HEAR the Warning Signs: Is it Time to Sell Turtle Beach?

September 15, 10:12 am

In the ever-evolving world of gaming accessories, Turtle Beach ($HEAR) has carved out a space as one of the foremost providers, leveraging its expertise to craft market-leading gaming headsets, well-received controllers, and groundbreaking gaming simulation accessories. However, with the stock price hovering at $10.2 per share, registering a notable 29% growth over the past six months, discerning investors may find it prudent to approach with caution as the road ahead appears to be laden with potential pitfalls. Here, we delve into alternative data points to map out the underlying currents steering Turtle Beach’s trajectory.

Treading Troubled Waters: A Look at Alternative Data

The encouraging signs emanating from the substantial uptick in Turtle Beach's share price may ostensibly reflect a company in its prime, but a closer inspection via our AI score - a comprehensive analytic tool assessing company performance through various lenses including financials, brand strength, and employee satisfaction - paints a grimmer picture, registering a sub-par score of 37 out of 100 and nudging it firmly into sell territory.

Despite maintaining a fairly positive business outlook at 70%, and a stable employment landscape highlighted by consistent job postings and a generally content workforce, the decrease in web traffic and diminishing social media presence raise red flags that cannot be ignored.

Decoding the Digital Decline: Web Traffic and Social Media Engagement

In an era where digital engagement is often symptomatic of a company’s heartbeat, the over 50% year-on-year plunge in web traffic is a harbinger of concern, signalling a potential retreat of its customer base and a dwindling interest in its offerings.

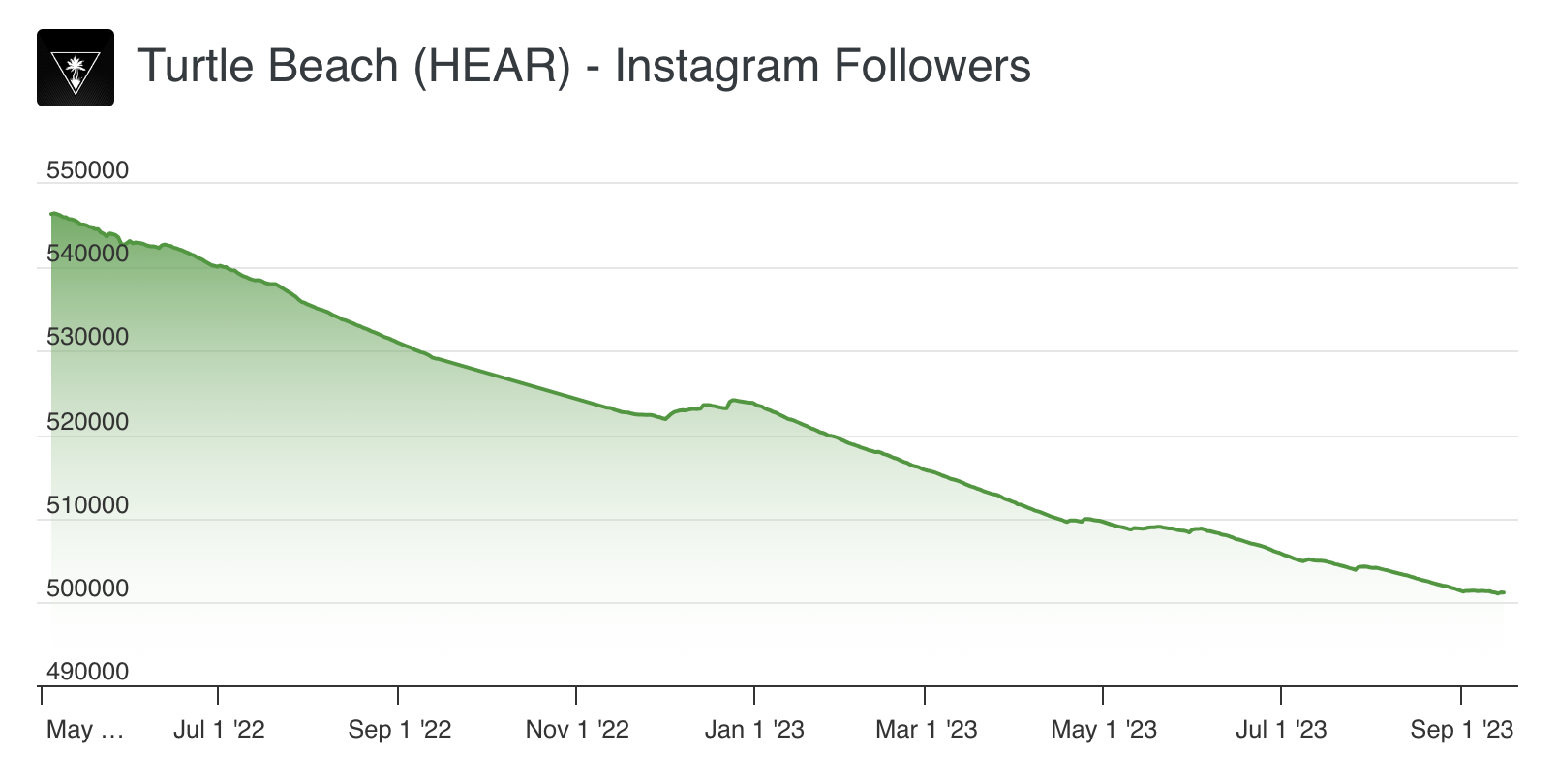

More alarming is the notable downturn in social media engagement - a critical yardstick in measuring brand health in contemporary times. Our data underscores a worrying trend: Facebook followers have been on a decline since March, a phenomenon historically linked to a dip in stock performance. Likewise, since initiating our tracking in May last year, Instagram followers have witnessed a steady decrease, with a 1.3% contraction in the last quarter alone, indicating a gradual erosion of its customer base.

Industry Context: Gaming and Accessory Trends

As we juxtapose Turtle Beach’s journey against the larger canvas of the gaming industry and headset market, it is imperative to note that the industry continues to grow at a healthy pace. However, amidst the sprawling landscape of gaming accessories, the competition is rife, and consumer preferences are constantly evolving, necessitating innovation and agility, elements seemingly lacking in Turtle Beach’s current strategy.

While the gaming industry trends upward, the headset market's dynamics are shifting, with users increasingly opting for multi-functional devices that offer value beyond gaming. This warrants a deeper insight into Turtle Beach’s portfolio and whether it is primed to adapt to the shifting sands of consumer preferences.

Conclusion

In light of the foreboding signs telegraphed by the alternative data points, the recent uptick in Turtle Beach's stock price might be a siren song luring unsuspecting investors. While the firm ground in business outlook and employee satisfaction offers a glimmer of hope, the undeniable downturn in digital engagement demands a cautious approach.

Investors keen on navigating the complex terrains of the gaming accessory marketplace would do well to heed the warning bells and potentially contemplate a strategic retreat, lest they find themselves caught amidst a downswing dictated by dwindling digital engagement and a failure to align with the dynamically evolving market trends.

While Turtle Beach has a storied legacy in the gaming world, it finds itself at a crossroads, where a pivot towards innovation and rejuvenated digital engagement strategy could possibly steer it away from the brewing storm. The coming months will be critical in determining whether Turtle Beach can regain its footing or if it will cede ground to agile competitors better attuned to the changing tides of the industry.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.