Tesla Delivers Record Quarter as Stock Soars: What Investors Should Watch Next

October 2, 8:44 am

Tesla’s stock price has been on an extraordinary ride recently. Over the past month alone, shares have jumped 32 percent, and the stock now trades at $436 per share. The move has been fueled by hype by retail investors and today the company announced record-breaking delivery numbers, although sentiment around the stock remains mixed.

Record Quarterly Deliveries

Today Tesla announce that the company delivered 497,100 vehicles in Q3. This was the company’s highest quarterly figure to date and significantly above the consensus estimate of 448,000 deliveries. Much of this surge came from buyers looking to capitalize on the final stretch of the $7,500 government tax credit.

Production was also robust. Tesla produced 447,000 vehicles in the quarter, including 435,800 of its most popular models, the Model Y and Model 3. Out of the total deliveries, 481,166 were Model Y and Model 3 vehicles, reaffirming the dominance of Tesla’s mass-market lineup.

For context, Tesla delivered 336,681 vehicles in Q1 2025, 384,122 in Q2 2025, and 462,890 in Q3 2024. The growth trajectory is clear, and Tesla’s ability to consistently push new records strengthens the company’s reputation as a market leader in electric vehicles - even though the company has faced a lot of backlash during the year as Elon Musk faced a lot of critisicm with his involvement in DOGE.

Investor Signals from Alternative Data

While financial headlines often focus on deliveries and earnings, alternative data offers valuable insights into Tesla’s future momentum. At AltIndex, our AI score for Tesla currently hovers around 50, which signals a hold. The stock’s recent climb may seem unstoppable, but investors should pay close attention to the following data points:

Hiring and Workforce Growth

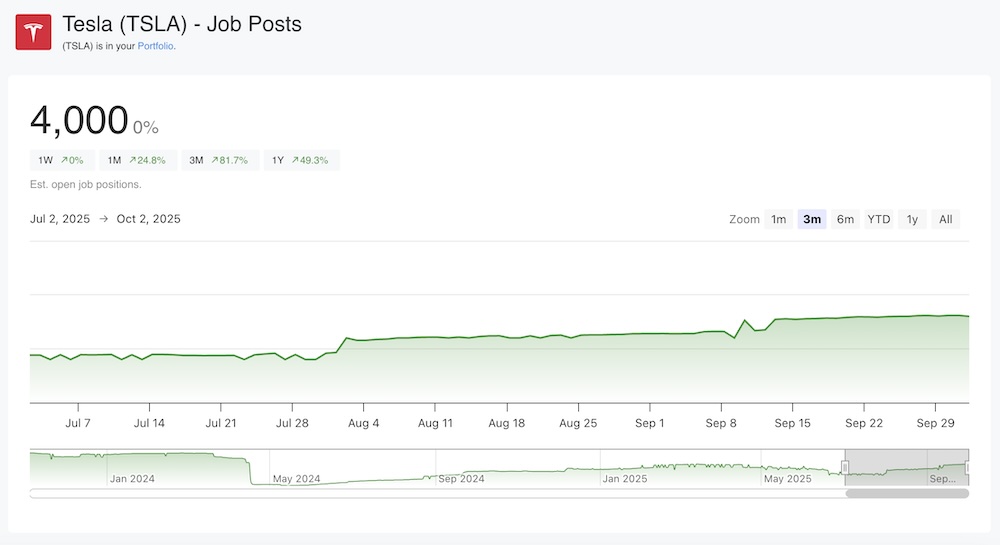

Tesla has increased its job postings in recent months (up 80% in just the last 3 months). Expanding headcount usually signals confidence in business growth, whether in manufacturing capacity, AI development, or expansion into new markets. A company aggressively hiring is generally investing in its future, which is an encouraging sign for long-term investors.

Customer Demand Indicators

Tesla’s mobile app downloads remain high and steady. For consumer-facing companies, app downloads is a strong proxy for demand, as it often reflects both new customer acquisition and ongoing engagement. Stable or rising downloads reinforce the notion that Tesla’s customer base continues to expand.

Insider Activity

Perhaps one of the more encouraging signals for investors is Elon Musk’s purchasing additional company shares. Insider buying often reflects management’s confidence in the long-term trajectory of the business and is worth monitoring closely.

Social Media and Sentiment

Despite the positive delivery numbers and insider buying, overall sentiment toward Tesla remains cautious. Social media platforms are a good barometer for public perception, and Tesla has shown some warning signs here. The company’s Instagram following has been declining year over year, raising questions about its global appeal. A shrinking follower base can hint at challenges in sustaining brand momentum, particularly as competition intensifies in the EV market.

What Investors Should Watch Going Forward

Sustainability of Demand: Monitor app downloads and web traffic to see if Tesla continues to attract new customers after the expiration of the tax credit.

Hiring Trends: Continued expansion in job postings would reinforce the idea of long-term growth and innovation.

Insider Buying: If Elon Musk and other executives keep buying shares, it strengthens the case for confidence at the top.

Social Sentiment: Pay attention to whether Tesla can reverse its decline in social media followers and reignite excitement among global consumers.

Competition: Watch for updates from rival automakers, such as Rivian, as the EV landscape is evolving quickly and new entrants could pressure Tesla’s dominance.

Conclusion

Tesla’s record quarter will be remembered as a milestone, with nearly half a million deliveries in just three months. The company continues to exceed expectations and push the boundaries of electric vehicle production. At the same time, investors should look beyond the headline numbers and weigh alternative data points such as hiring trends, app downloads, insider buying, and shifts in social sentiment.

It is also worth remembering that Tesla remains one of the most talked about stocks on Reddit and other online communities. Momentum and hype have played a powerful role in the stock’s past rallies, and they are likely to continue shaping its future. For investors, keeping a close eye on both the fundamentals and the chatter can provide an edge in navigating one of the market’s most closely watched companies.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.