Serve Robotics: Can Sidewalk Robots Deliver Investor Returns?

August 20, 9:12 am

Serve Robotics (SERV) has emerged as one of the most ambitious players in the race to reinvent last-mile delivery. Its small autonomous robots, designed to roll down sidewalks with groceries and takeout, are already active in several major U.S. cities. What was once a futuristic vision is now a daily reality for thousands of customers, with the company boasting more than 100,000 deliveries completed since 2022 at a success rate of 99.8%. The promise is simple: faster, cheaper, and more reliable delivery than human drivers in two-ton cars can offer.

Expensive Growth

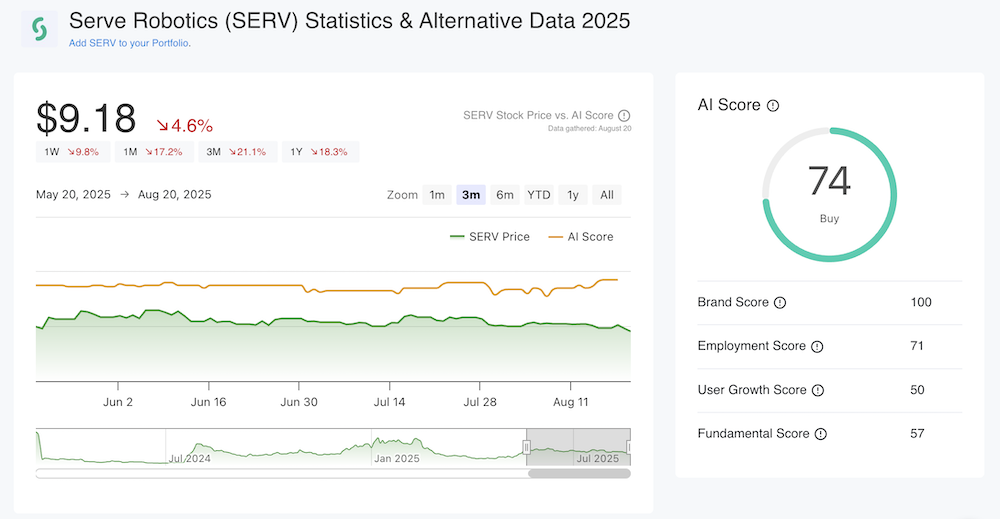

The stock, however, tells a more complicated story. Shares of Serve Robotics are currently trading just above nine dollars, giving the company a market capitalization of around $545 million. That valuation is lofty compared to its revenue base, which reached only $642,000 in the second quarter of 2025. Losses remain heavy, with more than $33 million burned in the first half of the year. While Serve holds $183 million in cash that should last until late 2026, investors are already weighing the likelihood of future capital raises and dilution. It is a classic growth-versus-burn dilemma.

Still, the potential is difficult to ignore. Serve is scaling rapidly through its partnership with Uber Eats, with plans to deploy 2,000 robots across multiple cities in the coming years. Management estimates that when the fleet reaches full utilization, the business could achieve an annual revenue run rate of $60 to $80 million. The long-term vision is even bolder: drive delivery costs down to a single dollar per order, a price point that could disrupt human-driven services entirely. Research from ARK Invest suggests that robotics and drone-based delivery could open a $450 billion market by 2030, and Serve intends to secure its slice of that opportunity.

The Acquisition of Vayu Robotics

The company is also investing in technology to stay ahead. Its recent acquisition of Vayu Robotics brings advanced AI navigation that could allow its robots to expand into new delivery environments such as bike lanes and road margins. This move is about more than efficiency - it positions Serve to move into new categories and regions faster, broadening the potential customer base beyond restaurants to retailers and service providers.

Alternative Data Signals Upside

Alternative data paints a picture of momentum building behind the brand. Social media engagement is on the rise, with double-digit follower growth across Instagram, X, and YouTube over the past three months. Web traffic surged by fifty percent in July compared to earlier in the year, a sign that awareness is spreading beyond the cities where Serve already operates. Hiring data reinforces the growth story, with LinkedIn employee counts up thirty percent and job postings up more than twenty percent during the same period. These are the kinds of early signals that often precede meaningful commercial traction.

Currently, taking all alternative data signals into consideration, Serve Robotics has an AI score of 74 - a buy signal.

Next Steps for Investors

For investors, the opportunity and the risk are two sides of the same coin. On the one hand, Serve is proving that its technology works at scale and that merchants are eager to sign on. Partnerships with Uber Eats and national brands like Little Caesars suggest confidence in the model. On the other hand, the company is still a long way from profitability, and the gap between current revenue and its ambitious targets is wide. Execution will need to be nearly flawless to justify today’s valuation, and any delay in scaling could force a new capital raise sooner than shareholders would like.

For now, Serve remains a high-risk, high-reward stock. Investors who believe alternative data insights being leading indicators and in the inevitability of autonomous delivery may see today’s volatility as an entry point. Those who are more cautious will want to track the company’s burn rate, unit economics, and the pace of robot deployment before committing capital.

Disclaimer: The information provided is for educational and informational purposes only and should not be construed as financial or investment advice. All investments involve risk, and you should conduct your own research or consult a qualified professional before making any investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.