Reddit's IPO: A Comprehensive Analysis for Retail Investors

March 12, 7:32 am

As Reddit prepares for its highly anticipated public offering, aiming to raise up to $748 million, the financial world is abuzz with speculation and interest. This momentous event places the social media platform, known for its dynamic and diverse forums, under the spotlight. But what implications does this have for the individual investor? Let's delve into the details of Reddit's IPO, uncovering the layers of opportunity and challenge that it presents.

A long awaited IPO

Reddit's journey to the New York Stock Exchange, under the ticker "RDDT," marks a significant chapter in the social media saga. With an anticipated valuation of nearly $6.5 billion, down from a previous estimate of about $10 billion, the platform is set to offer 22 million shares to the public. This move not only signifies Reddit's growth ambitions but also highlights the platform's unique position in the social media domain, being the first major U.S. social media company to go public since Pinterest in 2019.

Understanding Reddit's User Base and Financial Health

At its core, Reddit is a conglomerate of communities, boasting 267.5 million weekly active users globally. This user engagement is a double-edged sword, providing both a solid foundation for advertising revenue and a challenge in navigating the delicate balance between monetization and maintaining an authentic user experience. In 2023, Reddit's revenue reached $804 million, predominantly from advertising. However, the company's financials also reveal a net loss of $90.8 million, showcasing the growing pains of scaling a digital platform.

The AI Edge and Revenue Diversification

Amidst the AI revolution, Reddit sees an opportunity to leverage its "vast and unmatched archive" of human conversations. A recent deal with Google, worth $60 million per year, to train AI models on Reddit's user-generated content illustrates the potential new revenue streams. Yet, with advertising still constituting 98% of its revenue, the platform's future financial health hinges on diversifying its income sources and navigating the challenges of an ad-centric model.

Investor Considerations: Risks and Rewards

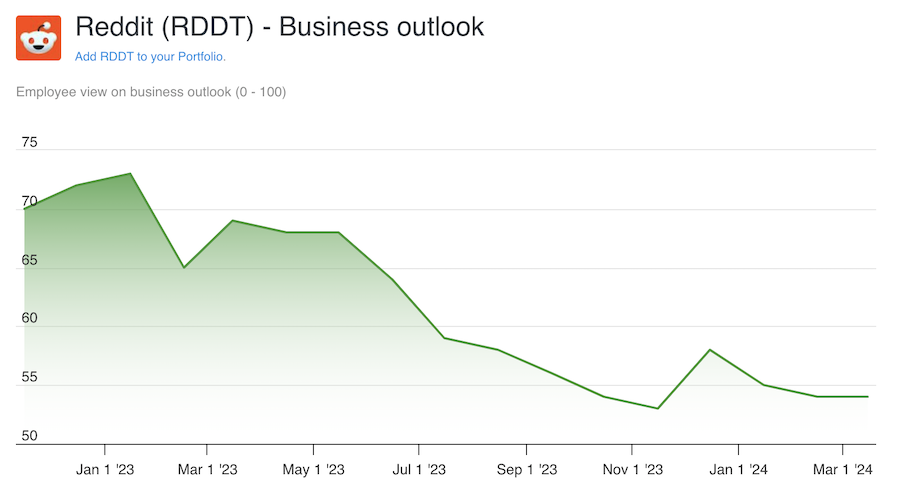

For retail investors, the allure of Reddit's IPO lies in the platform's robust user base and pioneering role in the AI domain. However, the investment landscape is marred with cautionary tales of tech IPOs. Reddit's reliance on advertising revenue, coupled with its community's skepticism towards commercialization, poses significant risks. Furthermore, alternative data insights suggest a declining business outlook among employees and a struggle to attract new users through traditional social media channels.

Reddit's Business Outlook according to employee ratings

The Verdict for Retail Investors

As Reddit prepares to enter the public market, retail investors are faced with a complex decision. The platform's strong engagement metrics, potential for revenue diversification, and strategic moves in AI present a compelling case for growth. However, concerns over profitability, the sustainability of advertising revenues, and the balance between user satisfaction and monetization efforts cannot be ignored.

In essence, Reddit's IPO embodies the quintessential high-risk, high-reward scenario. The platform's ability to innovate, monetize and adapt will be critical. For investors, the IPO offers a unique opportunity to partake in the growth of a platform that has redefined community engagement online. Yet, the path to profitability and long-term success is fraught with challenges, making Reddit's IPO a fascinating, albeit speculative, investment proposition.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.