Why iRobot’s Stock is Getting Sucked into Short Territory

September 21, 2:15 pm

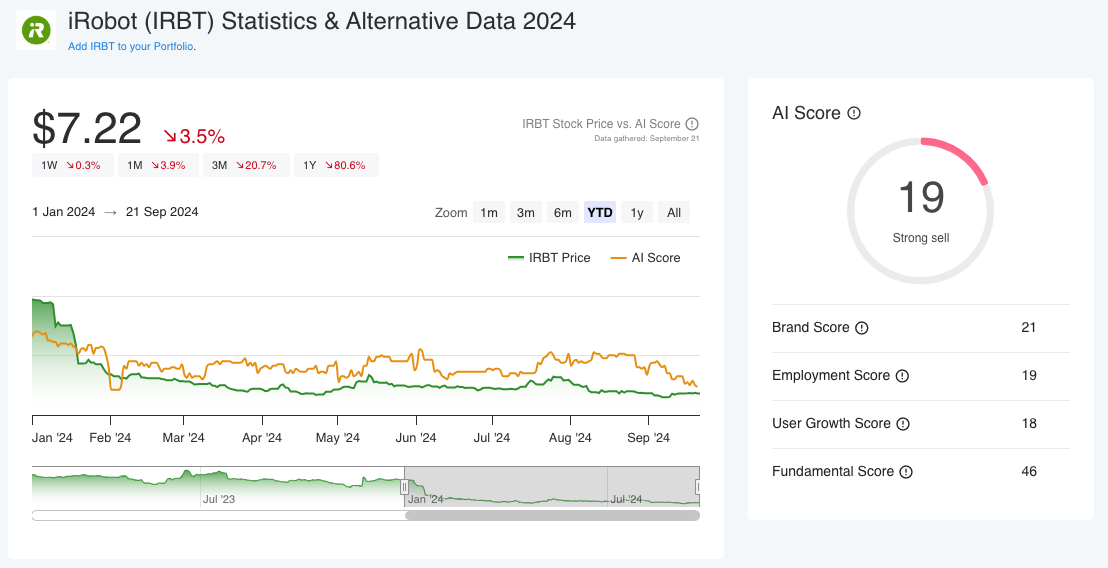

iRobot (IRBT) has been in a downward spiral for a while, especially since the Amazon deal fell through. The stock has plummeted 80% over the last year, and without a savior on the horizon, it’s hard to see how the company will avoid bankruptcy. While iRobot’s financial performance paints a grim picture, it’s the alternative data insights that truly highlight the company’s struggles and make it a prime target for short sellers.

But let's start with the financials.

iRobot’s recent financial performance underscores the severity of its current situation. In its Q2 earnings report, the company revealed some troubling numbers that point to ongoing challenges.

Revenue Growth: While revenue for the last quarter showed a 10.9% increase from the previous quarter, bringing the total to $166 million, this figure needs to be contextualized. Year-over-year, revenue actually decreased by 29.7%. This steep decline suggests that the quarterly increase might be a temporary blip rather than a sign of recovery.

Losses: The company reported a significant loss of $70.6 million, or $2.41 per share. This loss highlights iRobot's struggle to maintain profitability in a market that has become increasingly competitive. With margins under pressure and costs likely to rise as the company attempts to regain market share, the path to profitability seems steep and uncertain.

Product Shipments: iRobot shipped 574,000 units during Q2, marking a 30.9% decrease year-over-year. This sharp decline in shipments is a clear indication that demand for iRobot’s products is waning, likely due to both increased competition and a saturation of the market.

Average Selling Prices (ASP): The average selling prices of iRobot’s products decreased by 4.9%. This drop in ASP suggests that the company is either lowering prices to stay competitive or is being forced to do so due to weaker demand. In either case, this trend puts additional pressure on already thin margins.

Cash Reserves: As of June 29, 2024, iRobot’s cash and cash equivalents totaled $108.5 million, down from $118.4 million in the first quarter of 2024. This decline in cash reserves is concerning, as it indicates that the company’s financial cushion is shrinking. With these reserves, new CEO Gary Cohen has an estimated 1-2 years of runway to attempt a turnaround, but the odds are stacked against him.

Employee Outlook: A Declining Confidence

One of the most telling signs of a company's health is the sentiment among its employees. According to LinkedIn data, iRobot’s workforce has shrunk by 18% over the last year, signaling significant internal turmoil. This decline isn’t just about numbers; it’s also about morale. The business outlook among the company’s remaining employees has dropped by a staggering 51% over the same period. When employees lose faith in their company’s future, it’s often a precursor to further decline. This drop in confidence suggests that even those who remain are uncertain about the company’s direction and long-term viability.

Webpage Traffic: Interest is Waning

Another critical indicator of a company’s health is the level of interest it generates from potential customers. In the digital age, webpage traffic is a direct reflection of this interest. Unfortunately for iRobot, the numbers are not encouraging. Webpage traffic to iRobot’s site has decreased by 20% over the last year. This decline suggests that fewer people are visiting the site to learn about or purchase iRobot products, which could be a sign that the brand is losing its appeal in a crowded market.

App Downloads: Fading User Engagement

In addition to declining webpage traffic, iRobot has seen a significant drop in app downloads, down 24% over the past year. This decline is particularly concerning because the app is a key part of the user experience for iRobot products, especially for controlling and monitoring devices like the Roomba. A decrease in downloads indicates that not only are fewer people buying iRobot products, but existing users may also be disengaging, reducing their interaction with the brand. This drop in user engagement is a red flag for the company’s future growth prospects.

Conclusion: A Short-Seller’s Opportunity

The combination of declining employee outlook, reduced webpage traffic, fading app downloads, and weakening financials paints a bleak picture for iRobot. While the stock price is already low, these insights suggest that the company’s struggles are far from over. For short sellers, iRobot represents a prime opportunity to profit from a company in decline - unless, of course, someone steps in to turn things around. But given the current trends, that seems increasingly unlikely.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.