Robinhood Q4 Earnings Report: Can the Stock Keep Soaring Despite Bleak Outlook?

February 7, 7:34 pm

Robinhood Markets ($HOOD) is set to reveal its Q4 earnings on Wednesday. Investors will be keeping a close eye on the company's 2023 outlook, as analysts have already lowered their earnings projections for Q4 by 72%. Despite this, the stock has risen 30% YTD and Robinhood will need to deliver strong results to maintain its upward momentum.

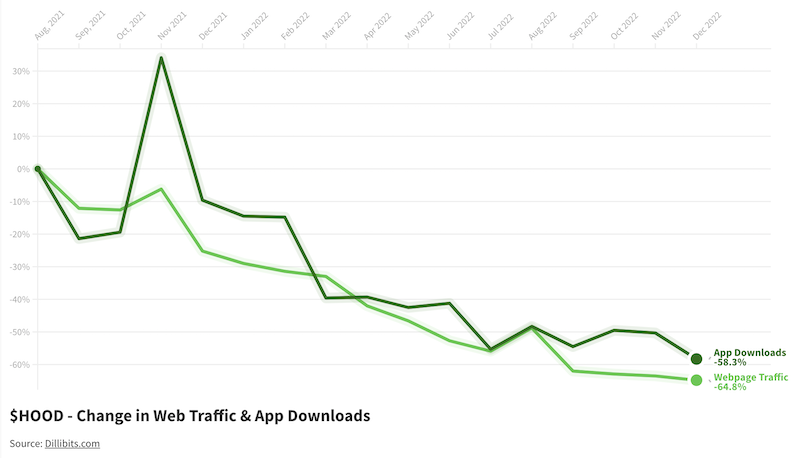

But alternative data suggests a challenging situation for Robinhood, with low employee morale and a business outlook score of only 36 out of 100. Additionally, the company has seen a 60% drop in webpage traffic and a 50% drop in app downloads in the last 18 months. This can indicate that Robinhood is struggling attracting new customers.

Combine this with a surprising decline in Instagram followers, and we have a couple of strong signals of a decreasing customer sentiment.

To gauge the company's performance, investors will be watching monthly active users, which dropped to 12.2 million in Q3, a decrease of almost 50% from Q2 2021. Analysts predict a further 28% drop in Q4.

The current upswing in the market could mean that business is slowly coming back to Robinhood, so for long term holders, the future might be brighter. But the decrease in webpage traffic, business outlook, MAU and Instagram followers could indicate that the company is currently struggling. Add a dire threat on the regulatory front to overhaul the handling of small investors, it makes sense for investors to exercise caution when considering investing in Robinhood, given short-term downside might be expected.

$HOOD earnings will be announced after hours February 8th.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.