The Power of Alternative Data: The Duolingo Success Story

February 29, 7:44 pm

In the rapidly evolving world of investment, traditional financial metrics and models remain foundational in evaluating company performance. However, the advent of alternative data has ushered in a new era of insights, providing a competitive edge to those who can harness its potential. At AltIndex, we specialize in leveraging these unconventional data points to offer unique buy and sell signals to our members. A prime example of our methodology's success is our early buy signal on Duolingo, a leading platform in language education, which has since demonstrated remarkable growth.

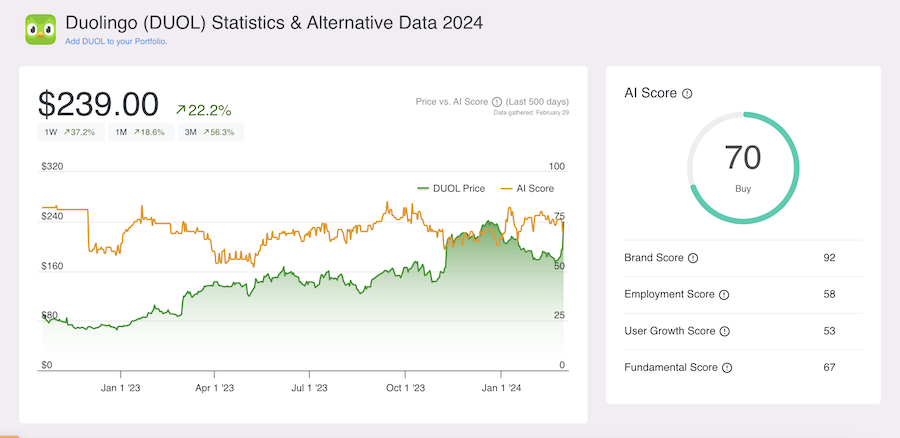

Duolingo Price and AI Score

Early Insights and the Buy Signal

Since January last year, Duolingo has been on our radar, not just for its financial performance, but more so for the alternative indicators that hinted at its burgeoning success. Our high AI score was particularly intrigued by Duolingo's growth in social media audience, a key indicator of the company's ability to attract new customers. Additionally, a steady increase in web traffic to duolingo.com suggested a significant volume of potential client sign-ups. Coupled with a high business outlook among employees, these indicators painted a picture of a thriving company, ripe for investment.

Our confidence in Duolingo was not misplaced. The company's earnings have consistently shown solid revenue growth quarter over quarter, reinforcing our buy signal and affirming the value of alternative data in identifying promising investment opportunities.

Record Earnings and Growth

Duolingo's recent earnings presentation further validated our optimism. The company reported a "record" fourth quarter, concluding an "exceptional" year marked by increased bookings, revenue, and profitability. Notably, daily active users surged by 65% year over year to nearly 27 million, while monthly active users rose by 46% to approximately 88 million. Such impressive user engagement metrics underscore the platform's growing appeal and effectiveness in language education.

Financially, Duolingo's performance was equally remarkable. The company earned $12.1 million, or 26 cents a share, in the fourth quarter, a significant turnaround from a loss of $13.9 million, or 35 cents a share, in the prior-year quarter. Revenue soared by 45% to $151.0 million, and the company ended the quarter with 6.6 million paid subscribers, a 57% increase from a year ago. With guidance for better-than-expected revenue for the current quarter and for 2024, Duolingo's trajectory appears exceedingly positive.

The Future of Duolingo and Language Education

As Duolingo continues to focus on delighting users, growing subscribers, and scaling its mission, the question remains not if, but how much the language education sector will grow. With the stock price up by over 150% since our initial buy signal, Duolingo's journey ahead may seem rich for new investors but the company is poised for continued growth, according to alternative data insights.

At AltIndex, we remain committed to providing our members with the insights needed to make informed investment decisions. Duolingo's remarkable journey from our early buy signal to its current success exemplifies the value of alternative data. As we look to the future, we are excited about the prospects of unearthing more opportunities like Duolingo, where the confluence of financial performance and alternative data insights paves the way for investment successes.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.