Alternative data points toward Airbnb boom

August 16, 7:32 am

Covid-19 spelt doom for the tourism industry in 2020 and 2021, with many countries shutting their borders to international visitors. But with the threat posed by the coronavirus settling down, many countries have now lifted travel restrictions, allowing the industry to grow again. One company that benefits from this situation is Airbnb.

Since its Nasdaq debut in late 2020, ABNB has soared as much as 223%. It hit an all-time high of $219.94 on February 11th 2021, since its initial offering of $68 per share. Even though the company suffered a loss in the first quarter of 2022, ABNB recorded a stellar comeback with $379 million in net income in the next quarter. Despite looming macroeconomic conditions, some analysts believe ABNB can resist a downturn.

In this post, we shed some insights using alternative data to show why ABNB could present a buying opportunity for investors.

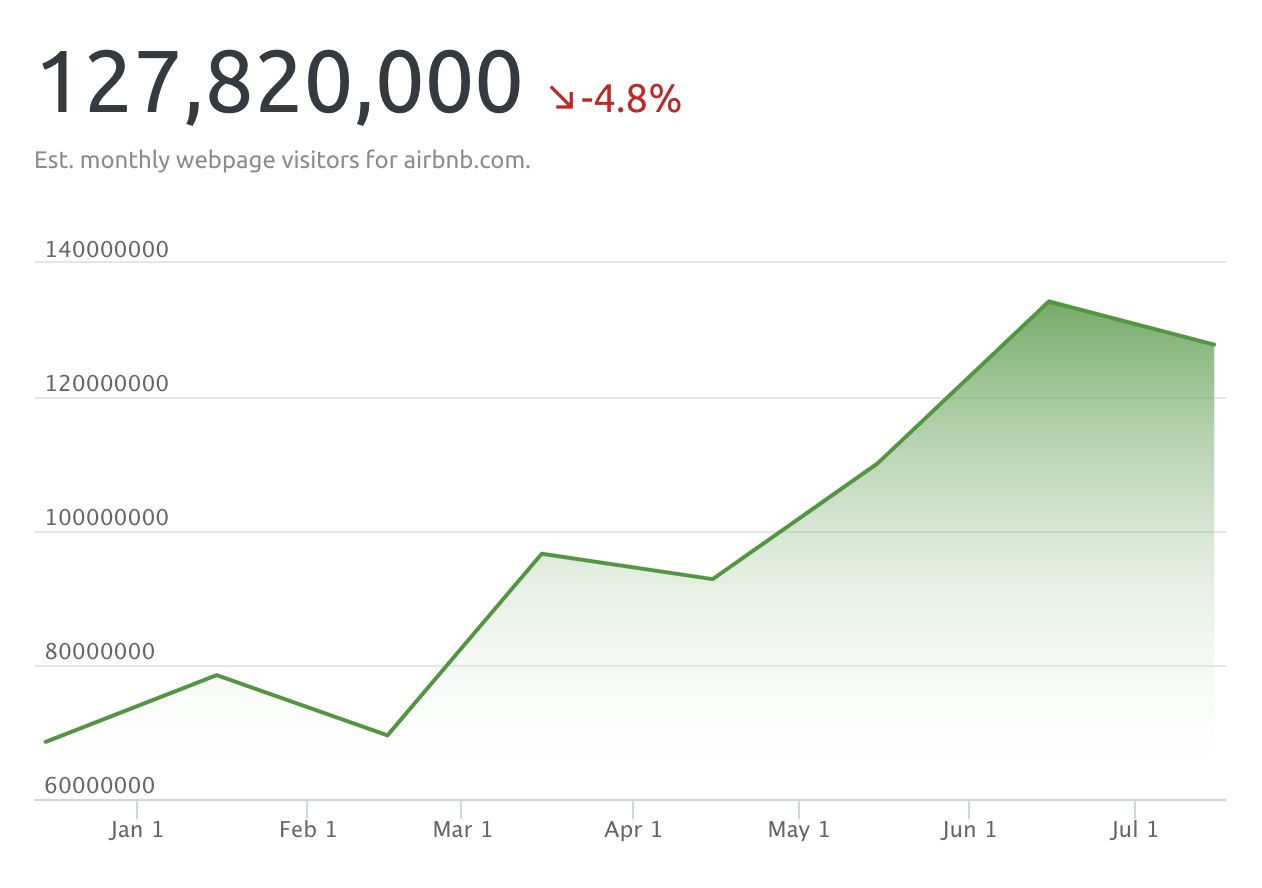

Growth in webpage traffic

Using multiple data providers, DilliBits has aggregated webpage traffic to airbnb.com. The data indicate that webpage traffic is steadily growing, with more than 127 million monthly visitors in July. The website had less than 80 million average visitors at the start of the year, which has since grown consistently. The stock price fluctuated during this period, but growing traffic could signal an upward trend.

Airbnb’s daily mobile app download figures have also grown gradually, up to an average of 85,000 (estimated) daily downloads from 61,000 in January.

The company has also had a 13% increase in subscribers on Youtube, a platform home to 2 billion users worldwide. As youtube grows more popular, the increasing popularity of Airbnb on the platform could indicate a growth in returning and new customers.

Steady job postings amid high inflation

As the world looms in high inflation, Airbnb has demonstrated steady job openings throughout the year. The ability to maintain their job openings at a constant level projects steady growth. As 72% of the businesses we monitor declined in open job posting statistics last month, companies that deflected away from this trend present an opportunity.

ABNB is also increasing its Google Adspend expenditure, which indicates marketing efforts to attract more customers.

The Surprise Element

Airbnb hosted more than 100,000 guests during the world cup in Rio and nearly 300,000 during the world cup in Russia. Later this year, Qatar will host the football mega event, and Australia will welcome cricket fans worldwide for the T20I World Cup. These are just two significant events for Airbnb. As the world continues to open up, we can expect to see more people looking for alternative stays, which will benefit the San Francisco-based company.

Alternative data on Airbnb point towards further growth for the company. With an impressive financial statement, increase in web traffic, app downloads, social media following, and a world now opening up post-pandemic, Airbnb could be one to watch out for long-term investors. If you find these insights informative, please sign up or join our newsletter to stay up to date.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.