Duolingo's App Download Growth and Mandarin Surge Signal a Strong Outlook for Investors

January 18, 4:44 pm

Duolingo (DUOL) might be gearing up for another growth phase as new data reveals a dramatic surge in Mandarin learners on the platform. The company recently reported a 216% increase in new Chinese (Mandarin) learners in the U.S. compared to this time last year. This unprecedented growth could signal a continued bright future for the language-learning app.

Learning Mandarin out of spite? You're not alone.

— Duolingo (@duolingo) January 15, 2025

We’ve seen a ~216% growth in new Chinese (Mandarin) learners in the US compared to this time last year. https://t.co/9hzwBxfTgD pic.twitter.com/qWM9f5oFYA

Skepticism After Reaching Record Highs

In December, Duolingo’s stock reached an all-time high of $373.03, sparking skepticism among investors about the company’s ability to sustain growth. Critics argued that advancements in AI tools, such as ChatGPT, could draw users away from Duolingo, providing alternative methods to learn new languages. However, alternative data insights reveal a different narrative, highlighting continued expansion and new opportunities for the platform.

Key Alternative Data Insights

Despite concerns, alternative data underscores the company’s resilience and growth trajectory:

- App Downloads: Duolingo’s app downloads continue to rise, up 16% month over month and 4% year over year.

- Social Media Growth:

- TikTok: Over 14.5 million followers, marking a 65% year-over-year increase.

- Instagram: Surpassed 3.7 million followers, up an impressive 139% year over year.

- YouTube: Exceeded 5.2 million subscribers, growing 182% year over year.

This growth across major social media platforms highlights Duolingo’s ability to engage with a broad audience, leveraging strong marketing to attract and retain customers.

The Mandarin Surge and Its Drivers

The surge in Mandarin learners appears to be influenced by political factors. Notably, as discussions about a potential TikTok ban in the U.S. intensify, some American users are turning to Xiaohongshu (RedNote), a Shanghai-based app tailored for a Chinese audience, where Mandarin is the default language. To engage effectively on this platform, many U.S. users are flocking to Duolingo for a crash course in Mandarin, driving unprecedented growth in this language segment.

Implications for Investors

For investors, this growth signals an expanding addressable market and potential long-term value. The increase in Mandarin learners reflects Duolingo’s ability to adapt to shifting trends and meet emerging user demands. Additionally, the company's robust social media presence and growing user base demonstrate a healthy ecosystem capable of sustaining engagement and attracting new customers.

While competition from AI-powered tools poses a potential challenge, Duolingo’s consistent growth in app downloads and active users suggests the platform remains a trusted and popular choice for language learners worldwide.

A Continued Buy Signal

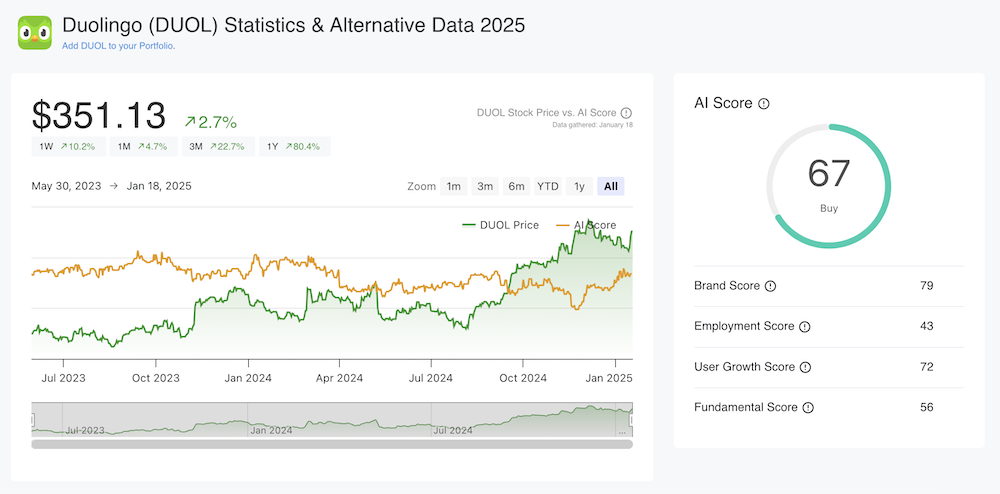

Duolingo Stock Price & AI Score

Duolingo’s recent surge in Mandarin learners, coupled with strong performance indicators from alternative data, points to continued growth and resilience. As global trends evolve and new opportunities emerge, the company appears well-positioned to maintain its upward trajectory. For investors, Duolingo’s ability to leverage these trends could translate into sustained value and growth in the years to come.

At AltIndex, our algoritm continues to provide Duolingo a buy signal, as it's been doing for the last 2 years.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.