Bitcoin Sentiment Turns Positive as US Fed Cuts Interest Rate

September 19, 10:01 am

The Federal Reserve’s decision to reduce interest rates for the first time since the early days of the COVID-19 pandemic has sent waves through financial markets, and the cryptocurrency space is no exception. On September 19, 2024, Bitcoin, the world's leading cryptocurrency, responded with a sharp increase, jumping 5 percent in value shortly after the announcement. As of 9:08 am this morning, Bitcoin was trading at $63,200, marking a significant uptick from its recent trading levels.

This surge in Bitcoin's price follows the Fed's decision on September 18 to cut its benchmark interest rate by 0.5 percentage points. The move, which comes just months ahead of the November presidential election, is a marked departure from the central bank's previous strategy of keeping rates elevated to combat inflation. With the Fed now nearing its long-term inflation target of 2 percent, the rate cut is expected to have widespread implications for the broader economy, influencing borrowing costs for consumers and businesses alike.

For investors, the Fed's rate cut signals a more favorable environment for higher-risk assets like cryptocurrencies. Historically, lower interest rates tend to drive demand for such assets, as they offer the potential for higher returns compared to traditional investments like bonds. Bitcoin, often dubbed 'digital gold,' appears to be benefiting from this renewed appetite for risk.

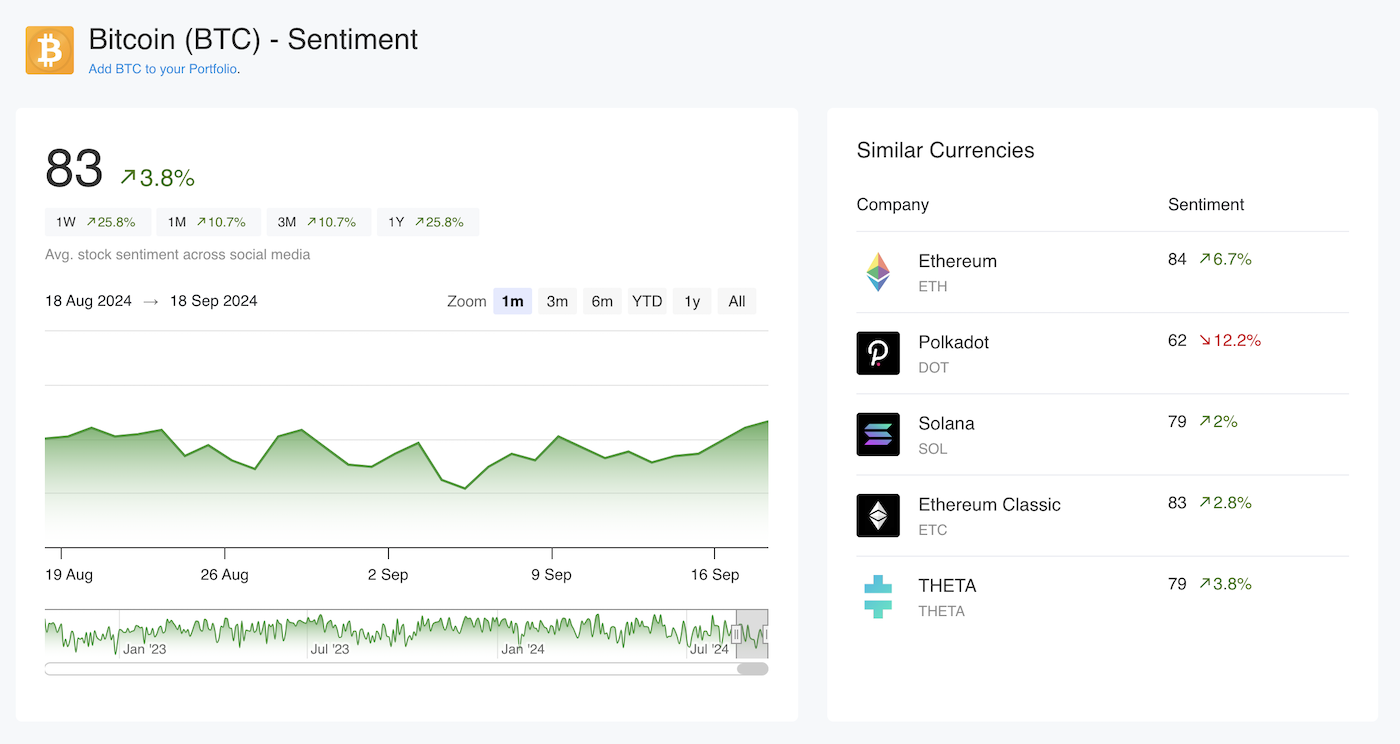

Uptick in sentiment

But it's not just the price that's on the rise; sentiment around Bitcoin has also seen a notable shift. Our sentiment data at AltIndex shows that after hovering around neutral for weeks, sentiment has surged to 83 on a scale of 0 to 100, indicating very positive sentiment in the market. This positive outlook is echoed by industry voices such as hedge fund manager Anthony Scaramucci, who recently suggested that the combination of the Fed’s rate cut and increasing regulatory clarity in the US crypto space could propel Bitcoin to new record highs.

In addition, Google search trends for Bitcoin are starting to climb, hinting at growing interest in the cryptocurrency. This uptick in searches could be an early sign of a new bull cycle, as more investors turn their attention back to Bitcoin in response to the changing economic landscape.

As the market digests the Fed’s rate cut and its broader implications, all eyes will be on Bitcoin to see if this rally can be sustained. For now, the combination of a favorable macroeconomic backdrop and positive market sentiment suggests that Bitcoin might be poised for further gains in the near future.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.