Analyzing Alternative Data for Lyft: Buckle Up for a Bumpy Ride

May 22, 6:24 am

In the wild world of investing, we all occasionally take a wrong turn. But when it comes to Lyft, Inc. ($LYFT), the stock has taken investors on a roller coaster ride that would make even the most daring thrill-seekers queasy. With a jaw-dropping 89% decline since the company’s IPO, it's enough to make your stomach drop faster than a steep hill. Recent developments offer little comfort, with a 26% drop in the past 6 months. With these alarming figures, and with our algorithm putting out a sell signal May 1st, let’s take a closer look at the financials and alternative data for the popular ride-hailing company.

C-Suite Shuffle and Cost-Cutting Measures:

Investors are looking to the new members of the C-suite to steer Lyft back on track. With the appointment of David Risher, an industry veteran from Amazon and Microsoft, as the new CEO, Lyft aims to regain stability. His immediate focus has been on cost-cutting measures, including significant layoffs of 1,072 employees and the elimination of 250 open positions. These steps were taken to finance price cuts in an effort to retain their diminishing market share and it can be seen in the company’s job postings over time.

Sour Sentiments and Employee Dissatisfaction:

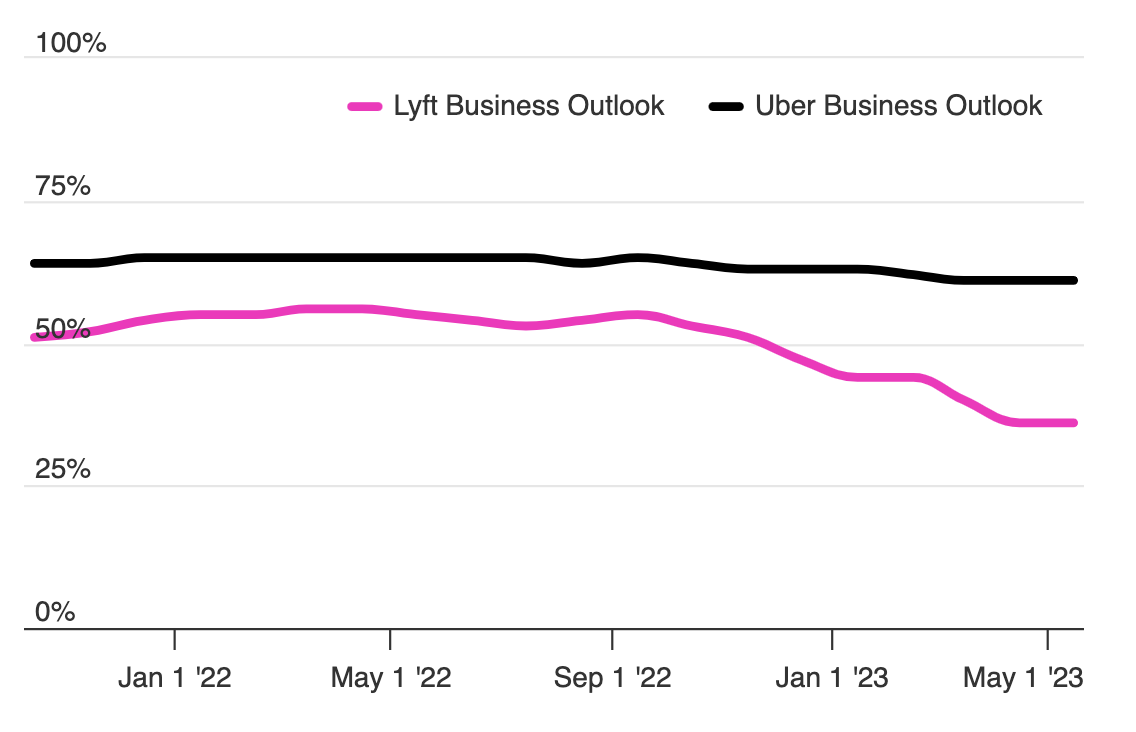

Lyft's declining stock sentiment on various internet forums reflects a growing skepticism among investors. Dropping from around 80 to a disheartening 60 (out of 100), it is evident that the average investor is becoming increasingly sour on the stock. This sentiment is echoed internally as well, with Lyft's employee ratings experiencing an 8% decline over the past year. Furthermore, the business outlook has dipped by a concerning 40% with only 36% of employees having a positive business outlook. In comparison, Lyft's main competitor, Uber, boasts a much higher business outlook at 61%.

Marketing Speed Bumps and Customer Attrition:

Lyft appears to be taking a sharp turn towards reducing marketing costs, as evidenced by a staggering 90% decrease in Google ad spending over the last three months. While this may save the company money, it could also result in fewer visitors to their website and, consequently, a decline in new customer acquisition. Additionally, the number of daily downloads for Lyft's mobile app, a critical platform for the company's customers, has decreased significantly. Estimates from a year ago indicate 25,000 daily downloads, whereas today that number has dwindled to 16,000. Furthermore, Lyft is experiencing a loss of followers across Twitter and Instagram, indicating a potential drop in marketing message reach and its potential impact on attracting new customers.

Revenue Roller Coaster and Investor Jitters:

Lyft recently reported $1 billion in revenue for the quarter ending in March, marking a 14% year-over-year increase and surpassing Wall Street estimates. However, the company's weak revenue forecast for the current quarter has caused concern among investors. The outlook for Lyft's financial road ahead remains uncertain, even with cost-cutting efforts and promises of improved service levels from the CFO.

Conclusion:

As Lyft maneuvers through a challenging landscape, its road to recovery seems filled with obstacles. While leadership changes and cost-cutting measures aim to regain stability, declining sentiments, shrinking customer base, and investor jitters pose significant challenges. The question remains whether Lyft can steer itself towards improved margins, increased customer acquisition, and a smoother ride in the future or if it will face an uphill battle for sustained success. Investors would be wise to buckle up and prepare for a bumpy ride ahead.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.