Rising Inflation? These Four Investments Can Keep Your Portfolio Strong

February 18, 4:04 am

Inflation remains stubbornly high, with the latest data showing a 0.5% increase in January 2025, pushing the current inflation rate to 3%. Federal Reserve Governor Michelle Bowman stated today that she wants to see more progress in reducing inflation before cutting interest rates further. With inflation continuing to pressure the economy, investors must seek assets that can preserve value and offer solid returns. In this article, we explore four investments that stand out in an inflationary environment: Coca-Cola (KO), JPMorgan Chase & Co. (JPM), Prologis (PLD), and Bitcoin (BTC). Each of these assets has strong alternative data insights from AltIndex, reinforcing their potential to outperform the market and be solid investments if inflation continues to be sticky.

1. Coca-Cola (KO) – A Resilient Consumer Staple

Reason to Buy: Coca-Cola remains a dominant force in the consumer staples sector, providing a hedge against inflation. As a company with strong brand loyalty and global market penetration, it has the pricing power to pass on rising costs to consumers.

Stock Price Trend: Over the past year, KO has demonstrated relative stability. Trading at $68.87 currently, up 13% over the last 12 months, it has held strong in the face of economic uncertainty, thanks to steady demand for its products.

AltIndex AI Score: The AI score for Coca-Cola is currently 59 (a Strong Hold) due to multiple factors such as:

- High employee satisfaction & encouraging business outlook among employees

- Month-over-month spike in sentiment across stock forums

- Web traffic increase, indicating rising consumer interest

These insights suggest Coca-Cola remains a stable, defensive investment with continued consumer demand.

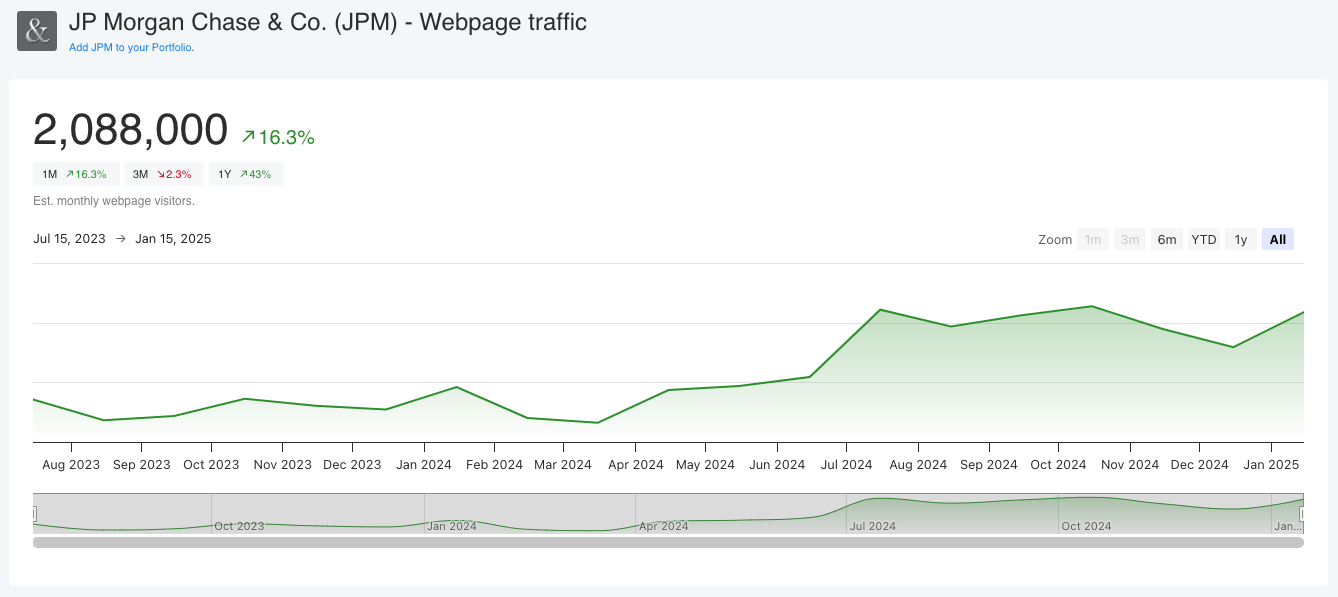

2. JPMorgan Chase & Co. (JPM) – A Financial Powerhouse Benefiting from Rising Rates

Reason to Buy: As inflation persists, the Federal Reserve may maintain higher interest rates, benefiting financial institutions like JPMorgan. The bank's diversified revenue streams, including lending, investment banking, and asset management, make it a strong inflation hedge.

Stock Price Trend: Currently trading at $276.59, up 54% in the last 12 months, JPMorgan has delivered consistent performance, supported by strong earnings and a resilient balance sheet.

AltIndex AI Score: The AI Score for JPMorgan Chase for is currently 55 (a Strong Hold) due to multiple signals such as:

- Strong fundamentals and low P/E ratio, signaling an undervalued stock

- Solid dividend yield of 1.81%, offering investors income stability

- Increasing web traffic, up 43% in the past month, indicating growing investor interest

- A stable trend across job postings, reinforcing financial strength

Given its financial resilience, growing demand, and the potential for higher net interest income, JPMorgan remains a solid option for inflationary times.

