Investing in Payoneer: Evaluating the Potential Amidst Job Cuts

July 17, 12:47 pm

Payoneer Global ($PAYO) is a financial technology company that focuses on empowering small and medium-sized businesses (SMBs) globally. Its core objective is to facilitate seamless cross-border transactions, enabling SMBs to transact, conduct business, and expand their reach on a global scale. As the world becomes increasingly interconnected, removing barriers and complexities associated with international payments is vital for SMBs to thrive. We believe that Payoneer's platform offers a comprehensive range of services that cater to these needs and our data points to a promising future.

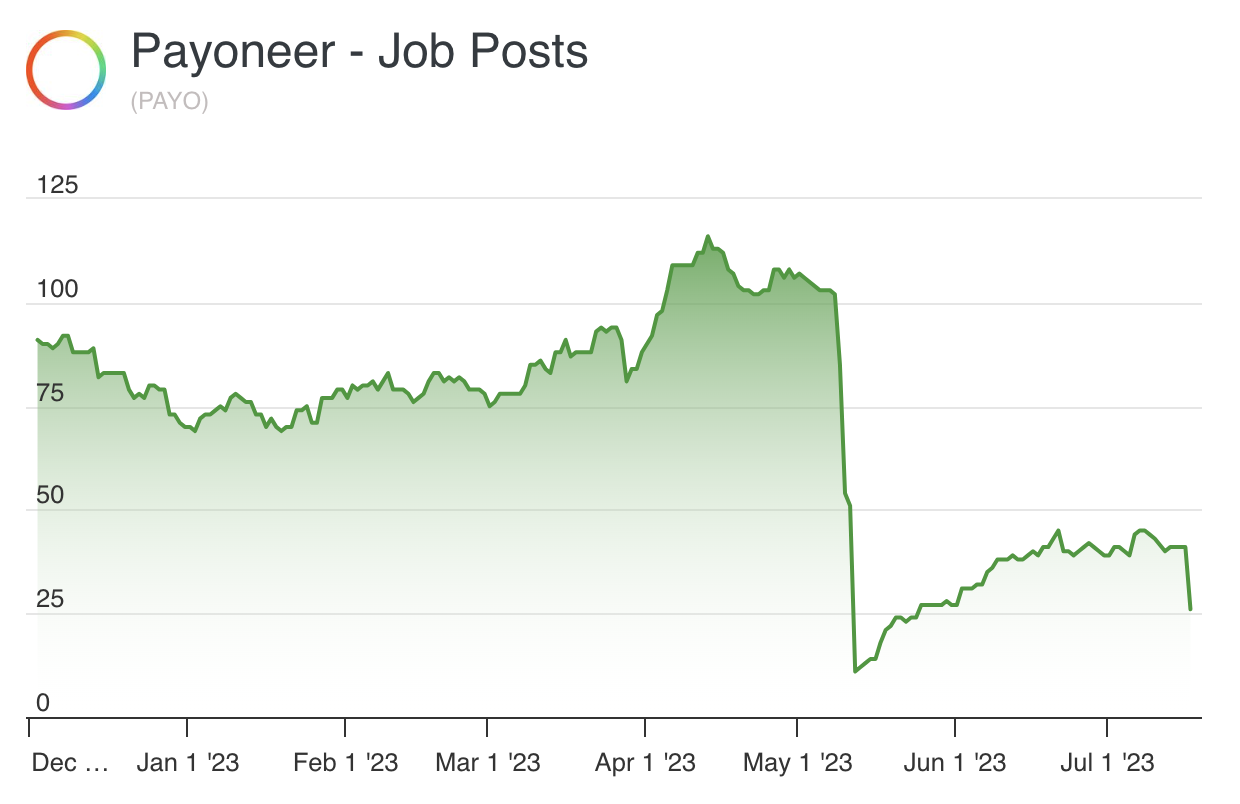

That said, the company recently revealed its plans to reduce its workforce by approximately 9%, as stated in an SEC filing. This decision comes as no surprise, given the company's earlier cut in job postings, which saw an 80% drop back in May. While these changes may raise concerns, they do not overshadow the investment potential of Payoneer in the financial technology sector.

Our AI analysis has assigned a target price of $5.85 (representing a 13.2% upside) to Payoneer, considering several long-term factors that indicate future growth. Notably, there has been a consistent increase in Payoneer's Instagram followers and YouTube subscribers, indicating a growing user base and enhanced brand recognition. Moreover, there has been a rise in mobile app downloads, and web traffic, all indicative of increasing interest in Payoneer's services. Payoneer's commitment to employee satisfaction is yet another interesting factor. Research has consistently demonstrated that companies with a higher business outlook among their employees tend to exhibit stronger performance in the stock market. Remarkably, despite recent workforce reductions, Payoneer has managed to achieve an impressive 35% increase in its business outlook over the past year. Additionally, Payoneer's fundamentals have displayed promising performance, with a 34% increase in revenue last year. These positive indicators demonstrate the company's potential for long-term success.

Looking ahead, Payoneer's second-quarter financial results are eagerly awaited. The company is set to announce its financial performance on August 8, 2023, before the market opens. These results will provide crucial insights for analysts and investors to gauge Payoneer's progress toward its strategic goals. Key metrics such as revenue growth, transaction volume, and user acquisition will be closely scrutinized, shedding light on the company's trajectory.

In conclusion, despite the recent restructuring and workforce reduction, Payoneer presents attractive investment prospects. Its commitment to empowering SMBs, coupled with positive financial performance, a growing user base, and employee satisfaction, indicates a promising future. However, investors should remain vigilant, conducting thorough research, monitoring market trends, and staying informed about Payoneer's financial results and strategic developments. By adopting a long-term perspective, investors can evaluate Payoneer's growth potential and make informed decisions regarding their investments.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.