Beyond Meat: Why Investing in the 'Hype' May Leave You Burned

March 16, 5:45 pm

Beyond Meat ($BYND) has been cooking up a storm as a pioneer in the plant-based meat industry. Though their last earnings report brought a pinch of good news with a slight increase in revenue and the CEO spicing things up with talk of sustainable growth, investors should chew on some concerning factors. Let’s dig in.

Beyond Meat went public in early May 2019 amidst massive hype, and its stock price soared up to $234 per share to the delight of early investors. However, the company has since struggled to turn a profit, remaining unprofitable for several years. Additionally, reports indicate that Beyond Meat is burning through its cash on hand, with less than a year of cash runway left.

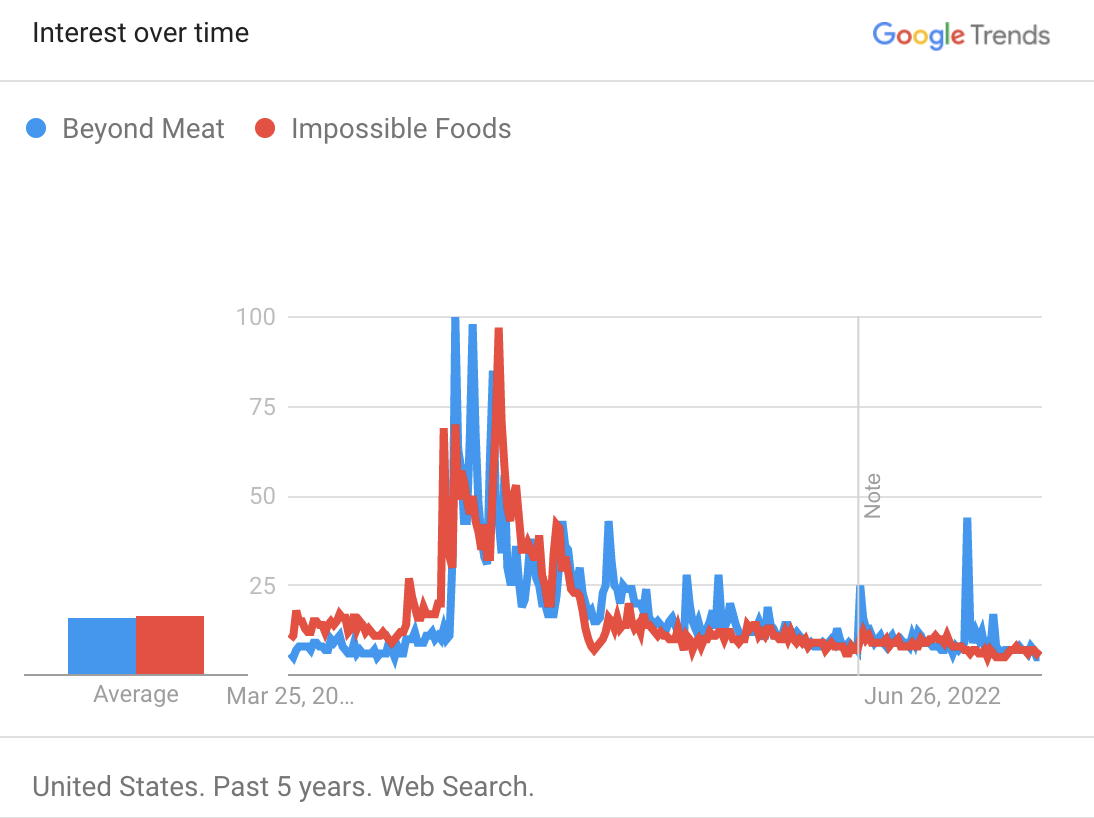

The early hype for plant-based burgers, Beyond Meat's main product, is fading. Google searches for Beyond Meat and its main competitor, Impossible Foods, have been trending down since 2019 which suggests that interest in these products is on the decline.

The hype amongst the company’s employees has also taken a hit according to reviews on sites like Glassdoor and LinkedIn. Many employees have cited poor management as a significant issue, leading to employees questioning the future of the company. Business outlook amongst employees has dropped from a high of 85 out of 100 in late 2019 to 42 in March this year.

In addition to the issues mentioned, Beyond Meat's website traffic has taken a 50% nosedive over the past two years, which could be described as a recipe for disaster.

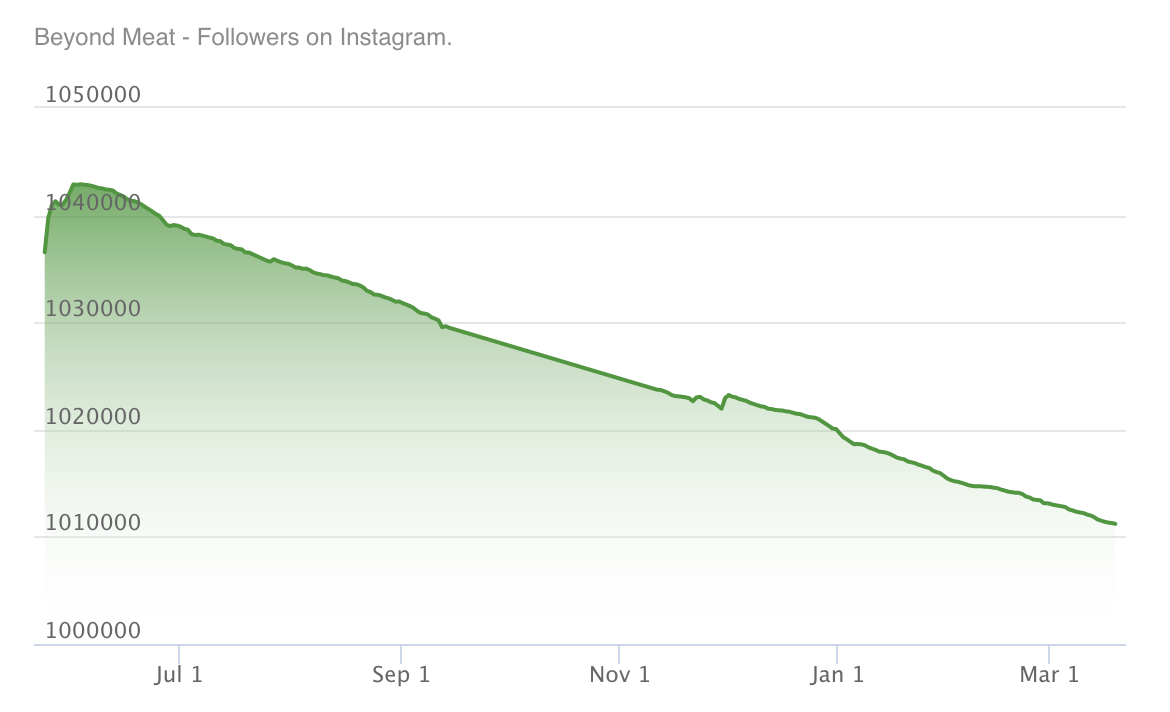

Furthermore, the company's social media channels have also struggled, with over 30,000 followers leaving Beyond Meat's Instagram page in the last year. This lack of engagement could be a red flag for potential investors, as a drop in webpage traffic and social media following could result in a decline in sales and overall company growth.

In summary, while Beyond Meat has had some positive moments, there are several reasons why investing in the company may leave a bad taste in the mouth of investors. These include declining interest in plant-based burgers, lack of profitability, employee dissatisfaction, declining business outlook, and a lack of growth in web traffic and social media engagement. Investors should carefully consider these factors before deciding to invest in Beyond Meat.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.