MoneyLion's Web Traffic Surge Could Signal a Smart Investment

February 11, 4:33 am

MoneyLion (ML), a digital financial services provider, has been gaining momentum, with its stock rising 76.9% over the past year. However, after a couple of months of stagnation, the stock could be primed for its next move. Our data highlights a sharp increase in web traffic and social media engagement for MoneyLion - key indicators of growing customer adoption. For retail investors looking for stocks with strong digital traction, MoneyLion’s rising engagement suggests a promising investment opportunity.

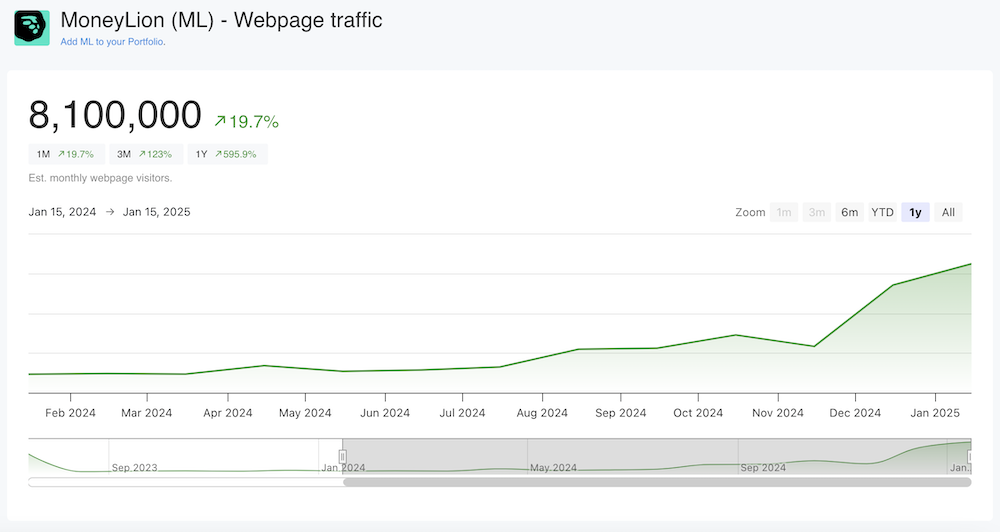

All-time high web traffic

MoneyLion’s website traffic, according to our estimates, has reached record levels, an encouraging sign for a fintech company relying on digital engagement. In the online financial services space, more web traffic usually translates into higher customer sign-ups, increased transactions, and stronger revenue streams.

MoneyLion est. Webtraffic over time

Retail investors should consider that high web traffic isn’t just about visibility - it’s about conversion. When users visit MoneyLion’s webpage, they engage with its financial products, from digital banking to lending and investment tools. A growing online audience increases the likelihood of higher customer retention and repeat usage, which could lead to long-term revenue growth.

Additionally, MoneyLion's Instagram followers and TikTok followers have doubled over the past year. In fintech, social media isn’t just for brand awareness; it’s a key acquisition channel. Platforms like Instagram and TikTok help fintech firms attract younger, tech-savvy users, often leading to a more engaged and loyal customer base.

Key Risks: Competition and Policy Shifts

While MoneyLion is gaining traction, the fintech space is fiercely competitive. Traditional banks are expanding their digital offerings, and new fintech startups constantly emerge, all vying for market share. MoneyLion must continue innovating to maintain its momentum.

Regulatory shifts could also impact the sector. With Donald Trump back in office, financial deregulation could create a more favorable environment for fintech firms, potentially benefiting MoneyLion. However, changes in consumer protection laws or data privacy regulations could pose new challenges. Investors should monitor policy developments closely, as they could shape the landscape for digital financial services.

The Take-Away

MoneyLion’s surge in web traffic and social media engagement is a powerful signal that retail investors should not overlook. These alternative data insights suggest strong customer adoption, which could drive future revenue growth. While competition and regulatory shifts remain factors to watch, MoneyLion's digital momentum puts it in a favorable position within the fintech sector.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always perform your own research or consult a financial advisor before making investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.