Is Buzzfeed Losing Its Buzz? Challenges Loom as Stock Drops and Audience Shrinks

March 21, 4:33 pm

Buzzfeed ($BZFD) has been abuzz with news lately. The company's news division, BuzzFeed News, is pivoting towards profitability by diversifying content offerings, and producing more long-form journalism and investigative pieces. To achieve this goal, the company also plans to launch a new opinion section and expand international coverage. The company will also rely on AI language models to produce more articles that they hope will go viral.

Despite these news, the stock has a high level of short interest, which is leading to a lot of volatility. Buzzfeed's stock rose by over 300% at the end of January when the company announced its plans to integrate AI language models but since then the stock is down by 70% with a current market valuation of $150 million.

Alternative data suggests that Buzzfeed may continue to face challenges, presenting a potential shorting opportunity. The company's mobile apps have less than 1000 downloads per day, compared to the New York Times, which has over 5000 downloads per day. Additionally, the number of people stating they work for Buzzfeed on LinkedIn has dropped by 5% in recent months, and only 45% of employees have a positive outlook with lack of innovation and direction being the strong concerns for Buzzfeed current employees.

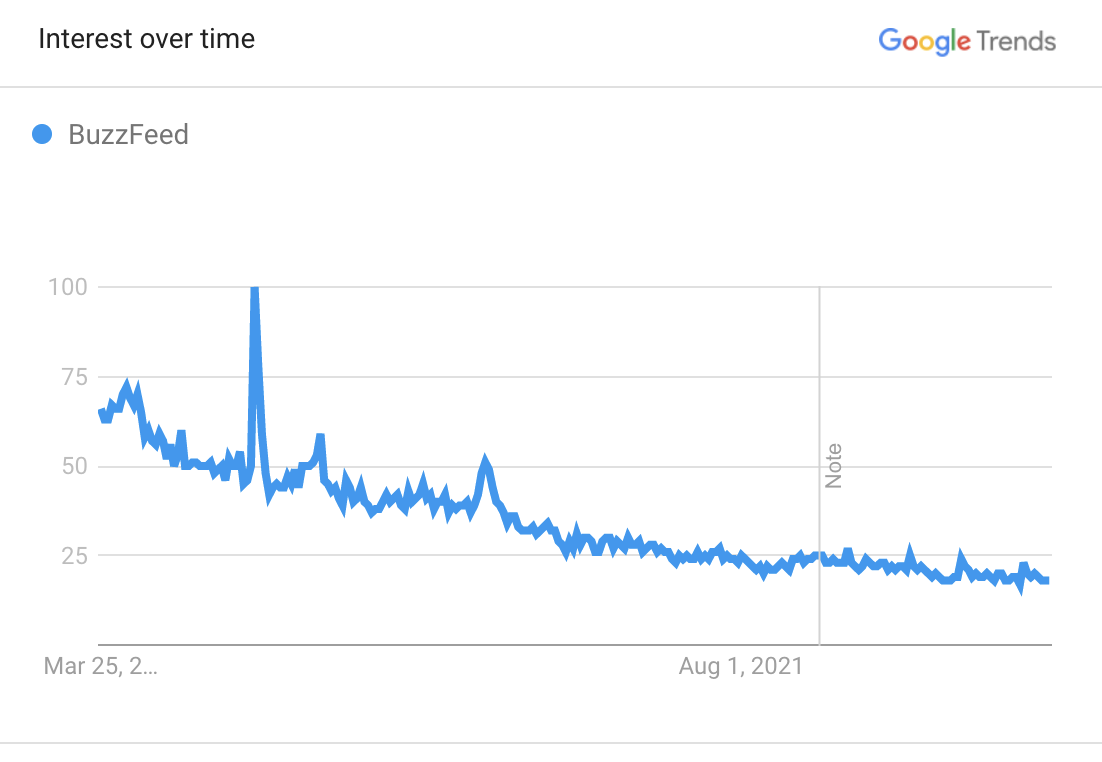

But the most worrisome for Buzzfeed is that its audience is shrinking, with the company losing followers on Facebook, Instagram, and Twitter. In just the last month, almost 30,000 users unfollowed Buzzfeed on Twitter. For a company relying heavily on its articles to go viral to lose followers on social media is not good news. To be a further "buzzkill", this trend might continue as Buzzfeed has been trending down in Google Searches over the last couple of years.

The company is also currently unprofitable and is not forecast to become profitable over the next three years. This adds further weight to concerns about the company's long-term financial sustainability and raises questions about the viability of its pivot toward profitability. As Buzzfeed continues to navigate these challenges, it will be interesting to see how the company adapts and evolves to maintain its position as a leading source of online content. Unfortunately, we don’t see a lot of upside at the moment.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.