Cracker Barrel Drops 10% After Earnings - But Is There Hidden Growth Ahead?

September 17, 3:04 pm

Cracker Barrel Old Country Store (CBRL) faced a rough day in the after markets, with shares falling 10% to $45 following its fiscal fourth-quarter earnings release. But while the financial results were mixed and the company continues to recover from a controversial rebranding effort, there are reasons to believe this may be a temporary dip. Beneath the surface, alternative data shows signs of renewed interest and potential growth that investors shouldn't ignore.

Mixed Earnings Report and Conservative Outlook

In its Q4 earnings call, Cracker Barrel reported results that fell slightly short of Wall Street expectations. Earnings per share landed at $0.74 compared to the expected $0.80. However, revenue surprised to the upside, coming in at $868 million versus $855 million expected.

Despite the positive revenue figure, the company issued guidance for fiscal 2026 that was well below consensus estimates. Cracker Barrel expects revenue between $3.35 billion and $3.45 billion, which is short of the $3.52 billion analysts had projected. It also forecasted a same-store traffic decline of 4% to 7% as it continues to navigate its brand overhaul and shifting consumer habits.

The Rebrand That Sparked Backlash

The earnings report follows a turbulent summer for the chain kickstarted by the announcement of a strategic transformation, including a new logo and modernized restaurant interiors aimed at rejuvenating the brand. The new black-and-yellow logo removed the iconic man sitting by a barrel and dropped the “Old Country Store” label.

Cracker Barrel's old and new logo

This redesign drew immediate criticism online. Many social media users described the logo as bland and characterless, while others accused the brand of turning its back on its Americana roots. The reaction was so strong that it clearly impacted sentiment heading into the earnings call. CEO Julie Masino acknowledged the feedback, saying the company was grateful that customers were so passionate and that efforts would now focus on enhancing the guest experience.

Alternative Data Tells an Interesting Story

While traditional financial metrics paint a cautious picture, AltIndex’s alternative data insights suggest that consumer interest may actually be rising for the company.

- Web Traffic: Visits to Cracker Barrel’s website have surged by over 50% month over month, suggesting a growing curiosity - or even controversy-driven attention - from both loyal customers and newcomers.

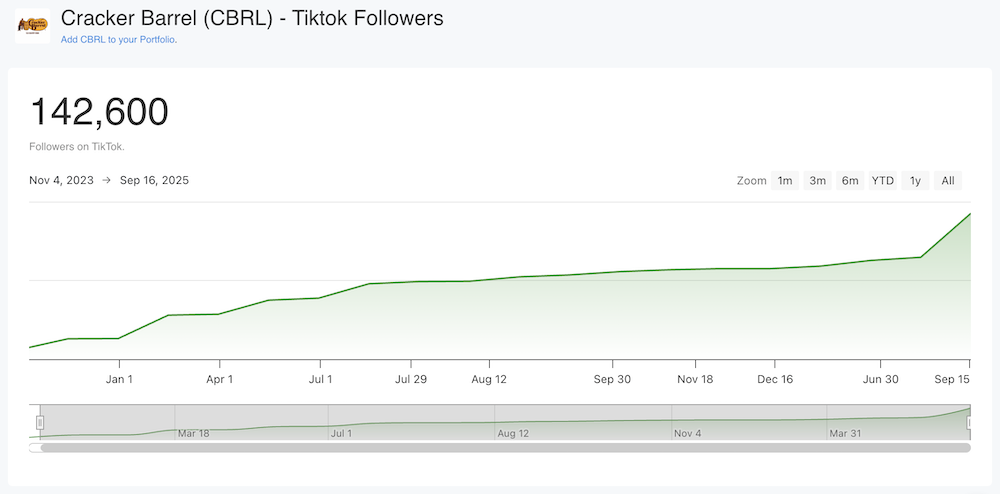

- Social Media Growth: Instagram followers are up 10% in the last 30 days. Twitter followers have increased by 19%, and TikTok has seen over a 20% growth in followers. Some of the brand’s TikTok videos have crossed millions of views, indicating strong viral traction.

- Search Trends: According to Google Trends, Cracker Barrel experienced a spike in search interest during the rebranding controversy. While the trend has cooled in recent days, the attention likely introduced the brand to a wider audience.

Cracker Barrel's TikTik Followers

This surge in digital engagement echoes similar cases we’ve seen before. For example, American Eagle experienced a major jump in social metrics prior to a significant 50% increase in its stock price. While digital signals don’t guarantee a turnaround, they often precede shifts in consumer sentiment and sales performance.

What to Watch Going Forward

Investors looking at Cracker Barrel now are faced with an interesting decision. The brand is in a state of flux - shedding part of its identity in search of future relevance - but early signals indicate that the shake-up is drawing attention. Whether that attention translates into foot traffic and stronger sales remains to be seen.

Key areas to monitor include:

- Next Earnings Report: Will the uptick in digital engagement show up in revenue or customer traffic data?

- Sentiment Recovery: Can the brand rebuild trust among its core customer base while attracting a younger demographic?

- Marketing Strategy: Will the company leverage the surge in online attention to drive promotional campaigns or limited-time offers?

Bottom Line

Cracker Barrel’s recent sell-off may reflect investor concern over a brand stuck between tradition and reinvention. But alternative data signals are flashing green. With web traffic and social media followers sharply up, there’s a clear opportunity here - if the company can capitalize on the attention.

Investors should keep an eye on how this attention converts into sales. With the stock now trading at a discount and early signs of renewed interest, Cracker Barrel might just be a short-term opportunity hiding in plain sight.

Want to track how alternative data predicts the next stock moves? Sign up for AltIndex and get early insights before the market reacts.

Disclaimer: The information provided is for educational and informational purposes only and should not be construed as financial or investment advice. All investments involve risk, and you should conduct your own research or consult a qualified professional before making any investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.