How $20 Million in Lobbying Makes Meta a Safer Bet for Investors

February 3, 2:15 pm

Meta, the behemoth behind Facebook, Instagram and WhatsApp, has not only been a pioneer in connecting the world but also in navigating the complex web of political and regulatory challenges that come with such a vast digital empire. Recent years have seen the company at the center of numerous controversies, from its role in elections within the US and abroad to concerns over user privacy and the safety of children on its platforms. Such issues have understandably given investors pause, introducing perceived risks to the stability and future profitability of the company. However, a closer examination of Meta's strategic responses, particularly its lobbying efforts and recent financial performance, reveals a different story—one where the risk to investors is progressively diminishing.

The Power of Lobbying

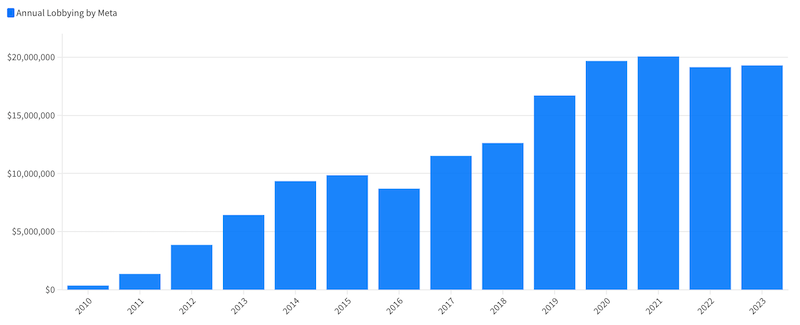

Meta has emerged as one of the most formidable lobbyists in recent years, a strategy that has become increasingly central to its operations amid growing regulatory scrutiny. In the third quarter of the last year alone, Meta reported an impressive expenditure of over $5,140,000 on lobbying activities. This is not a new trend; over the past decade, Meta has consistently increased its lobbying budget, with annual expenditures now around $20 million, surpassing those of its tech counterparts like Amazon and Google.

Yearly lobbying expenditure (estimated) for Meta

Strategic Focus Areas

Meta's lobbying efforts are meticulously targeted, focusing on areas crucial to its operational and business model sustainability:

Cybersecurity and Data Security: By lobbying for enhanced cybersecurity measures and data security protocols, Meta underscores its commitment to user data protection and platform integrity.

Election Integrity and Content Policy: Efforts in this area aim to address the contentious issue of social media's role in elections, combating misinformation and voter suppression.

Digital Services Taxes and Corporate Tax Issues: The company is engaging in discussions that could significantly impact its financial bottom line and global operations.

Trade Agreements and Digital Trade: Lobbying here shows Meta's intent to influence policies affecting its international operations and the broader digital economy.

Technology and Internet Regulation: Meta addresses critical issues like copyright piracy, online advertising, and the pivotal Section 230 of the Communications Decency Act.

Site note: As an investor, you have to applaud Meta for being very open about their lobbying efforts and disclosing all their political engagements on their webpage.

The Crucial Role of Section 230

One of the most important lobbying efforts for Meta is the defense of Section 230, a federal law that shields internet platforms from liability for third-party content. This law is a linchpin in Meta's operational model, allowing for the moderation of content without facing the legal repercussions a publisher might. With both major US political parties scrutinizing this law, Meta's lobbying is a crucial effort to safeguard its interests. Despite calls for reform, Meta's lobbying prowess significantly diminishes the likelihood of adverse changes, ensuring a stable operational environment.

A Financial Milestone: Meta's Latest Earnings Report

This Thursday marked a significant financial milestone for Meta, as the company reported its strongest quarterly sales growth in over two years. With a 25% increase in sales to $40.11 billion for the quarter ending in December, Meta's financial performance not only exceeded expectations but also underscored the success of its investments in AI and enhanced targeted advertising. Furthermore, the announcement of its first-ever dividend and a significant rise in its share-buyback authorization by $50 billion reflect the company's robust financial health and confidence in its future prospects.

Following the announcement of strong earnings and its first-ever dividend, alongside reporting a user base growth to 3.07 billion monthly active users on Facebook, the stock soared by 20%.

Implications for Investors

For investors, Meta's aggressive and strategic lobbying efforts, combined with its strong financial performance, signal a diminishing risk profile. By fostering a favorable political and regulatory landscape and demonstrating financial resilience, Meta not only mitigates potential threats but also cements its market dominance. This proactive approach in shaping policy, regulation, and leveraging AI for business growth underscores the company's resilience and strategic foresight, offering reassurance about its long-term stability and growth prospects.

In conclusion, while Meta Platforms continues to face political and regulatory headwinds, its substantial investment in lobbying and remarkable financial achievements serve as formidable shields, reducing investor risks and ensuring the company's enduring success in the digital age. Through strategic lobbying, Meta not only navigates the present challenges but also secures its future, reinforcing its position as a resilient and savvy player in the global tech arena. However, it's important to remember that no investment comes without risk, and investors should conduct their own due diligence and consider their risk tolerance when making investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.