Alternative data and fundamentals suggest that Google is a buy

February 12, 8:08 pm

Alphabet Inc ($GOOGL) has been at the forefront of technological advancements for over two decades. But the company has recently been taking a beating with an almost 10% drop in market cap in the last couple of days, bringing its current stock price to $94 per share. In this article, we will explore Alphabet Inc's current position, analyze our alternative data, and show why we believe now may be an opportune moment to consider investing in the search technology giant.

Workforce Efficiency and Increased Web Traffic

Alphabet Inc ($GOOGL) recently reported earnings per share of $1.05 and revenue of $76.05 billion. While this was a slight miss of analyst expectations, we see some positive indicators that others may be overlooking.

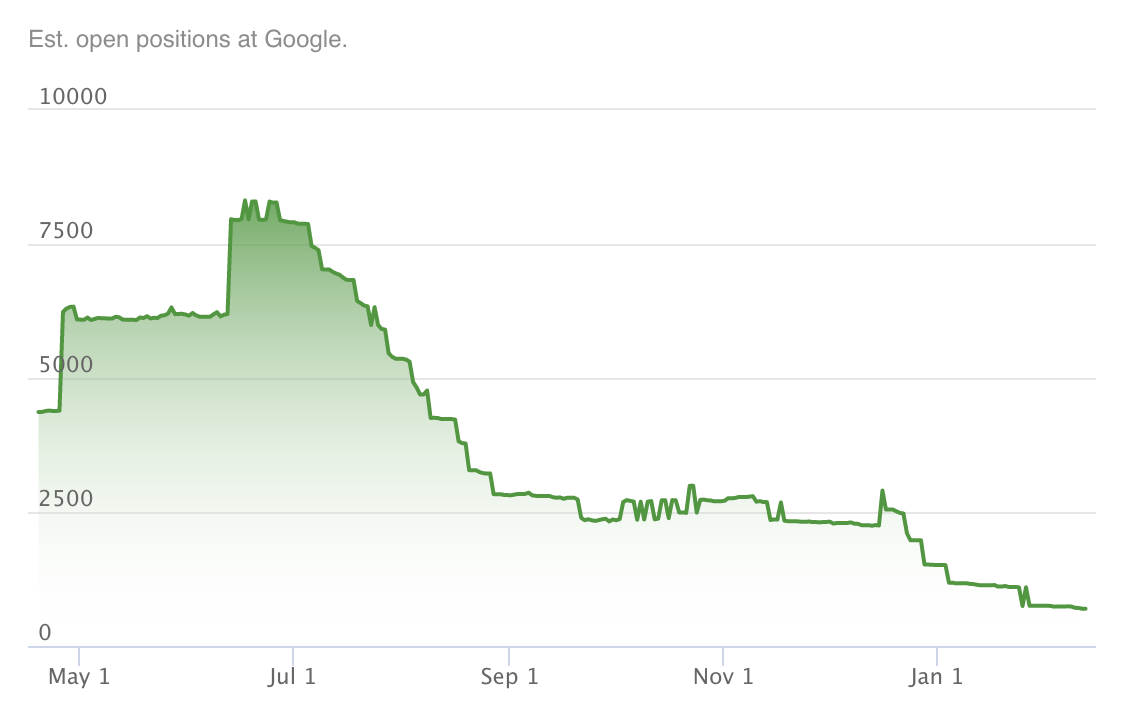

First, the company has been implementing cost-saving measures, as evidenced by a 90% decrease in job posts since July and a recent announcement of a 6% workforce reduction. As a soft landing might be ahead of us, and with that more money being invested in advertisement, we believe that Alphabet will be able to grow its revenue while improving its margins.

Despite facing challenges, the company boasts a remarkable talent pool capable of developing innovative products utilizing AI and machine learning. Employee morale remains high with a satisfaction rate of 89, the highest among all FANG stocks.

Furthermore, the trend of rising web traffic on Google.com continues, with January having the highest visitor count in the three years since our web traffic analysis started. This growth extends beyond just web traffic, as app downloads for Youtube continue to be robust. Our estimates place Youtube as one of the most widely downloaded social media apps, surpassing Tiktok, Facebook, Snap, and Twitter in popularity.

Add to that the sentiment around the stock is hovering around 80 (also the highest amongst the FANG stocks) and there are a couple of indicators that suggest the company is on the right track and poised for growth.

