Netflix's Tyson vs Paul Sparks Surge in Reddit Mentions - but Sentiment Turns Bearish

November 16, 2:33 pm

Netflix ventured into live sports streaming in a big way this past Friday with one of the most anticipated boxing events of the year: Jake Paul vs. Mike Tyson at AT&T Stadium. The event, heavily promoted as a marquee live-streaming showcase for the platform, was poised to cement Netflix’s ambitions in the live sports space. However, technical issues marred the event, sparking a firestorm of criticism and raising questions about the company’s readiness for high-traffic live events.

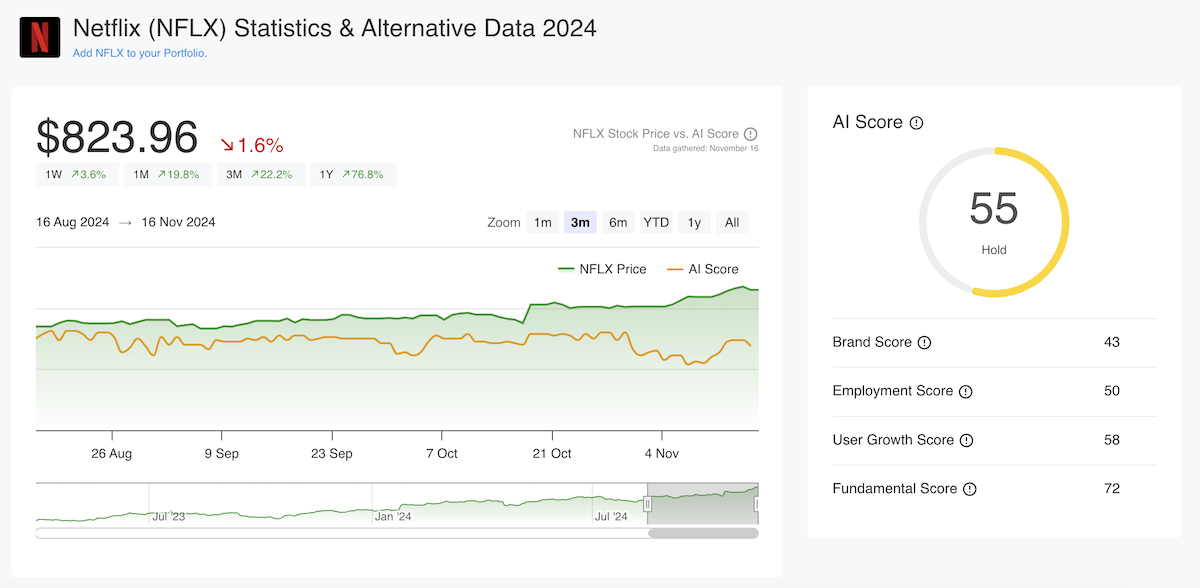

As of today, Netflix (NFLX) is trading at $823.96, marking a 76.8% increase year-over-year - a sign of the streaming giant’s continued dominance and investor confidence. However, events like Friday’s could introduce some short-term turbulence.

Netflix Stock Price & AI Score

Social Media Backlash

The boxing match was a landmark moment for Netflix, drawing millions of viewers. The platform saw a huge spike in search traffic and social media mentions, with a particularly massive surge on Reddit. According to AltIndex data, Netflix mentions on Reddit increased by more than 1,000% in a single day. While this level of buzz might seem like a marketing win, the sentiment behind those mentions tells a different story.

Out of a possible 100, Netflix's sentiment score on Reddit plunged to a bearish 37. Frustrated users across platforms like X and Reddit voiced complaints about constant buffering, blurry video quality, and dropped streams, especially during the undercard bouts. Popular comments highlighted users’ anger and even musings about shorting Netflix stock come Monday.

What Went Wrong?

The streaming issues likely stemmed from a massive and unexpected spike in concurrent viewers, overwhelming Netflix’s infrastructure. While this technical failure casts doubt on the platform's readiness for live sports streaming, it also underscores Netflix's ability to draw a massive live audience—a feat even traditional sports broadcasters struggle with.

The Bigger Picture for Netflix

The timing of this event is critical. Netflix is set to begin live-streaming WWE Raw starting in January, a weekly event that will test the company’s live-streaming capabilities regularly. Friday’s fight was seen as a stress test for these ambitions, but the results leave much to be desired.

For investors, this presents a dual narrative:

1. The Bearish Case:

The streaming issues highlight significant operational risks. Netflix has built its brand on seamless streaming, and these technical hiccups could damage trust among subscribers. If the company cannot resolve these bandwidth and infrastructure problems, it risks alienating users and advertisers alike, especially with high-stakes content like WWE Raw on the horizon.

2. The Bullish Case:

Despite the technical failures, the sheer volume of viewers signals untapped potential in live sports streaming. Netflix has proved it can attract a large audience, even in a space dominated by traditional sports networks and platforms like ESPN+. If it can address its infrastructure shortcomings, live sports could become a lucrative addition to its portfolio and a driver of both subscriptions and ad revenue.

Investor Outlook

Netflix’s stock may face volatility in the short term as the negative sentiment from this event ripples through social media and news cycles. The sentiment on platforms like Reddit—where many retail investors congregate—is particularly concerning. Talks of shorting the stock highlight how the market may react to Friday’s fiasco.

However, the long-term opportunity remains compelling. Netflix is entering a crowded but lucrative space with live sports streaming. If it can iron out its technical issues, the company has a clear path to diversify its revenue streams, attract new subscribers, and capitalize on advertising revenue.

Bottom Line

Friday’s boxing match was a double-edged sword for Netflix. It showcased the company’s ability to attract massive audiences while simultaneously exposing cracks in its infrastructure. For investors, this means balancing short-term risks against the long-term potential of live sports streaming. As Netflix prepares for WWE Raw in January, the next few months will be critical in determining whether the company can rise to the challenge - or whether live sports streaming will prove to be its Achilles’ heel.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.