Is Peloton a Buy or a Sell After Positive Earnings?

August 22, 3:33 pm

Peloton's (PTON) latest earnings report, which sent its shares soaring by 35%, has sparked renewed interest in the beleaguered connected fitness company. After a turbulent period marked by leadership changes and declining sales, Peloton has shown signs of recovery. But is this rebound sustainable, or are investors being overly optimistic? Let's dive into the numbers and see what the alternative data suggests about Peloton's future.

Earnings Overview: A Glimmer of Hope?

Peloton's fiscal fourth quarter brought some much-needed good news. The company reported a modest 0.2% year-over-year revenue growth, marking the first time since the 2021 holiday quarter that Peloton has achieved positive sales growth. With sales reaching $643.6 million, the company narrowly beat Wall Street's expectations of $631 million. Additionally, Peloton managed to significantly narrow its losses, posting a loss of $30.5 million (8 cents per share) compared to a much larger $241.8 million (68 cents per share) in the same quarter last year.

Peloton's focus on profitability over growth is evident. The company has made substantial cuts to its marketing and sales spending, leading to a $25.5 million reduction in these expenses. As a result, Peloton delivered adjusted EBITDA of $70 million, far exceeding analyst expectations, and generated $26 million in free cash flow—marking two consecutive quarters of positive cash flow.

Alternative Data: A Mixed Bag

While the earnings report impressed investors, the alternative data paints a more nuanced picture. Let's explore some key metrics:

Job Postings: A proxy for company growth, job postings have been steadily declining. In September last year, Peloton had 240 open positions. By June this year, that number had plummeted to just 40, with a slight recovery to 60 positions as of the writing of this article. This decline could indicate a cautious approach to expansion or signal deeper concerns about the company's future growth prospects.

Webpage Traffic: Peloton's webpage traffic has remained steady at an estimated 5 million visitors per month, a slight increase year over year. While this stability is encouraging, it suggests that Peloton's ability to attract new customers is not growing significantly.

Social Media Growth: Peloton's social media presence shows stagnation. The company's Instagram followers grew by only 2.3% year over year, while Facebook followers increased by just 1.1%. These modest gains highlight the challenges Peloton faces in expanding its customer base.

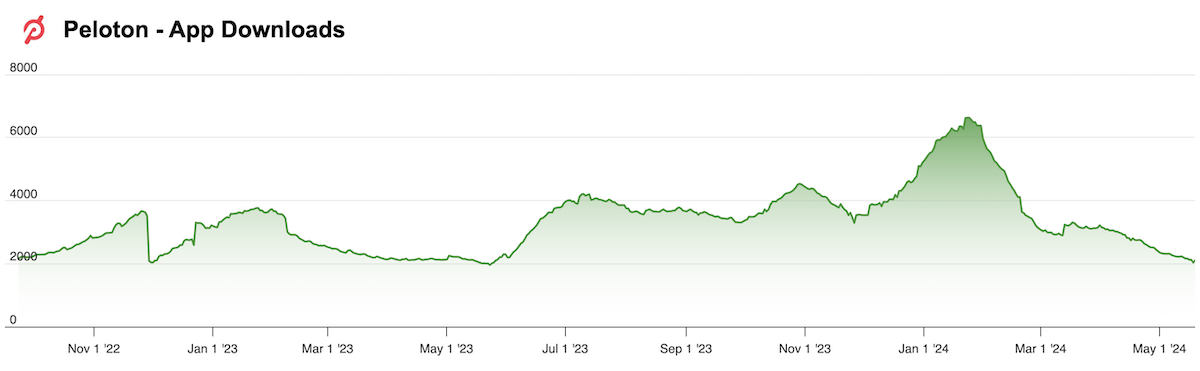

App Downloads: Perhaps the most concerning metric is the decline in app downloads. At AltIndex, we've tracked Peloton's mobile app downloads for the last two years, and the current estimated daily download rate of 1,300 is at its lowest point in that period. This decline in downloads raises red flags about customer retention and engagement.

Estimated daily downloads of Peleton's mobile apps

What Does This Mean for Investors?

While Peloton's recent earnings report shows positive signs of recovery, the alternative data presents challenges that cannot be ignored. The company's shift towards profitability is commendable, but the declining job postings, stagnating social media growth, and decreasing app downloads suggest that Peloton still has significant hurdles to overcome.

At AltIndex, we currently have a sell signal on Peloton. The 35% spike in share price following the earnings report may be overly optimistic, given the company's ongoing challenges. Investors should approach Peloton with caution, recognizing that while the earnings report is a step in the right direction, the road ahead may still be rocky.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.