Gold Prices Soar and Alamos Gold Rides the Wave — AltIndex Saw It Coming

April 21, 1:43 pm

As the U.S. dollar continues to slip and market uncertainty rises, investors are turning to one of the oldest safe-haven assets: gold.

On Monday, gold prices surged to an all-time high, breaking past $3,400 an ounce. Spot gold climbed 2.6% to $3,415.24, after reaching an intraday record of $3,424.25. Meanwhile, U.S. gold futures jumped 3% to $3,426.30. The rally was driven by a weakening dollar - sparked in part by President Donald Trump's criticism of Federal Reserve Chairman Jerome Powell - and renewed concerns around U.S.-China trade relations. As trust in the U.S. economy wavers, gold becomes more attractive to investors seeking stability.

One company that’s capitalizing on this gold rush is Alamos Gold (AGI) - and at AltIndex, we flagged the opportunity early.

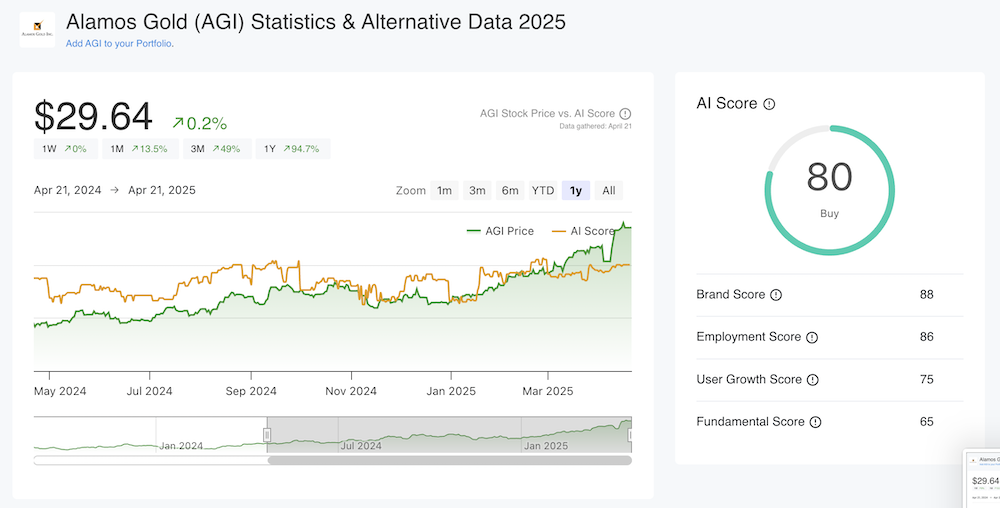

Alamos Gold Price & AI Score

Our Buy Signal on Alamos Gold

We issued a buy signal on Alamos Gold on January 19, when our AI score rose to 78 out of 100. At the time, the stock was trading at $19.50. Since then, AGI has soared to $29, marking a 50% gain in just three months.

That bullish signal wasn’t random. Our AI model draws from dozens of alternative data sources - and Alamos Gold lit up across the board.

Why Our AI Score Remains Bullish

1. Web Traffic Surge

Web traffic to Alamos Gold’s webpage hit an all-time high in March, signaling a surge in investor interest and research activity.

2. Social Media Growth

- YouTube: Subscriber count is up 155% over the last 12 months.

- Twitter: Follower growth has risen by 11%.

- StockTwits: Subscriber count has increased 15%, with overall sentiment remaining strongly bullish.

These metrics indicate rising interest from both retail investors and the broader market community.

3. Hiring Activity

Our algorithm heavily weighs job postings, as hiring tends to correlate with future growth. Over the last 12 months:

- Job openings at Alamos Gold are up 70%.

- According to LinkedIn data, employee count has grown 21%.

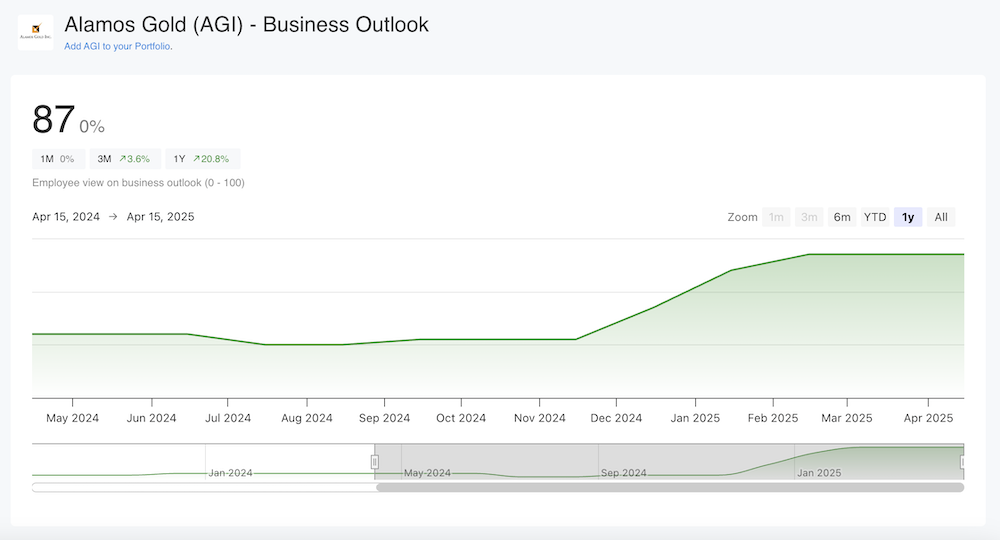

4. Positive Employee Outlook

According to employee reviews, 87% of Alamos Gold workers now report a positive business outlook - a 20% jump year-over-year. Happy employees and hiring growth are both positive signs of operational momentum.

The Fundamentals Are Strong, Too

Alternative data isn’t the only thing going right. The company is growing financially:

Q4 2024 revenue came in at $376 million, up from $231 million in Q4 2023 - a sharp 63% increase year-over-year.

Adding to the bullish sentiment, Scotiabank recently raised its price target on Alamos Gold to $33 (from $25) and reiterated an Outperform rating. The firm remains optimistic about the gold and precious minerals sector heading into 2025, expecting continued M&A activity and asset optimization across the industry.

Looking Ahead

Alamos Gold is set to release its Q1 2025 earnings after the market closes on Wednesday, April 30, followed by a senior management call on May 1 at 11:00 a.m. ET.

With gold prices soaring, the dollar weakening, and alternative data showing sustained momentum, Alamos Gold is one of the key players to watch in this rally. At AltIndex, we’ll continue tracking these signals so our users can stay ahead of the curve.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.