Opportunities across Google's Business

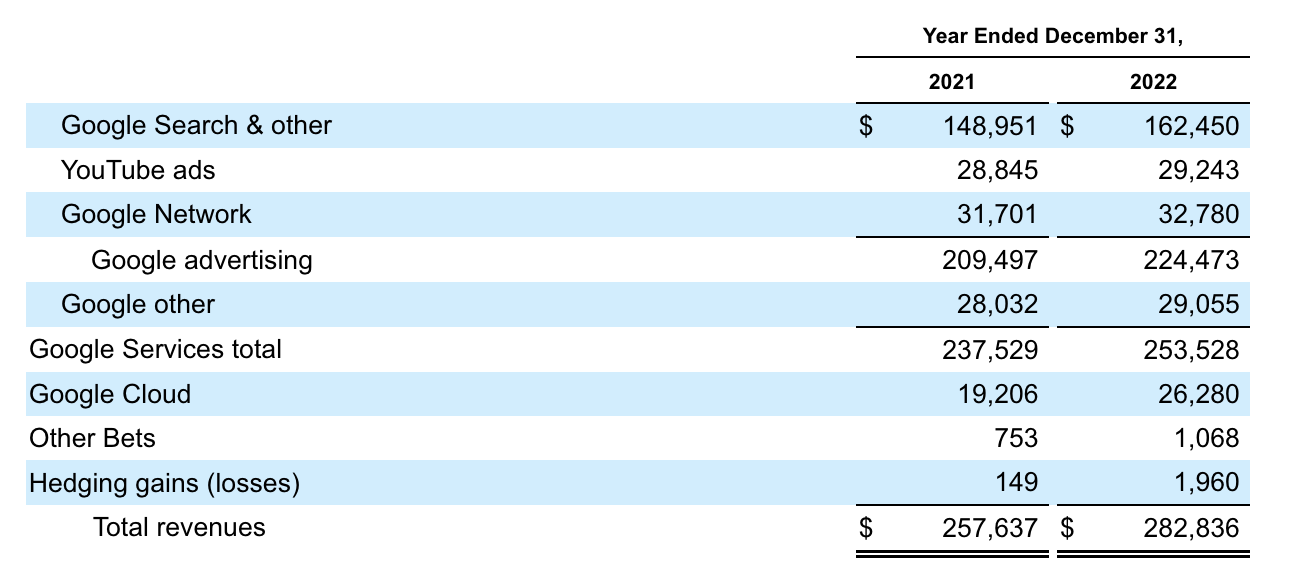

Google boasts an extensive business portfolio, comprised of a range of highly successful and innovative products. The company's offerings are incredibly well-integrated and have been key to maintaining its dominant position in the technology industry. And while Google is primarily recognized for its powerful search engine, other products like YouTube, Android (with a 71% market share globally), Gmail, and Chrome also enjoy immense popularity and will continue to drive the company's success in the years to come. For example, Google Cloud has experienced remarkable growth, with its revenue increasing by a staggering $7 billion from 2021 to 2022.

Another good example is Youtube, which some analysts estimate would have a standalone value of over $180 billion.

Despite this impressive product diversification, online advertising remains the company's primary source of revenue, accounting for the majority of its earnings in 2022.

Defending Market Share in the Face of Competition

Unless you have been under a rock, you have probably heard about Open AI (the company behind ChatGPT) and their recent partnership with competitor Microsoft ($MSFT). This new technology, along with the not-so-impressive chatbot promotional video from Google, contributed to a $100B loss in market cap over just the last couple of days. While unfortunate, we argue that these concerns, among others, are overblown, which creates a compelling buy opportunity today.

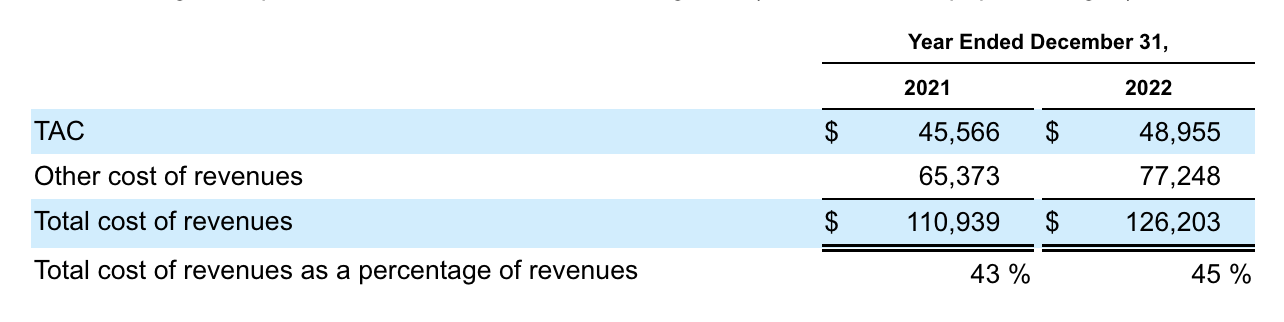

Some interesting commentary, as discussed at length by Chamath Palihapitiya, David Friedberg, and others in Episode 115 of "The All In Podcast" is Google’s economies of scale, and ability to retain market share by tactics such as increasing its traffic acquisition cost (TAC). In simpler terms, this is just Google increasing the amount it pays advertisers and key stakeholders as a weapon to undercut the competition. In 2022, Google spent ~$48B on TAC, and they are probably not scared to increase that over time as it is quite efficient to generate revenue and a competitive edge.

Even if strategies like this do not succeed, Microsoft's potential 5% market share could potentially be a boon for Google, as it will ease the regulatory and legal pressures from the government, allowing Google to operate more freely.

So, is it a good time to invest in $GOOGL? Only time will tell, but the company is still printing money with its ads business, there are a lot of positive indicators in all of our alternative data and the market might have overreacted last week, it may be worth considering.

Disclaimer: This is not financial advice. Do your own DD.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.