Is Victoria’s Secret Buying Social Media Followers? Why Investors Should Be Cautious

December 4, 3:03 pm

Victoria’s Secret (VSCO) has been on a remarkable run, hitting a 52-week high of $43.90 and climbing over 84% in just the last three months. For retail investors, this growth may seem like an enticing opportunity. However, when you peel back the layers of this success story, there’s a reason to approach with caution—particularly concerning the company’s recent social media metrics.

A Sudden Surge in Social Media Followers

At AltIndex, we’ve been monitoring Victoria’s Secret’s social media presence for years. While the brand has maintained a large following, something unusual happened in mid-October: an explosive growth in followers across TikTok, Instagram, and YouTube.

- TikTok: The brand’s followers doubled in less than a week, leaping from 2.6 million to 5.4 million.

- YouTube: Between October 15 and 18, Victoria’s Secret gained 800,000 new subscribers.

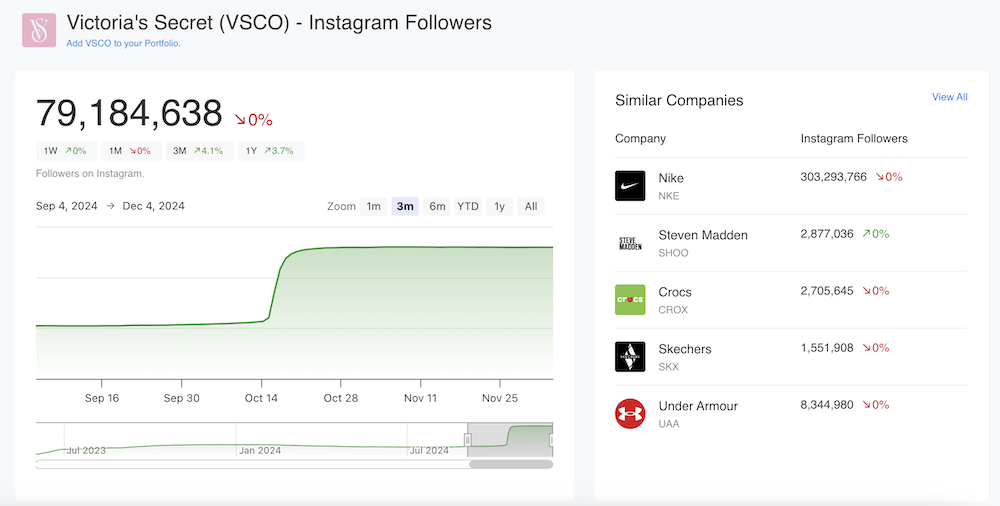

- Instagram: During the same time period, the company’s account added 3 million followers, climbing from 76 million to 79 million.

Victoria Secret Instagram Followers

These gains would be impressive if they aligned with a viral campaign, major product launch, or other significant marketing efforts. However, no such events were evident, and follower growth has stagnated since. In fact, Victoria’s Secret’s Twitter followers have been in a consistent decline over the last 18 months.

Are These Followers Real?

The simultaneous spikes across multiple platforms raise questions about the authenticity of these followers. Purchasing followers is not uncommon for brands looking to boost their perceived popularity, but it rarely translates into genuine consumer engagement or sales. Fake or inactive followers can artificially inflate metrics, giving investors a distorted view of a company’s market reach and potential.

For a company like Victoria’s Secret, which is heavily reliant on brand strength and consumer perception, real and engaged social media followers are critical. Inflated follower counts might mislead investors about the effectiveness of its marketing and the actual interest in its products.

Why Social Media Matters for Victoria’s Secret

Social media is one of the most powerful tools in Victoria’s Secret’s arsenal for reaching its core demographic—young, trend-conscious consumers. Authentic followers mean potential customers, who could drive revenue through direct purchases or brand advocacy. Conversely, a high follower count filled with bots or inactive accounts does nothing for the bottom line.

For investors, analyzing social media trends is increasingly important. Followers, likes, and engagement metrics can provide insight into brand health and consumer sentiment. Unusual activity, such as what we’ve seen with Victoria’s Secret, should be a red flag.

What This Means for Retail Investors

Victoria’s Secret’s stock performance is undeniably impressive, but relying solely on stock price and financial metrics could lead to an incomplete picture. Alternative data, such as social media trends, offers a deeper layer of analysis, helping you make more informed investment decisions.

At AltIndex, we specialize in providing these insights. From social media trends to alternative data metrics, we help investors uncover what others may overlook. Victoria’s Secret is a prime example of why digging deeper into the data matters. As you evaluate this stock - or any stock - try to get access to all the data, not just the headlines.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.