The Best Dividend Stocks to Watch in 2025

December 18, 10:00 am

Dividend stocks have long been seen as a strategic way to generate a steady stream of income, while potentially benefiting from stock price appreciation. As we move into 2025, the economic landscape suggests that well-selected dividend-paying companies could be a solid part of a balanced portfolio. With interest rates projected to remain moderate and many companies increasing their shareholder returns, dividend stocks can offer not only cash distributions but also a measure of stability against market uncertainty. In addition, many dividend-paying firms tend to have mature business models, robust cash flows, and a track record of rewarding their shareholders.

Here are five dividend stocks that could perform well in 2025. Our analysis at AltIndex points to solid fundamentals, upbeat analyst opinions, and encouraging alternative data signals - like growing hiring, high employee satisfaction, and strong online interest.

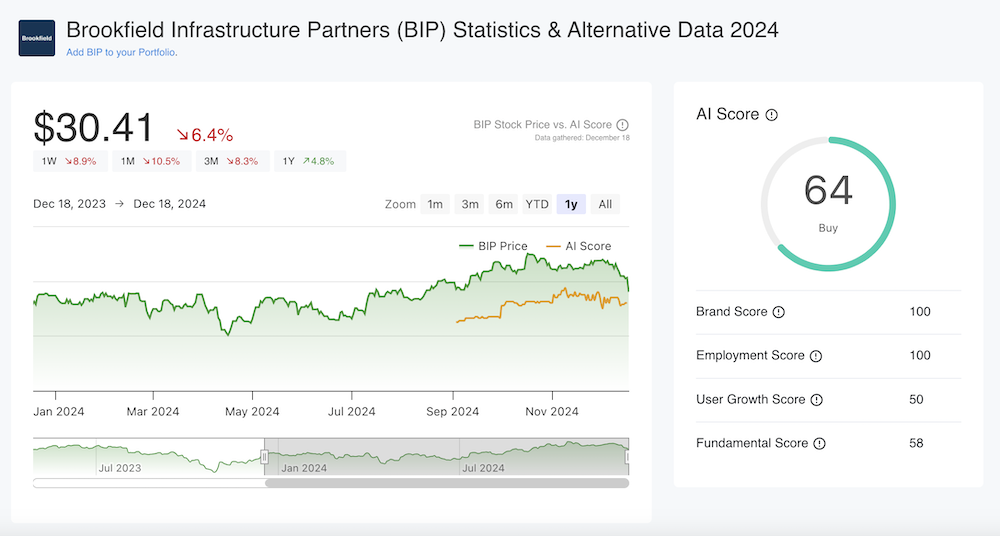

Brookfield Infrastructure Partners (BIP)

Price: $32.49

Price Change YoY: 12%

Dividend Yield: 5%

AI Score: 64

Why BIP Could Excel in 2025:

Brookfield Infrastructure Partners is well-positioned to thrive in an environment where global infrastructure needs are expanding. Our algorithm highlights a surge in social media followers, indicating growing retail investor interest. The stock also boasts a 100% buy rating from analysts, suggesting widespread confidence among professionals. A spike in job postings signals corporate growth, while the jump in revenue year over year illustrates the company’s resilience and its potential to increase shareholder distributions in the future.

View BIP Price, AI Score & Alternative Data Insights

Alliance Resource Partners (ARLP)

Price: $26.04

Price Change YoY: 48%

Dividend Yield: 10.5%

AI Score: 65

Why ARLP Could Excel in 2025:

Alliance Resource Partners has benefited from stable commodity prices and disciplined cost management. A smaller but meaningful uptick in revenue in the last quarter suggests consistent performance in its core operations. The company also enjoys a 100% buy rating from analysts, and our algorithm notes a substantial improvement in employee sentiment, reinforcing a positive internal view of the company’s future. This all adds up to a compelling story for investors looking for a high-yielding dividend player in the energy and materials sector.

View ARLP Price, AI Score & Alternative Data Insights

Trinity Capital (TRIN)

Price: $14.44

Price Change YoY: 7.8%

Dividend Yield: 14%

AI Score: 67

Why TRIN Could Excel in 2025:

Trinity Capital stands at the intersection of venture funding and structured capital solutions. A notable increase in insider buying suggests that company leaders are confident in the stock’s future prospects. High employee satisfaction indicates a strong internal culture that could lead to steady operational performance. Furthermore, we believe that venture capital firms specializing in growth capital will see upside with the new U.S. administration’s focus on stimulating domestic investment. This environment could pave the way for Trinity’s portfolio companies to flourish, thereby supporting dividend growth.

View TRIN Price, AI Score & Alternative Data Insights

Petrobras (PBR)

Price: $13.52

Price Change YoY: -3.2%

Dividend Yield: 13.2%

AI Score: 70

Why PBR Could Excel in 2025:

Petrobras is poised for a stronger showing, despite its recent dip in stock price. Our algorithm is encouraged by the month-over-month spike in job postings, suggesting that the company is ramping up its operations. Combined with solid financials, positive employee feedback, and a 100% buy rating from analysts, there is a sense of renewed momentum. Notably, Petrobras will rejoin the Dow Jones Sustainability Index in February 2025, signaling a commitment to responsible business practices that can attract a broader range of investors. A high dividend yield further sweetens the proposition for income-focused investors.

View PBR Price, AI Score & Alternative Data Insights

Rio Tinto (RIO)

Price: $61.46

Price Change YoY: -10.8%

Dividend Yield: 6.99%

AI Score: 73

Why RIO Could Excel in 2025:

Rio Tinto, a global mining heavyweight, has strong fundamentals that our model finds appealing. Month-over-month increases in job postings suggest the company is preparing for growth in demand for metals and minerals. Its solid financials and favorable internal sentiment, backed by a 100% buy rating from analysts, provide additional reassurance. Rio Tinto’s substantial dividend yield, near 7%, makes it an attractive option for investors seeking both income and long-term exposure to essential commodities markets.

View RIO Price, AI Score & Alternative Data Insights

Conclusion

As 2025 unfolds, these dividend stocks stand out as compelling picks that combine high yields with growth-oriented signals. At AltIndex, we specialize in uncovering these types of opportunities through alternative data insights, giving you the confidence to make more informed investment decisions. By carefully analyzing metrics that go beyond traditional fundamentals - such as hiring trends, employee satisfaction, and social media presence - AltIndex empowers investors to uncover hidden value and stay ahead of market shifts.

For an updated perspective, visit our Best Dividend Stocks page, updated daily with fresh data and ratings, so you can stay a step ahead of the market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research or consult a qualified financial professional before making investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.