Alternative data suggest that Cloudflare (NET) is a buy

May 19, 2021, 7:21 am

The last couple of weeks have been brutal for tech stocks. But I believe that this drop presents a lot of buying oppurtunities and today I’m going to focus on a long-time friend of mine, Cloudflare.

Cloudflare is a cloud services provider that makes the internet faster, more reliable, and more secure. After becoming a public entity in late 2019, the company is yet to generate profit but reported bottom-line numbers that mostly beat the consensus estimates in Q1. The company caught my eye early as I was starting to use their services and discovered that they were ahead of their competition. I quickly hit Reddit and realized that I was not alone with this sentiment. This was back in June of 2020 and the stock quickly grew by over 100%.

2021 has been less kind to the stock with it being down 6% year to date. But latest alternative data shows that the web infrastructure company is on track to tap the unfolding opportunities, supported by growing webpage traffic, downloads and job postings.

Steady webpage traffic growth

According to webpage traffic from multiple data providers, April was a strong month with more than 12M visitors to Cloudflare.com. This number has been steadily growing by 8% month over month since December (stock price has slightly decreased during same time period). The average visitor is also visiting more pages and staying longer on their webpage.

And it’s not only their webpage traffic that gets more visits. Their app downloads is at an all-time high with more than 4.5M downloads in the last 30 days.

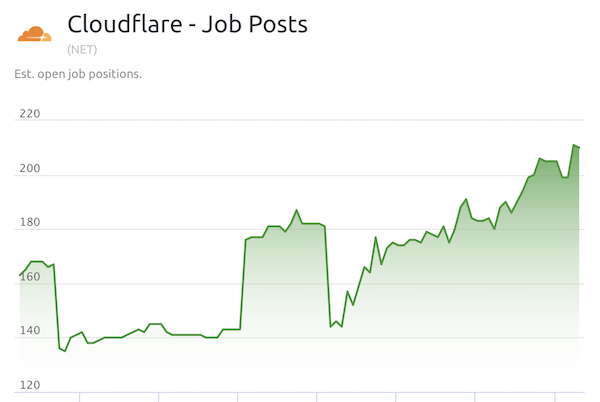

Number of open job posts have doubled

In February, Cloudflare had an average of 140 open job positions. Today that number has surged to over 200 which tells me that the company is expecting to grow even faster.

Another piece of interesting nugget regarding jobs: according to LinkedIn data, the number of employees are up by 5% over the last 2 months.

How about the competition?

Cloudflare is often benchmarked against Fastly, another cloud computing services provider, and while Cloudflare’s stock has been flat year to date, Fastly has plummeted by more than 50%. Fastly might have been overvalued last year, but that it still a big pill to swallow. And it doesn’t help that Fastly’s webpage traffic is down more than 10% since January.

Their number of employees, according to Linkedin, has been fairly flat since March, indicating that the company is not growing as fast as Cloudflare.

Fair to say, I think Cloudflare is a safer bet.

Summary

Cloud stocks should be flourishing as more businesses shift their operations online. But the scare of inflation and a more “moderate” view at tech stocks in 2021 have erased what, in my opinion, should have been a price increase for several good tech stock. Cloudflare is involved in a lot of potential growth drivers such as serverless computing, internet of things (IoT), and 5G (it’s no surprise that one of the most common themes in Reddit mentions for Cloudflare is “growth”). These present massive opportunities for the company to tap into.

With earnings and revenue in Q1 topping analyst estimates, Morgan Stanley’s price target of $91 and growth in webpage traffic, downloads, job postings and employees, I’ve started to add to my position in Cloudflare.

Note: This is not financial advice. Do your own DD.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.