AltIndex Launches Technical Analysis Page, Enhancing Investment Decision-Making

December 15, 8:54 am

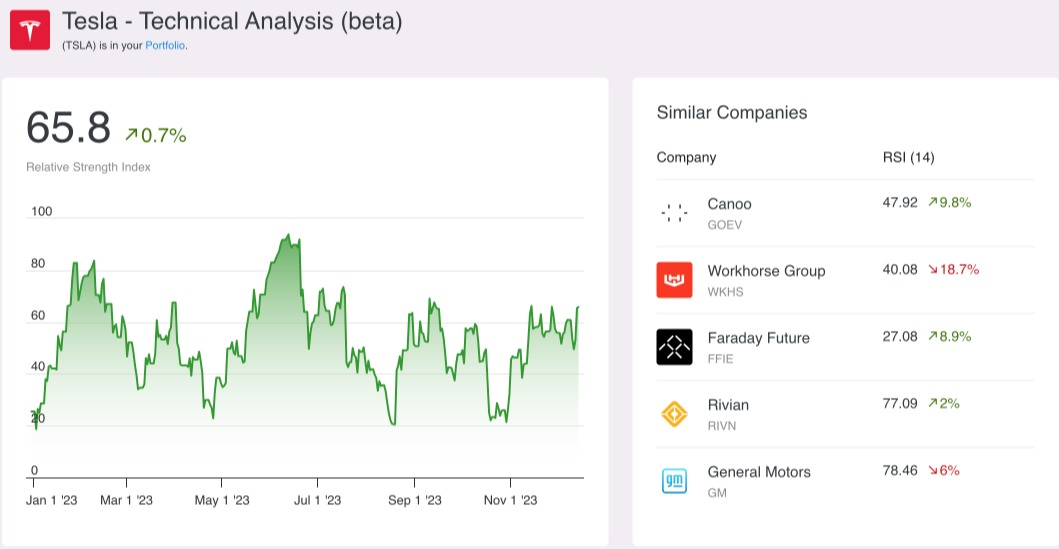

AltIndex, known for its comprehensive approach to stock market data, has expanded its offerings with the Technical Analysis page. This addition aligns with AltIndex's commitment to providing in-depth and accessible financial data. It caters to both novice and experienced investors, emphasizing a practical approach to stock market analysis through a range of technical indicators, including the Relative Strength Index (RSI).

Screenshot of the Technical Analysis for Tesla

Understanding Technical Analysis in Investing

The Technical Analysis page serves as a foundational resource for understanding the role of technical analysis in investing. Technical analysis involves studying market statistics, primarily past prices and volume, to forecast future stock price movements. This method contrasts with fundamental analysis, which focuses on a company's financials and industry conditions.

Technical analysis is an essential tool for identifying market trends, patterns, and potential shifts in stock prices. It helps investors gauge market sentiment and make predictions based on historical data. The new page on AltIndex demystifies these concepts, making them accessible and actionable for its users.

A Comprehensive Suite of Indicators

The page includes a diverse range of indicators, each offering distinct insights:

Moving Averages: Useful for spotting trends and potential trend reversals.

STOCH (9,6) and STOCHRSI (14): Indicators for understanding market overbought or oversold conditions.

MACD (12,26): A momentum indicator that reveals relationships between two moving averages of a stock’s price.

CCI (14): Useful in identifying cyclical trends in stock prices.

ATR (14) and ROC: These provide insights into market volatility and the rate of price change.

Emphasizing a Three-Pronged Analytical Approach

In the realm of investment analysis, there are three critical pillars: fundamentals, technicals, and alternative data insights. Fundamentals focus on the financial health and operational efficiency of a company, technicals delve into market trends and patterns through statistical analysis, and alternative data insights provide unconventional perspectives that often uncover hidden aspects of a company's future potential.

AltIndex's platform now embodies this triad of analytical perspectives, offering users a comprehensive and multifaceted approach to stock evaluation. Investors have the unique advantage of accessing a wide array of data points, from in-depth earnings reports and market trend analysis to innovative alternative data insights, all in one place. This integration of diverse data types ensures that users of AltIndex have a well-rounded, informed view of the stocks they are interested in, allowing them to make more nuanced and effective investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.