Best Buy's Dimming Sales Outlook: Is It Time To Sell?

November 26, 5:02 pm

Best Buy (BBY) recently slashed its full-year sales forecast, highlighting persistent challenges in the consumer electronics market. Despite an early holiday shopping season and the launch of new AI-enabled laptops and iPhones, the retailer’s sales fell short of Wall Street’s expectations, underlining concerns about waning consumer demand. For retail investors, this report serves as a critical reminder to consider both traditional financial metrics and alternative data insights when evaluating stocks.

A Soft Quarter Amidst Mounting Challenges

For its fiscal third quarter, Best Buy reported earnings per share of $1.26, narrowly missing Wall Street’s $1.29 estimate. Revenue came in at $9.45 billion, down from $9.76 billion in the prior year and below analyst expectations of $9.63 billion. Comparable sales declined by 2.9%, reflecting weak demand in categories like appliances, home theaters, and gaming. Even the much-anticipated launch of AI-enabled laptops and Apple’s refreshed lineup of iPads failed to provide a significant boost.

CEO Corie Barry attributed the disappointing results to macroeconomic uncertainty, inflation pressures, and shifting consumer priorities. While demand has picked up in recent weeks as holiday sales gain traction, Barry tempered expectations for the crucial holiday quarter, forecasting comparable sales to range from flat to a 3% decline.

Structural Shifts Hampering Growth

The broader consumer electronics market faces headwinds, including:

- Pandemic Aftermath: Many consumers upgraded their electronics during the COVID-19 pandemic, leaving little urgency for replacements.

- Inflationary Pressures: Rising costs for necessities like food have curbed discretionary spending.

- Shift to Experiences: A growing preference for services such as travel and dining out has diverted spending from electronics.

Additionally, geopolitical concerns, such as potential tariffs on Chinese goods, pose risks to Best Buy’s supply chain. With approximately 60% of its inventory sourced from China, new tariffs could pressure margins further.

Red Flags in Alternative Data

While Best Buy’s stock has seen a 33% increase over the past year, alternative data signals suggest potential trouble ahead:

- Insider Selling: Insiders, including CEO Corie Barry, have sold nearly $600 million worth of shares in the past year. Barry alone offloaded shares worth $17 million.

- Declining Employee Sentiment: Only 41% of employees hold a positive business outlook, reflecting internal concerns about the company’s direction.

- Falling Web Traffic: Traffic to bestbuy.com has dropped by an estimated 17.8% over the last year, indicating weaker online engagement.

- Low Job Postings: Job postings, often a leading indicator of growth, are down 38% year over year.

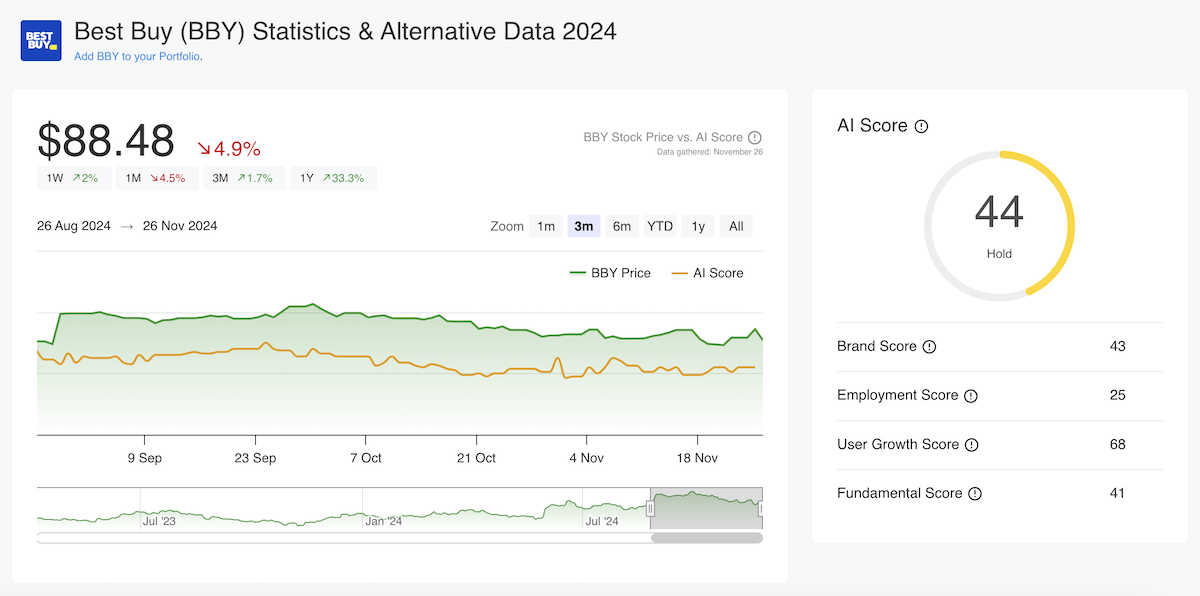

These data points feeds the AI score for Best Buy, which sits at a modest 44 out of 100 - hovering near sell territory.

Best Buy Stock Price & AI Score

What Should Investors Do?

Retail investors should weigh these findings carefully. While Best Buy’s stock may appeal to short-term traders capitalizing on volatility, long-term investors may want to tread carefully. The combination of insider selling, weakening employee sentiment, and declining online engagement raises questions about the company’s ability to navigate current challenges.

For those seeking deeper insights, alternative data can be invaluable in making informed decisions. At AltIndex, we leverage alternative data to uncover hidden trends, helping investors identify opportunities and mitigate risks. Whether it’s Best Buy or another stock on your radar, alternative data often offers a more diversified lens through which to evaluate and predict company performance.

Disclaimer: The content provided in this article is for informational purposes only and should not be considered as financial advice. Investing in stocks involves risk, and past performance is not indicative of future results. Always conduct your own research or consult with a financial advisor before making investment decisions. AltIndex is not responsible for any losses incurred based on the information provided.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.