Alternative Data Delivers Another Strong Buy as Netflix Surpasses Expectations

January 22, 5:33 am

Netflix (NFLX) has once again proven its strength, reporting a stellar quarter that exceeded Wall Street’s expectations. On the heels of this news, Netflix’s stock surged more than 15% in after-hours trading to $1,001, and AltIndex members were well-positioned to benefit thanks to our early signals.

Earnings Highlight Record Growth

In its December quarter, Netflix reported earnings of $4.27 per share on $10.25 billion in revenue, handily beating analyst expectations of $4.21 per share on $10.11 billion in sales. These figures represent a 102% year-over-year earnings growth and a 16% increase in sales.

The streaming giant also shattered subscriber growth projections, adding 18.91 million new subscribers in Q4 to end 2024 with 301.63 million subscribers globally. Wall Street analysts had anticipated just 10.18 million new subscribers. However, this is the last quarter Netflix will report subscriber numbers, shifting its focus to revenue and operating margin instead.

Netflix’s Q4 content slate played a significant role in this growth, with highlights including the highly anticipated second season of Squid Game, the addition of Carry-On to its all-time Top 10 films list, and landmark streaming events like the Jake Paul vs. Mike Tyson boxing match and two NFL games on Christmas Day.

In addition to its strong quarterly results, Netflix announced a $15 billion stock buyback and raised its full-year revenue outlook to $43.5-$44.5 billion, surpassing the prior range of $43-$44 billion. To align with its success, the company also introduced price hikes across all subscription tiers, which analysts believe could further bolster revenue growth.

Alternative Data Insights

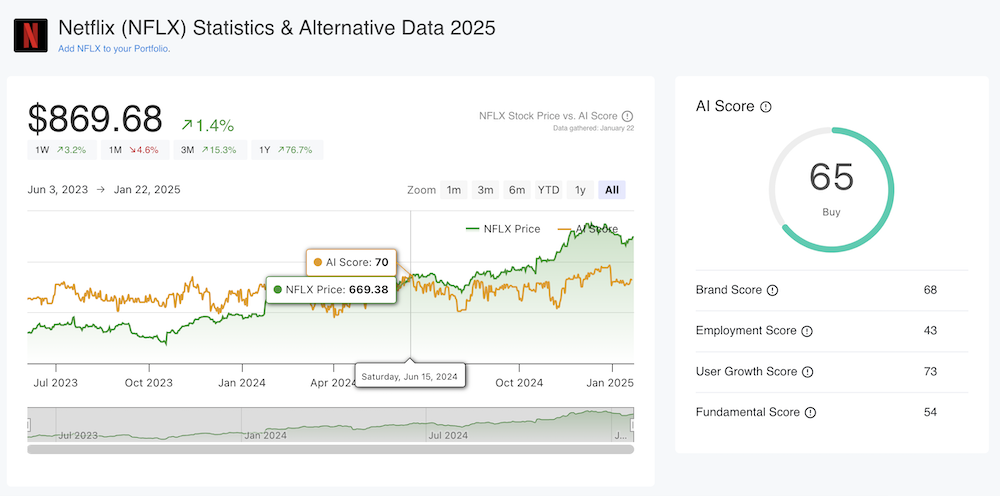

Netflix has long been a favorite at AltIndex, consistently earning buy signals based on its strong AI score. Our proprietary AI Score evaluates companies on various alternative data insights, providing early indicators of future company performance. Netflix last achieved a strong buy signal in June 2024, when the stock was trading at $669. Investors who acted on that signal have enjoyed substantial gains, with the stock now above $1,000.

Netflix Stock Price & AI Score

What fueled Netflix's impressive AI Score? Beyond its growing revenue and subscriber base, we identified critical growth metrics such as:

Web Traffic: December marked an all-time high for Netflix’s web traffic according to our estimates, up 43% year-over-year. Increased site visits have historically been a reliable proxy for growth in streaming businesses, giving AltIndex subscribers a clear indicator of Netflix’s popularity.

Mobile App Downloads: Netflix mobile app downloads have risen steadily, with a 16% year-over-year increase, demonstrating expanding user engagement and an influx of new subscribers.

Social Media Growth: In just the past three months, Netflix gained millions of new followers on Instagram and TikTok, further solidifying its presence in pop culture and attracting a younger demographic.

Timely Alerts for Subscribers

Netflix’s earnings report sparked discussions across social media, with Reddit activity skyrocketing shortly after the announcement. AltIndex members with Reddit alerts received a summary of the discussions, highlighting earnings results and providing interesting investor sentiment.

These Reddit alerts are a new feature that all our our premium members can take full advantage of.

The Power of Alternative Data as a Tool for Prediction

Our ability, thanks to alternative data signals, to detect key growth drivers before earnings announcements has given our members a unique edge. By leveraging signals such as web traffic, app downloads, and social media trends, investors were able to anticipate Netflix’s strong performance and capitalize on the stock’s surge.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.