maintain that power.

And that’s where companies like Quanta Services (PWR) and MYR Group (MYRG) come in. These firms don’t just benefit from the AI race - they’re essential to it. At AltIndex, our alternative data and AI-driven insights show both companies are positioned to thrive as demand for energy infrastructure and skilled electricians grows in step with AI’s explosive momentum.

Quanta Services: Powering AI’s Infrastructure

Quanta Services (PWR) is one of the most strategically important players in this shift. The company provides specialized contracting services for electric power, renewable energy, and communications infrastructure. This is what’s needed to build and maintain modern data centers.

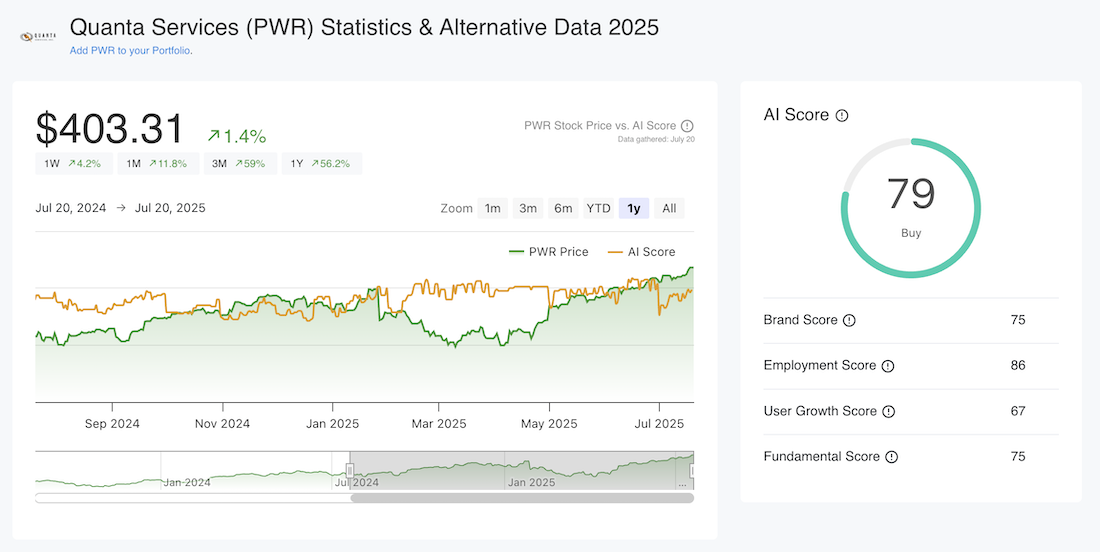

- AI Score: 79 — Buy Signal

- Stock price: $403 (All-time high)

- Target price: $482

- Revenue: Up year-over-year

- Employee growth: +17% YoY (LinkedIn data)

- Job postings: Rising, indicating expansion

- Employee sentiment: 91% positive business outlook

This growth isn’t just theoretical. The company is hiring aggressively, signaling increasing demand. Employee satisfaction is also trending up, with 91% of Quanta’s workforce expressing confidence in the company’s direction. In a previous article, we explored how a high business outlook often correlate with steady stock appreciation.

In a world where data centers are rapidly becoming the backbone of AI, Quanta Services is building the power grids and systems that make it all possible. That’s why our algorithm gives it one of the highest scores in the industrial space right now.

Note that we already highlighted PWR as a buy in an article that we posted in July last year. The stock is since up 56%.

MYR Group: A Strong Challenger With Room to Run

MYR Group (MYRG) might not be as well known as Quanta, but it's making serious waves. The company specializes in electric utility infrastructure, providing services from transmission lines to substations. As data centers consume more energy, these systems are becoming mission-critical.

- AI Score: 60 — Buy Signal

- Stock price: $191

- Target price: $207

- Net income: Up 46% last quarter

- Employee growth: +13.3% YoY (LinkedIn data)

- Employee sentiment: 71% have a positive business outlook

- Insider buying: CFO and senior director purchased shares

- Analyst consensus: 75% buy rating

What sets MYR apart is its execution. The company has delivered strong quarterly earnings and continues to see growth in both hiring and sentiment. Insider buying is also a bullish signal - when executives put their own money behind the stock, it shows confidence that the growth trend will continue.

The Big Picture: Demand for Electricians and Infrastructure Is Surging

As tech giants race to build out AI infrastructure, one thing is clear: they will need thousands of skilled electricians and massive upgrades to power systems across the U.S. The demand is so high that companies are expected to overpay just to get projects off the ground. That puts Quanta and MYR in a uniquely powerful position.

They don’t just build power infrastructure. They are the infrastructure behind the infrastructure.

Why AltIndex Is Bullish

At AltIndex, we use alternative data like employee growth, job postings, insider trades, and online sentiment to anticipate trends before they show up in earnings reports. Both Quanta Services and MYR Group are showing strong signals across the board:

- Growing teams and rising job postings

- High and improving employee outlook

- Positive insider and analyst sentiment

- Strong financial performance

These are the kinds of companies that quietly outperform when infrastructure becomes a limiting factor. With AI demand skyrocketing, we believe Quanta Services and MYR Group are well positioned for continued upside.

Want to track alternative data insights like these? Sign up at AltIndex to get real-time alerts on employee growth, insider trades, and AI-powered buy/sell signals.

Disclaimer: The information provided is for educational and informational purposes only and should not be construed as financial or investment advice. All investments involve risk, and you should conduct your own research or consult a qualified professional before making any investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.