AltIndex Adds Insider Trading Feature: A Closer Look at Jeff Bezos's $2 Billion Stock Offload

February 11, 8:02 am

In the ever-evolving landscape of investment tools and resources, AltIndex is proud to announce a new enhancement to our platform: the introduction of an Insider Trading section on our stock pages. This new feature is designed to empower investors with detailed insights into insider transactions, offering a deeper understanding of the stocks they are interested in.

Why Insider Trading Data Matters

For savvy investors, tracking the buying and selling activities of company insiders has always been a strategy worth considering. Insiders, including executives, board members, and stakeholders with substantial shares, possess an intimate understanding of their company's operations, future prospects, and potential challenges. Therefore, their trading activities can provide valuable signals to the market.

When insiders buy shares, it often indicates their confidence in the company's future performance, suggesting a bullish outlook. Conversely, insider selling does not inherently signal a lack of faith in the company's prospects. It may reflect a variety of personal or strategic reasons, such as diversifying assets, tax planning, or realizing gains.

A Closer Look at Insider Transactions

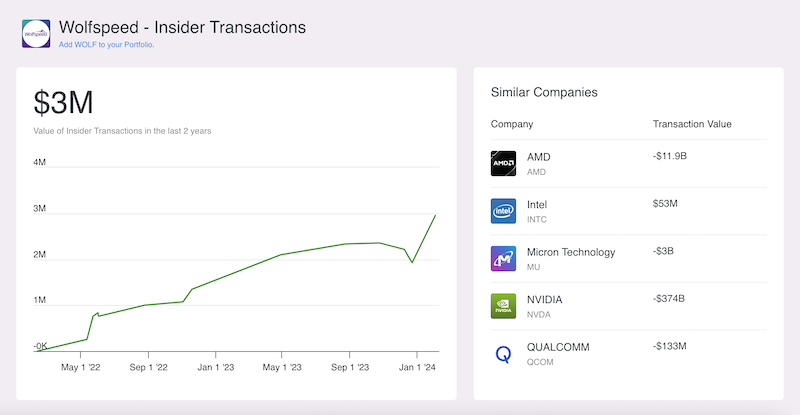

The centerpiece of AltIndex's new feature is a comprehensive chart detailing the value of all insider transactions over the last two years. This visualization not only highlights the volume of insider trading but also offers context to these activities, enabling investors to discern patterns or significant events.

For instance, the recent acquisition by Warren Buffet of a major stake in Occidental Petroleum underscores a strong belief in the company's value and potential. Similarly, the increased positions of three insiders in WolfSpeed hint at the company's unrecognized potential within the semiconductor industry, marking it as a stock to watch.

Screenshot of WOLF Insider Transactions

The Case of Jeff Bezos and Amazon

A notable example of insider trading activity is Jeff Bezos's sale of approximately 12 million Amazon shares, valued at nearly $2 billion. This move, part of a pre-announced plan to sell up to 50 million shares by January 2025, has captured widespread attention. However, it's crucial to interpret such actions within their proper context. Amazon's disclosure of this plan in their latest annual report, coupled with Bezos's interest in funding his space venture, Blue Origin, suggests strategic portfolio management rather than a bearish outlook on Amazon's future.

AltIndex's Mission

At AltIndex, our mission is to democratize access to comprehensive financial, technical, and alternative data insights for retail investors. We believe that informed investment decisions are the cornerstone of financial empowerment. By integrating insider trading data into our stock analysis tools, we aim to provide our users with a more nuanced understanding of market dynamics and the confidence to make smarter investment choices.

In a world where information is power, AltIndex is your partner in navigating the complexities of the stock market, offering clarity and insight in an often opaque financial landscape. Join us on this journey to investment success, where informed decisions lead to brighter financial futures.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.