3 Companies Presenting a Shorting Opportunity

November 10, 5:34 pm

As we approach the end of this calendar year, Dillibits have picked three companies that displayed a consistently downward trajectory during the last 12 months. We will closely examine the shorting opportunity presented by Zoom, Overstock, and Opendoor. Zoom's stock price has increased 68% during the 12 months, while the stocks of Overstock and Opendoor have also experienced a 77% and 93% setback, respectively.

We have discussed several businesses in the past, such as Spotify, that displayed strong growth indicators despite the declining stock price. Unlike them, these three companies show little or no growth prospects. Dillibits incorporates multiple alternative benchmarks to provide fundamental insights.

The once-essential video meetings platform Zoom was a game changer during the pandemic for the education industry and many others. Zoom's popularity has decreased since the world returned to normalcy post-pandemic. It may be argued that the company failed to offer a different angle to stay relevant with changing times. The company fell short of its projected sales by $0.1billion in their latest financial outlook, which left wall street disappointed, and alternative insights tell a similar story. The sentiment across multiple stock for forums is a low 61 (out of 100), the web traffic is down 38% in the last 12 months, app downloads have declined 33%, and Google Adspend expenditure is down 62%. These insights tell us a story that is anything but promising.

Online real estate company Opendoor has also slumped 93% since last year. The stock has consistently receded in this period. So much so that the only case Opendoor stock advocates for is to short it. The CEO of the company Eric Wu announced job cutbacks citing the most challenging real estate market in 40 years as one of the reasons. The user sentiment of the company is at a mediocre 57 out of 100. The stock has minimal upside as new job postings are practically negligible. Almost all alternative insights - such as app downloads, webpage traffic, social media mentions, and Google Adspend expenditure - paint a bloomy picture. Nearly all of them fell during the preceding 12 months. There are only 6 open job postings at Opendoor after the company maintained more than 150 available job postings for four months between November 2021 and February 2022.

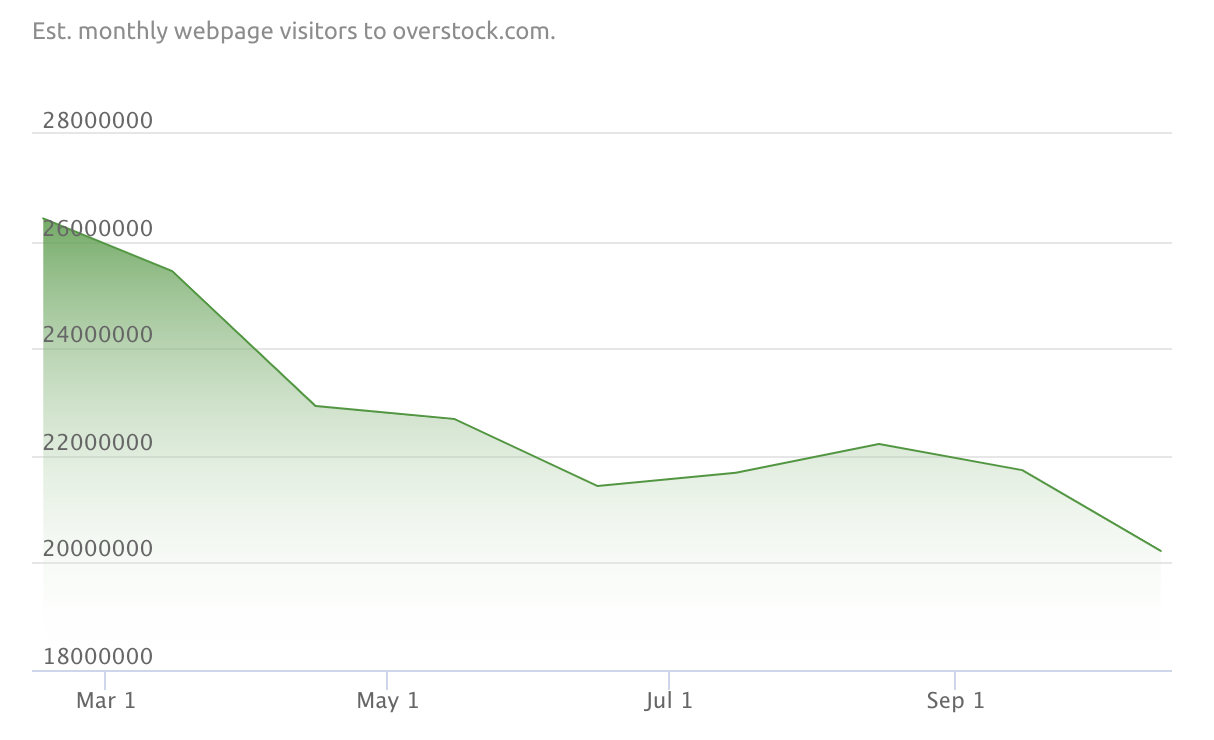

Another company that follows a similar trend in terms of the stock price is the American internet retailer Overstock.com. According to the third quarter financials, Overstock made a $460 million net revenue, which accounts for a 33% decrease year over year. Overstock has dipped 77% during this period, and their open job postings have declined from 90 to 13. Like Opendoor and Zoom, the webpage traffic of the online retailer has also fallen with almost 25% in the last 8 months.

Luckily, even declining stocks allow investors to profit by shorting stocks. Zoom, Opendoor, and Overstock have shown little to no promise lately, and their stock is already declining. The only question investors need to ask themselves is how much more can these stock prices plummet?

Subscribe to our newsletter for more insights!

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.