Groupon's Stock Surge: A Company Reborn or a Masked Decline?

September 29, 6:33 pm

Shares of Groupon (GRPN) have experienced a meteoric rise in 2023, soaring 73% overall and nearly quadrupling in the last six months. This has propelled the company to a market cap of $478 million, igniting the interest of many stock market enthusiasts. But beneath the gleam of surging stock prices lies a set of alternative data points that paint a more complex picture.

Let’s look at the number

Since its 2008 inception, Groupon has built a lucrative model, deriving most revenue from net commissions on third-party sales and fees from digital coupons. Their formula has fostered collaborations with over a million merchants, resulting in the distribution of 1 billion coupons and a return of $25 billion for these businesses.

Recent financials, however, tell a nuanced tale.

In Q2, Groupon reported revenue of $129.1 million, beating analyst expectations by $5.82 million. Although a beat, the revenue still saw a drop of 15% year over year. Groupon also reported a loss per share of $0.10, which was better than the consensus estimate of a loss of $0.41 per share.

Groupon's profit margins have also been improving in recent quarters. In Q2, the company reported a profit margin of -1.88%, which is an improvement from the profit margin of -28.22% in the same quarter a year ago.

The company's management team is confident that the company can achieve profitability and return to growth in the near future as CEO Kedar Deshpande has said that the company is focused on mobile, customer experience, and profitability. He has also said that the company is benefiting from the ongoing recovery of the local economy.

The Alternative Picture

However, alternative data shines a light on some concerning trends:

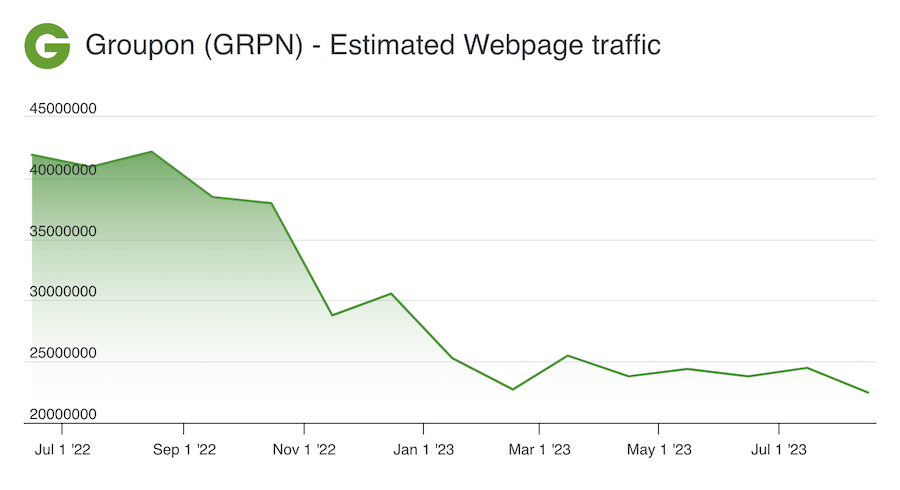

Digital Footprints Waning: App downloads and web traffic, crucial indicators of user engagement, have dwindled. With a 20% decline in app downloads and a nearly 50% drop in web traffic year over year, the company's digital engagement seems to be waning.

Employee Morale: Employee business outlook has taken a hit too, plunging by 28% year over year. A discontented workforce, even with optimistic executives, can spell trouble for the company's long-term growth.

Social Media Engagement: Groupon's social media trajectory is mixed. While the company has managed to maintain its Instagram audience, it has been gradually losing followers on Facebook and Twitter - platforms crucial for modern-day marketing and engagement.

Search Interest: Google Trends data showcases a diminishing interest in the company, as searches for Groupon have been trending downwards over the past couple of years.

Investor's Delight, Consumer's Flight?

The prevailing sentiment seems to be a dichotomy. On one hand, investors are flocking to the stock, enamored by its robust performance and hope that revenue will continue to grow. On the other hand, consumers appear to be distancing themselves from the company, as evidenced by declining app downloads, web traffic, and search trends. The question that begs answering is, can investor confidence be sustained if the customer base continues to shrink?

In Conclusion

Groupon's story in 2023 is one of contrasts. The soaring stock price and the stark alternative data highlight the importance of a holistic evaluation before making investment decisions. While the stock may be riding high now, with leadership being optimistic about the future, potential investors need to weigh if this is a fleeting moment of glory or a sustainable trajectory, especially when customer engagement seems to be on the decline.

Our AI score seems to think that Groupon is a company in decline and currently has a sell rating on its stock.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.