MP Materials Sees Surge in Web Traffic, Strong Earnings, and Soaring Stock Price

August 8, 5:43 pm

MP Materials Corp. (MP), a leading American rare-earth materials company headquartered in Las Vegas, Nevada, continues to capture investor attention. The company owns and operates the Mountain Pass mine, the only active rare earth mine and processing facility in the United States, making it a strategic asset in an industry critical for advanced technologies.

Over the past week, shares in MP Materials have risen 11.6% and could potentially climb further as investors digest its latest second-quarter earnings. The company is in the midst of ramping up rare-earth magnet sales, bolstered by expansion plans that will help fulfill high-profile deals with the Department of Defense and Apple. These partnerships position MP Materials as a key domestic supplier in an increasingly geopolitically sensitive market.

Earnings Show Strong Momentum

The company’s earnings report brought encouraging news for shareholders. Revenue surged 84% year over year, reflecting both growing demand and effective scaling of operations. Losses narrowed significantly, with adjusted EBITDA at a $12.5 million loss compared to a $27 million loss in the same period of 2024. This improvement in profitability signals that MP Materials is moving closer to sustained positive cash flow while continuing to invest in capacity and innovation.

Alternative Data Reveals Spike in Public Interest

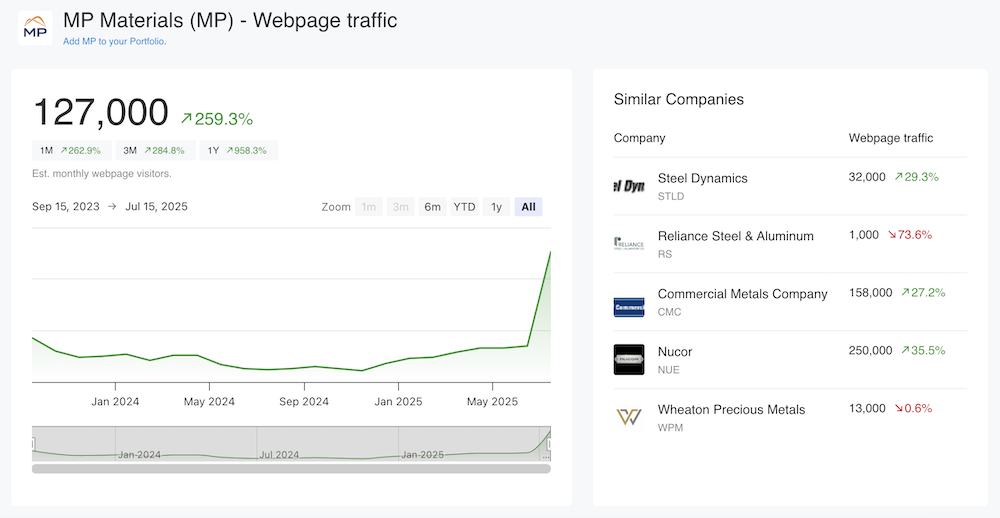

Beyond financial results, alternative data paints a compelling picture. At AltIndex, we track multiple signals of company health and market sentiment. According to our estimates, MP Materials just recorded a new monthly high in web traffic. In July, approximately 127,000 people visited the company’s website, representing an almost 300% increase in just three months. Such a dramatic jump often reflects heightened investor curiosity, customer engagement, and media coverage, which can serve as leading indicators of future growth.

Stock Performance and Early Buy Signal

MP Materials’ stock performance over the past year has been nothing short of remarkable. Shares are currently trading at $74.3, representing a staggering 567% gain over the last 12 months. At AltIndex, we issued our first buy signal on the stock in February, based on a combination of alternative data insights and financial analysis. Investors who acted on that early recommendation have seen returns exceeding 200%, underscoring once again the value of combining traditional financial metrics with alternative data signals.

What Investors Should Monitor Next

For investors looking to keep tabs on MP Materials’ momentum, several straightforward indicators can help gauge ongoing growth:

- Website Traffic Trends: Continued increases in monthly visitors can signal rising interest from potential customers and investors.

- Headcount Growth: According to LinkedIn data, MP Materials’ headcount is up 30% over the last year, reflecting operational expansion.

- Job Postings: "Online job listings are at an all-time high, up 100% year over year, suggesting the company is investing heavily in future capacity.

- Stock Price Movement: The massive jump in share price might scare some new investors away, so it is worth watching for a dip or a price level that aligns with one’s own risk assessment.

MP Materials is proving to be a success story in the U.S. mining and materials sector, blending strategic positioning, operational momentum, and strong market interest. With global demand for rare earth elements expected to rise sharply due to their critical role in electric vehicles, renewable energy, and advanced electronics, the company is well positioned to benefit from this long-term trend. For investors, it remains a stock worth watching closely as it navigates its next phase of growth and capitalizes on increasing demand.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.