Spotify signal’s continued growth with more users, web traffic and downloads

October 26, 5:45 pm

Spotify released its earnings yesterday, in which the company reported wider-than-expected losses for the third quarter. The company did beat on both revenue and user growth (more on that later) but investors did not like streaming platform's wider-than-expected loss, along with its declining gross margins, which came in at 24.7%, missing expectations of 25.2%. The market responded to this information accordingly and the price is now down to $84 per share, a new all time low for Spotify. We believe that this is an interesting price point for a growth company.

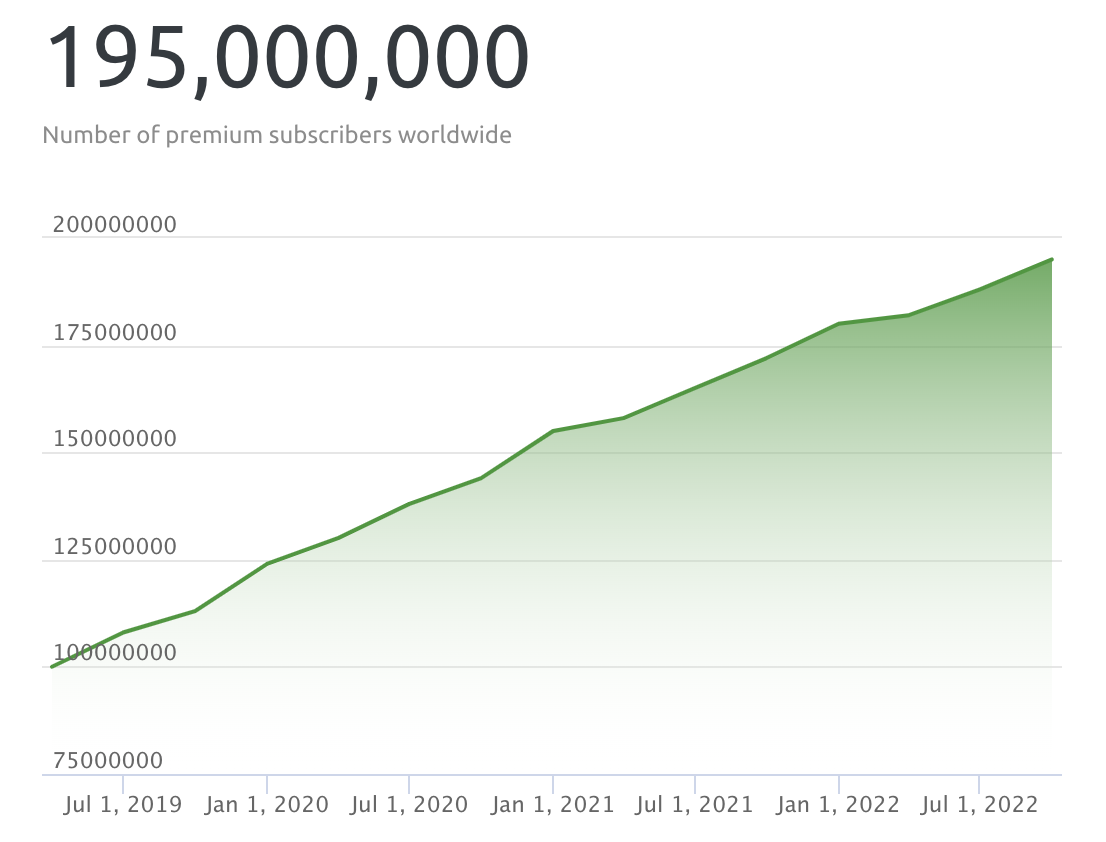

Spotify was a booming stock during the pandemic, with its share price touching an all-time peak of $364, but since its peak, the price has steadily dropped. This pattern is true for a lot of tech companies so to get a better understanding of the company’s worth, we have to look at their user growth and data from before the pandemic. Before covid, back in 2019, the audio streaming company hosted 100 million paying subscribers and had a market cap of $24B. Putting those numbers up against each other means that each subscriber was valued at $240. Today, 3 years later, the market cap has dropped to $18B but the company’s paying subscribers have nearly doubled to 195 million. This brings the subscriber value down to $92.

At AltIndex, besides user statistics, we also download and analyze several alternative data points that reflect on Spotify’s overall business health. One of the indicators is webpage traffic to spotify.com, which has increased by almost 50% year to date. We have also observed that the company’s mobile app downloads have increased by 15% in the same time period. These statistics should build a strong case for the continued growth of Spotify premium subscribers.

While the traffic and app data keeps projecting an upwards trend, hiring statistics also narrate a similar story. Spotify has consistently maintained its hiring strategy and not freezed hiring like other tech companies. And, according to data from LinkedIn, their employees have increased in the last year with no signs of slowdown.

If Spotify were still just a music streaming business, the loss in the third quarter would be a reason to stay away since growth would seem to come at a high price. But Spotify has built up a strong streaming platform with music, audiobooks and podcasts and added to the gap between them and their competitors.

It is true that the overall decline in the ads industry is a cause of concern. But we believe that Spotify has built a strong streaming platform and that the alternative data hints towards growth. Add that margins should drop as paying subscribers keep climbing, and we might just have a good buying opportunity right now.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.