Let's be honest - is it time to short HNST?

July 25, 8:23 am

The Honest Company, Inc., founded by actress Jessica Alba in 2011, has gained popularity for its focus on providing eco-friendly and non-toxic products for babies and households. However, recent developments indicate potential troubles ahead for the company. With the AI Score dropping to a concerning 22, significant insider selling, declining social media followers, web traffic, and plummeting employee morale, it might be time to consider shorting $HNST.

AI Score Hits 22: A Strong Sell Signal

The Honest Company recently received an AI Score of 22, a key metric utilized to gauge a company's overall outlook. This score serves as a strong sell indicator and is derived from a comprehensive analysis of the company's performance across various alternative data points and its financial health. Investors should pay close attention to this signal, as it indicates potential headwinds that may impede the company's growth and profitability.

Unprofitable and No Forecast of Profitability

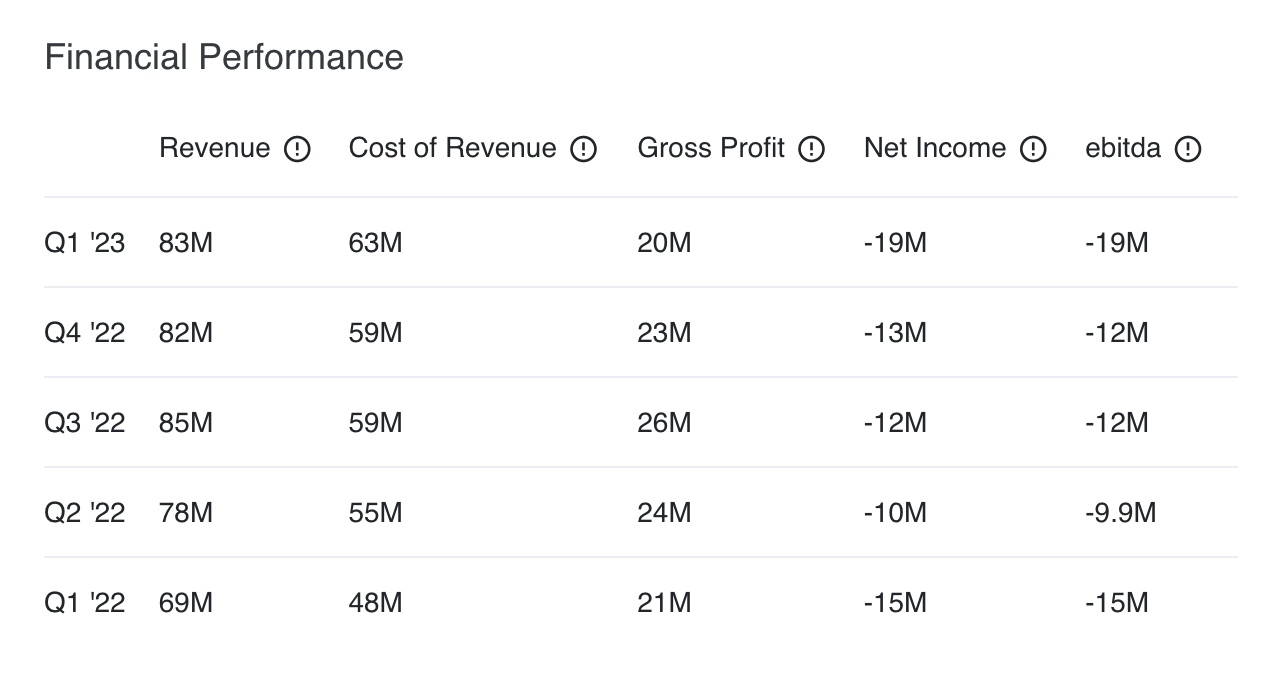

The Honest Company's financial performance raises concerns as it remains unprofitable with no expected improvement in the next three years. Sustained losses could raise questions about the company's ability to manage costs, pricing strategies, or potential market saturation.

Without a clear path to profitability, investors may lose confidence in the company's ability to deliver long-term value.

Insider Selling Raises Red Flags

During the past three months, The Honest Company has witnessed a notable surge in insider selling. Key stakeholders and executives, including the Chief Revenue Officer (CRO) and Chief Product Officer (CPO), have recently divested a substantial number of shares, which could be interpreted as a lack of confidence in the company's future prospects. Such actions by insiders often serve as warning signs to investors, prompting them to reevaluate their positions and potentially reducing their exposure to the company, thereby contributing to further declines in the stock price.

Social Media Exodus: Audience Abandonment Raises Concerns

The power of social media as a barometer for a company's popularity and customer satisfaction cannot be underestimated. Unfortunately for The Honest Company, its social media data tells a concerning story. The company has lost followers on major platforms like Facebook, Twitter, and Instagram over the past year. A dwindling online presence and a shrinking client base suggest waning consumer interest and potential issues with the company's products or marketing strategies.

Web Traffic Plummets by 38%

Another alarming sign for The Honest Company is the substantial drop in web traffic. In June, honest.com recorded an estimated 357,000 visitors, which marks a 38% decline since May. Such a sharp decrease in web traffic can be an indication of decreased brand appeal or a lack of effective online marketing efforts. It may also suggest stronger competition in the market or an overall downturn in consumer demand for the company's products.

Employee Morale Hits Rock Bottom

Beyond external metrics, internal employee sentiment can provide valuable insights into a company's health and prospects. Glassdoor data indicates a significant decline in the company's business outlook among employees over the last 12 months, with only 37% expressing a positive outlook. Such low morale can lead to decreased productivity, increased turnover, and difficulty attracting top talent. It also raises questions about the company's internal culture and management practices.

Conclusion

Given the troubling indicators surrounding The Honest Company, investors may want to exercise caution and consider the possibility of shorting its stock. The AI Score, insider selling, lack of profitability, declining social media presence, plummeting web traffic, and disheartened employee outlook together paint a concerning picture. While shorting a company's stock carries inherent risks, the data points outlined here suggest that The Honest Company may face significant challenges in the near future. Investors should conduct their own due diligence and carefully weigh the potential risks and rewards before making any investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.