Canoo (GOEV) Drops from $228 to $0 and Shuts Down, 16 Months After Our Sell Signal

January 22, 4:55 am

This week, Canoo (GOEV) announced that it would be ceasing operations and filing for Chapter 7 bankruptcy. The electric vehicle (EV) maker, once touted as a pioneer in the EV space, is once again reminding us about the importance of tracking alternative data for investors.

The Rise and Fall of Canoo

Canoo launched in 2017 with an ambitious vision: to redefine the EV market with its unique "lifestyle vehicle." The company’s innovative skateboard chassis allowed for a swappable design, catering to multiple use cases such as delivery vans, passenger vehicles, and pickup trucks. Canoo gained significant attention for its futuristic approach and managed to secure notable partnerships with the U.S. Army, Walmart, USPS, and even the state of Oklahoma. However, these wins were not enough to sustain the company.

On January 17th, Canoo announced its insolvency after failing to secure desperately needed funding. Negotiations with the U.S. Department of Energy’s Loan Program Office and foreign investors ultimately proved unsuccessful. Chairman and CEO Tony Aquila expressed disappointment over the outcome and thanked employees and customers for their support, stating in a press release that operations would cease immediately and the company’s assets would be liquidated.

From Investor Darling to Bankruptcy

Canoo was once a darling of stock forums and investing subreddits, with its stock price reaching $330 at its peak. However, the hype could not mask the underlying issues. Investors who ignored warning signs are now left holding worthless shares. But this downfall was not entirely unforeseen.

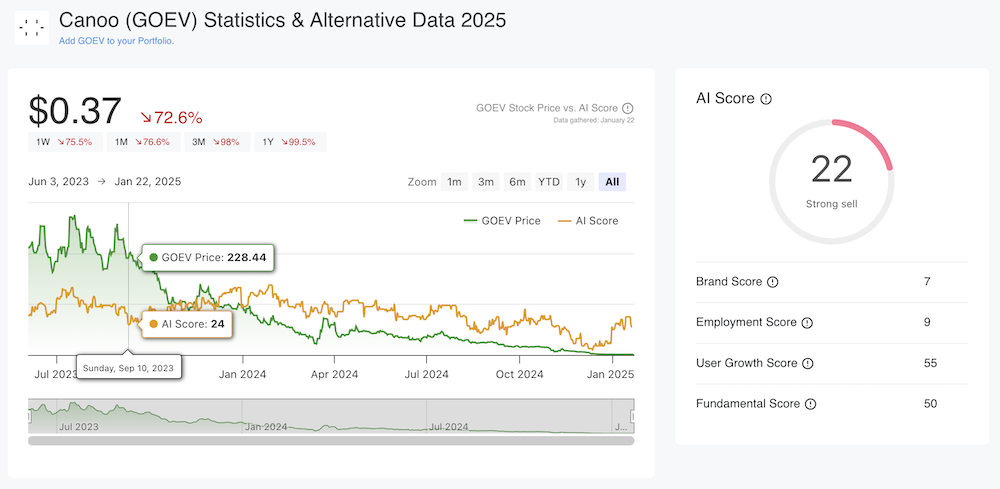

At AltIndex, we issued a sell signal for Canoo as early as September 2023, when its AI score dropped to 24 out of 100, and the stock was trading at $228 per share. This low score reflected a cascade of negative trends across critical alternative data points:

Declining Web Traffic: Online interest in Canoo’s vehicles was decreasing, signaling waning consumer interest.

Negative Employee Sentiment: Employee outlook on platforms such as Glassdoor suggested a deteriorating business environment.

Reduced Job Postings: A decline in hiring activity further underscored the company’s challenges.

Falling Revenue: Part of the low AI score was also Canoo’s inability to generate sustainable revenue.

These signals painted a clear picture of a company in distress, long before its public announcement of insolvency.

Opportunities for Short Sellers

Investors who acted on our sell signal and shorted Canoo’s stock were able to capitalize on its decline. The stock’s collapse from $228 to $0 underscores the importance of leveraging alternative data - not just to identify promising investment opportunities but also to spot potential shorting candidates.

And so Canoo’s bankruptcy serves as a stark reminder of the value of alternative data in modern investing. While traditional financial metrics provide one perspective, alternative data offers deeper, often earlier, insights into a company’s health and trajectory. At AltIndex, we continue to empower investors with the tools they need to stay ahead of the curve and make informed decisions.

By tracking key metrics such as web traffic, employee sentiment, and job postings, our members had the information needed to avoid Canoo’s collapse and, for some, profit from its decline. As the market evolves, alternative data remains an essential resource for identifying both opportunities and risks.

You can read more about stocks to short now according to declining alternative data signals.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.