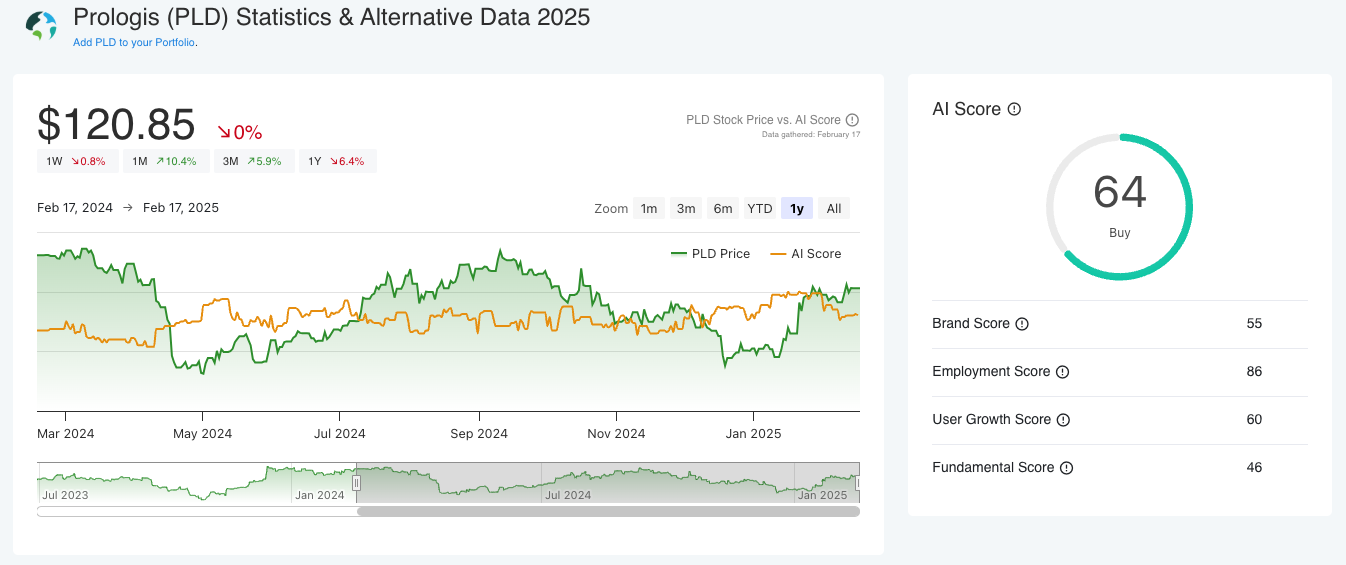

3. Prologis (PLD) – A Leading REIT

Reason to Buy: Real estate is a historically strong performer during inflation, as property values and rental income tend to rise. Prologis, a logistics-focused REIT, is particularly well-positioned, benefiting from high demand for warehouse space in the e-commerce sector.

Stock Price Trend: Prologis is currently trading at $120.85, down 9% in the last 12 months but up 10% in the last month.

AltIndex AI Score: The AI Score for Prologis is currently 64 (a Buy) due to multiple insights such as:

- Revenue growth is solid, reflecting strong demand

- Dividend yield of 3.18%, providing reliable income

- 90% of employees have a positive business outlook, reinforcing company strength

- Sentiment score of 90/100 across stock forums, showing strong investor confidence

Prologis stands out as a real estate play with robust growth potential and reliable income in an inflationary environment.

4. Bitcoin (BTC) – A Digital Inflation Hedge

Reason to Buy: Bitcoin is often viewed as a store of value and a hedge against inflation. With increasing adoption and growing institutional interest, Bitcoin continues to gain traction as a digital asset.

Price Trend: Over the past year, Bitcoin has experienced volatility (up by 84% in the last 12 months, but down by 7% in the last month) but remains in a long-term uptrend. Currently trading around $96,143, Bitcoin has outperformed many traditional assets.

AltIndex AI Score: The AI Score for Bitcoin is currently 50 (a Hold) but there are many reasons to be bullish such as:

- A 25% increase in followers on the Bitcoin subreddit, indicating growing retail interest

- A 10% increase in Stocktwits followers, highlighting rising investor sentiment

- A 17.7% growth in Bitcoin’s Twitter following, signaling expanding mainstream adoption

As digital assets continue to gain legitimacy and grow in popularity among Main Street, Bitcoin remains a compelling option for those looking to hedge against inflation with a decentralized store of value.

Conclusion

With inflation at 3% and interest rates remaining high, investors must be selective in choosing assets that can withstand economic pressures. Coca-Cola, JPMorgan Chase, Prologis, and Bitcoin each provide unique benefits in an inflationary environment.

As always, when selecting assets to invest in - especially in times of economic uncertainty - combining alternative data with fundamental and technical analysis can offer a significant advantage. At AltIndex, we continue to provide our members with market-leading alternative data insights that drive smarter investments. By staying informed on sentiment trends, web traffic, and employee outlooks, investors can better navigate inflation and make better, more informed investments.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.