Tariffs and Inflation Pressure: Is Bitcoin the Answer for Investors?

February 2, 9:33 am

In recent days, Bitcoin’s price (BTC) has experienced a notable dip, falling below the $100,000 mark for the first time since January 27. This drop comes on the heels of U.S. President Donald Trump’s announcement to impose additional tariffs on imports from China, Canada, and Mexico. The move has not only rattled traditional markets but has also stirred a mix of caution and curiosity in the crypto world.

Tariffs and Market Turbulence

On February 1, the White House announced a 25% additional tariff on imports from Canada and Mexico, as well as a 10% additional tariff on imports from China. While energy resources from Canada are subject to a slightly lower tariff, the broader impact of these measures has been swift. Canadian Prime Minister Justin Trudeau confirmed plans to hit the U.S. with a 25% tariff on $106.5 billion worth of goods, while China's Ministry of Commerce signaled plans to file a complaint with the World Trade Organization (WTO) and promised countermeasures. Similarly, Mexican President Claudia Sheinbaum hinted at a strategic response, including both tariff and non-tariff measures to safeguard national interests.

For Bitcoin, these geopolitical moves have had immediate repercussions. The cryptocurrency that just 2 days ago was worth $105k per coin has dropped to $98,188.

Inflation Concerns Versus Bitcoin as a Hedge

Traditionally, tariffs can lead to increased costs for consumers, potentially driving inflation. In an environment where inflation is a growing concern, Bitcoin is sometimes considered an alternative asset - a hedge against rising prices. However, the reality for Bitcoin investors is more nuanced.

Market participants are weighing the inflationary potential of tariffs against the risk aversion triggered by geopolitical tension. While some view Bitcoin as a safeguard against inflation, the immediate response to the tariff announcement has been a retreat, as reflected in the changing investor sentiment.

But the connection between dollar inflation and Bitcoin’s price has been observed in previous market cycles. For instance, in early 2021, as expansive monetary policies raised concerns about dollar inflation, Bitcoin experienced a notable rally. Investors, wary of the declining purchasing power of traditional currencies, increasingly turned to digital assets in search of a hedge. Similarly, episodes during periods of economic uncertainty have occasionally spurred Bitcoin rallies, with some viewing the cryptocurrency as an alternative store of value when inflation expectations rise.

While these examples do not establish a definitive rule, they underscore the notion that, at times, Bitcoin has played a role in diversifying portfolios amid inflationary pressures.

Shifting Investor Sentiment and Robust Interest

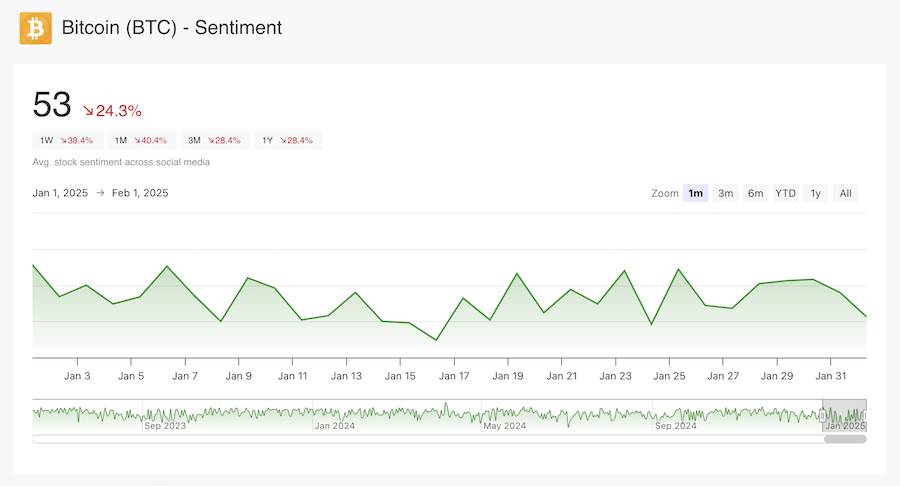

Recent data from multiple investor forums provides a snapshot of how market attitudes are shifting. Over the past couple of days, the bullish sentiment for Bitcoin, which was once at a robust 70 out of 100, has declined to a neutral 53. This drop in sentiment highlights the immediate caution among investors, even as many still hold long-term optimism for Bitcoin.

Despite these short-term fluctuations, the overall interest in Bitcoin remains strong. Google search trends, while lower compared to the November peak, are still significantly higher year over year. Moreover, the Bitcoin subreddit has seen a 6% increase in followers over the last three months. These indicators suggest that the appetite for information and community engagement around Bitcoin continues to grow, even in the face of market jitters.

The Road Ahead

The current scenario underscores a key characteristic of the cryptocurrency market: its ability to absorb shocks and maintain underlying interest despite volatility. As global trade tensions and tariff measures continue to unfold, Bitcoin’s near-term price movements may remain sensitive to such geopolitical events and the inflation pressures they can induce.

Yet, the persistent community engagement - from heightened Google searches to a growing Bitcoin subreddit following - suggests that investors are not dismissing Bitcoin's potential role in a diversified portfolio. With past instances where inflation concerns have coincided with Bitcoin rallies, some investors are beginning to consider whether the cryptocurrency might serve as a counterbalance in times of mounting economic pressures.

Ultimately, the question remains: Is Bitcoin the answer for investors facing tariffs and inflation pressure? For many, the answer lies in a careful balancing act - recognizing that while Bitcoin may offer a hedge in uncertain times, its volatile nature demands a long-term, well-informed strategy. Investors that are in Bitcoin for the long-term might see the near-term future as a good buying opportunity.

As these economic dynamics evolve, investors are urged to stay updated and weigh the risks alongside potential rewards.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.