AltIndex Predicts: Tupperware Stock Sinks as Company Files for Bankruptcy

September 17, 5:33 pm

Tupperware Brands (TUP), a name synonymous with food storage solutions, is on the verge of filing for bankruptcy, signaling the collapse of a company that once held a firm grip on American households. According to insiders, the home-goods giant is preparing to enter court protection after breaching the terms of its debt agreements, with over $700 million in liabilities weighing heavily on the business. The company has enlisted financial and legal advisors to navigate the complex process, but the future looks bleak. On the news of the impending bankruptcy, Tupperware’s stock tumbled by more than 50%, marking yet another blow for the embattled brand.

The path to this downfall has been long and troubling. Despite efforts to revive the business, Tupperware has faced declining demand for its once-popular products. Last year, the company underwent significant leadership changes, replacing CEO Miguel Fernandez with Laurie Ann Goldman in a desperate attempt to right the ship. In June, Tupperware announced the closure of its only U.S. factory and laid off 150 employees, a decision that underscored the financial strain it was under.

Tupperware's iconic plastic containers, introduced to the world in 1946, once defined the food storage market. Its innovative airtight seal, paired with a unique direct sales model driven by suburban women hosting Tupperware parties, helped it flourish. But as consumer behavior shifted and competition grew, the company failed to adapt. By 2022, the company still relied on over 300,000 independent salespeople—a strategy that could not withstand the forces of modern e-commerce and retail disruption.

AltIndex’s Early Warnings: A Sell Signal Before the Crash

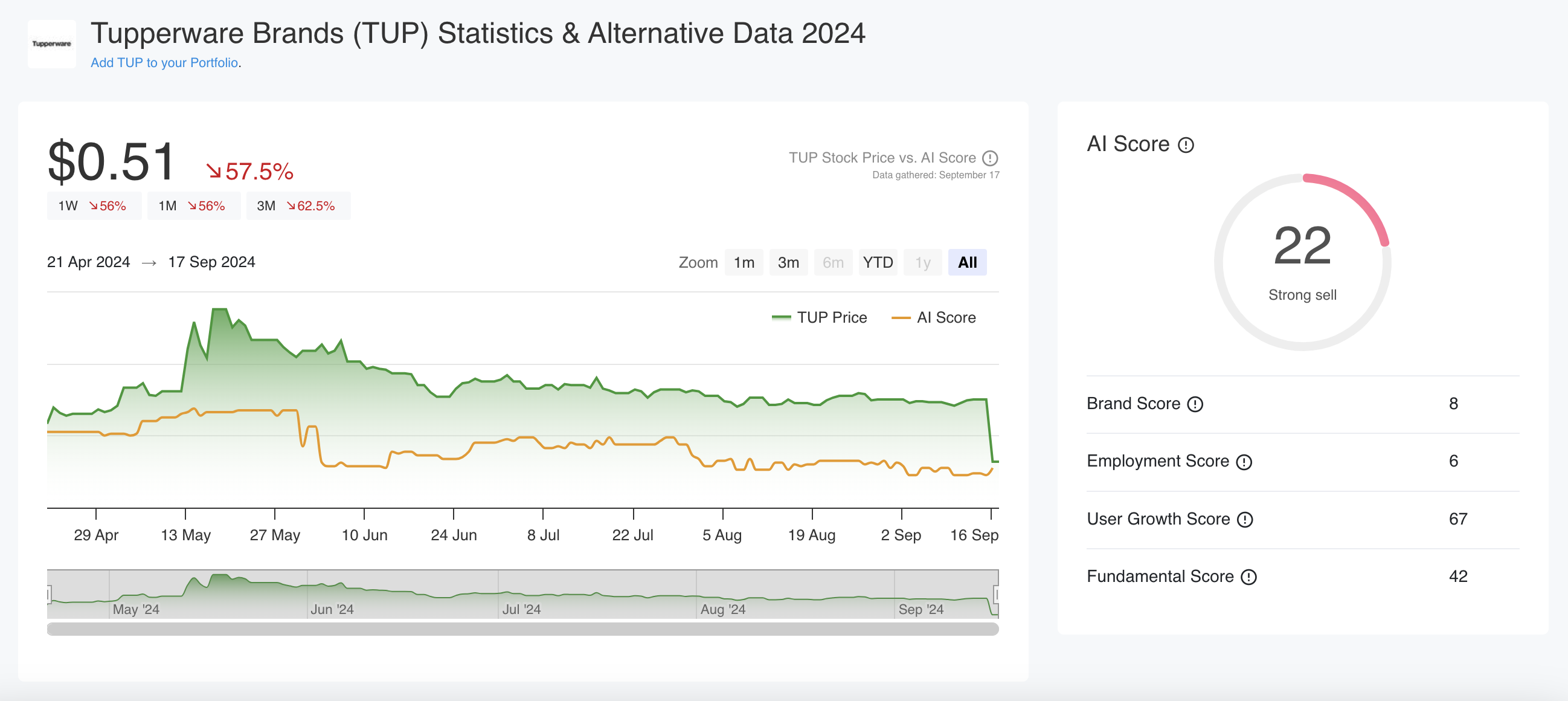

At AltIndex, we identified Tupperware's struggles long before the broader market. Our alternative data insights offered members a sell signal as early as June, when the AltIndex AI score for Tupperware plummeted to 25, indicating a strong sell. This decision was based on a variety of factors, particularly drawn from alternative data sources, which revealed the underlying issues plaguing the business.

Key metrics that contributed to this sell signal included a long-term decrease in the company’s Twitter and Instagram followers - social media platforms that have become essential for brand visibility and engagement. Additionally, Tupperware saw a continuous drop in job postings, a telltale sign of a company scaling down rather than preparing for growth. Internal sentiment also pointed in the wrong direction, with employee satisfaction declining month over month and business outlook from within the company deteriorating steadily.

Financial data further confirmed our suspicions, as Tupperware’s revenue suffered quarter after quarter, reinforcing the bearish outlook.

Since issuing our sell signal, Tupperware’s stock has plummeted by over 70%, rewarding investors who acted on our recommendation with significant gains from shorting the stock.

The Power of Alternative Data in Investing

Tupperware’s collapse serves as a cautionary tale for investors, but it also highlights the immense power of alternative data in predicting market moves before they become headline news. At AltIndex, we leverage data that goes beyond traditional financial metrics—social media trends, employee sentiment, hiring patterns, and more—to provide a deeper understanding of a company’s trajectory. In the case of Tupperware, these signals were clear long before the bankruptcy filing, offering proactive investors the chance to make informed decisions and capitalize on market downturns.

As the world of investing continues to evolve, staying ahead of the curve means embracing new tools and insights. Alternative data has proven its value time and again, and for investors seeking to navigate volatile markets, it offers a distinct advantage. Whether identifying short opportunities like Tupperware or uncovering hidden growth stocks, alternative data is reshaping how we understand companies and their potential.

For investors looking to uncover more opportunities like Tupperware, where alternative data signals potential shorting opportunities, AltIndex offers comprehensive insights. To read more about stocks to short based on our AI-powered analysis, head over to our dedicated section, Best Stocks to Short or sign up to get access to our weekly newsletter and stock alerts.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.