Spotify Hits High Notes Again: Q2 2024 Earnings Boost Stock by 11%

July 23, 11:12 pm

Shares of Spotify (SPOT) surged today after the music streaming giant released its Q2 2024 earnings. At the time of writing, SPOT stock is currently up over 11%, trading at $330 per share. The significant rise reflects investor confidence driven by several positive metrics.

Key Metrics from Spotify’s Q2 2024

Spotify reported robust growth across multiple areas:

Monthly Active Users (MAUs): 626 million, a 14% increase year-over-year.

Premium Subscribers: 246 million, a 12% rise year-over-year.

Ad-Supported MAUs: 393 million, up 15% year-over-year.

Total Revenue: €3.8 billion (approximately $4.1 billion), marking a 20% year-over-year growth.

These impressive numbers indicate Spotify's strong market presence and ability to attract and retain users, even as it slightly missed its own guidance of 631 million MAUs for Q2 by 5 million. Despite this shortfall, the overall performance has overshadowed this miss.

Cost-Cutting and Financial Efficiency

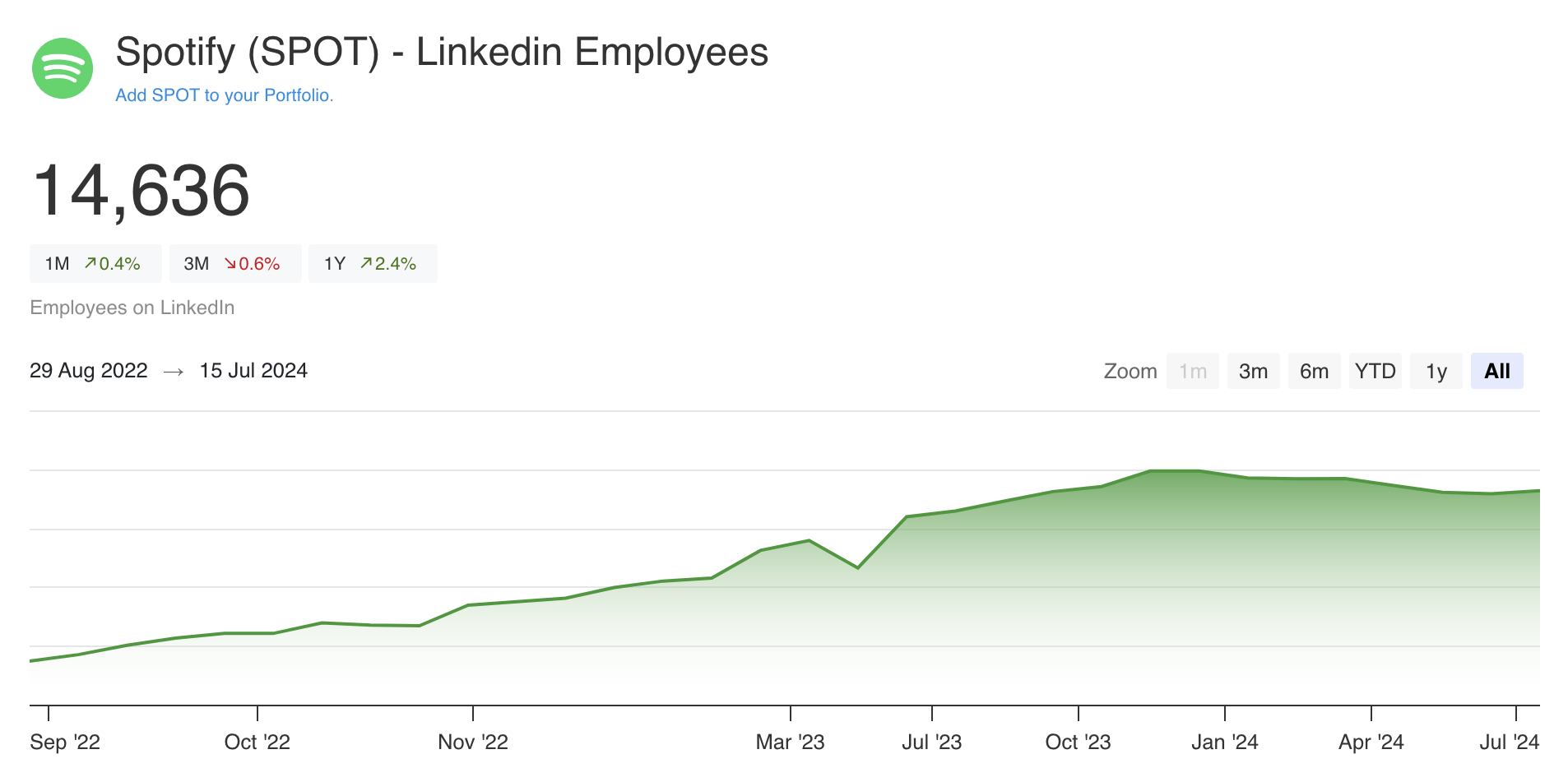

Spotify's focus on cost-cutting measures has played a significant role in its positive earnings report. Operating expenses declined by 16% year-over-year, primarily due to reduced marketing expenditures and layoffs. Since November last year, the number of employees has been on a downward trend, reflecting the company's strategic downsizing efforts.

Spotify employees according to LinkedIn data

Job and Social Media Insights

Tracking the number of people who state they work for Spotify on LinkedIn and the number of open job posts, it's evident that Spotify has been stringent with new hires since the end of 2022. This disciplined approach to managing personnel and operational costs has contributed to the company's improved financial health.

Price Hikes and Revenue Growth

Spotify's latest price hikes, effective this month, have also been a catalyst for investor optimism. The Premium Individual plan will increase from $10.99 to $11.99, impacting both new and existing subscribers. This move is expected to bolster revenue further in the upcoming quarters.

CEO's Vision and Future Outlook

In the earnings press release, CEO Daniel Ek expressed optimism about Spotify's future, highlighting the company's innovation and business growth. "It’s an exciting time at Spotify. We keep on innovating and showing that we aren’t just a great product, but increasingly also a great business. We are doing so on a timeline that has exceeded even our own expectations. This all bodes very well for the future," he said.

For Q3 2024, Spotify anticipates:

MAUs: 639 million

Premium Subscribers: 251 million

Revenue: €4.0 billion (approximately $4.35 billion)

Social Media and Customer Growth

Spotify's strong social media presence has significantly contributed to its growth. According to AltIndex, our algorithm rated Spotify with a high AI score of 77 in December last year, prompting a buy signal. Since then, the stock has risen by 75%. The following social media statistics highlight Spotify's impressive brand-building efforts:

Twitter: 16.1 million followers, a 37% increase year-over-year.

Instagram: 11.5 million followers, up by 13.6% year-over-year.

Reddit: 1.9 million followers, up by 98% year-over-year.

Threads: 2.4 million followers, up by 100% year-over-year.

TikTok: 3 million followers, up by 20% year-over-year.

YouTube: 1.7 million subscribers, a 13.5% increase year-over-year.

These growing follower counts reflect a strong and loyal customer base, enhancing Spotify's market position and long-term growth prospects.

Investor Takeaway

Investors should be encouraged by Spotify's Q2 2024 results and strategic initiatives. The company's ability to grow its user base, increase revenue, and improve financial efficiency while maintaining a strong social media presence bodes well for its future. Despite the slight miss in MAUs, Spotify's overall performance and future outlook make it a compelling investment opportunity.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.