Alternative Data Suggests: Top 3 Stocks to Consider Shorting This Year

January 15, 2:33 pm

Shorting stocks is a strategy that allows investors to profit when they believe a company’s stock price is likely to decline. While it involves higher risk compared to traditional investing, it can be a valuable tool for hedging or capitalizing on overvalued companies. By analyzing alternative data signals - such as web traffic, app downloads, insider trading, and market sentiment - investors can identify stocks that may be overhyped or facing significant challenges. In this article, we explore three stocks that show potential for shorting in 2025 based on key alternative data trends.

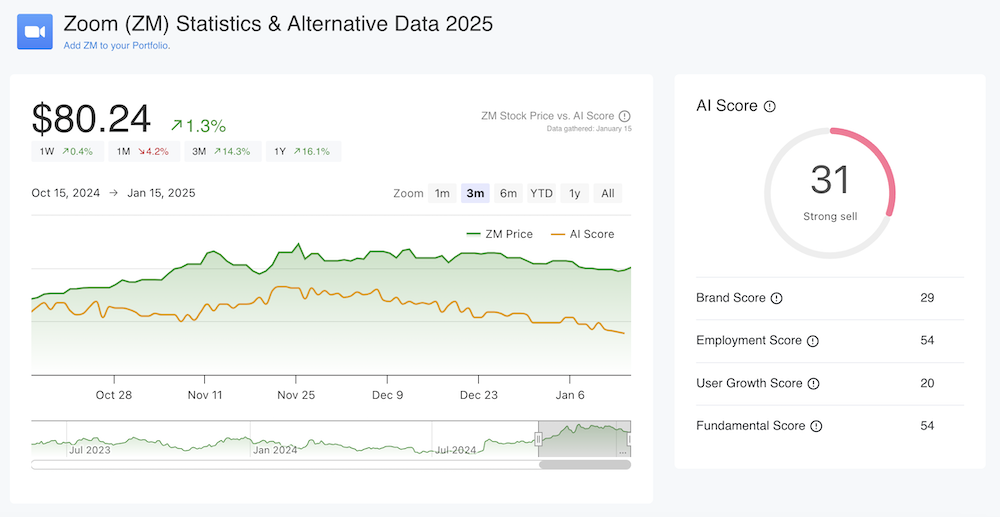

1. Zoom Video Communications (ZM)

Current Price: $80.5

Market Cap: $24.4B

AI Score: 31

Zoom has experienced significant growth since its pandemic-driven peak, but its current alternative data trends are concerning:

- App Downloads: A critical growth proxy is down 5% year-over-year, indicating waning interest in its mobile app.

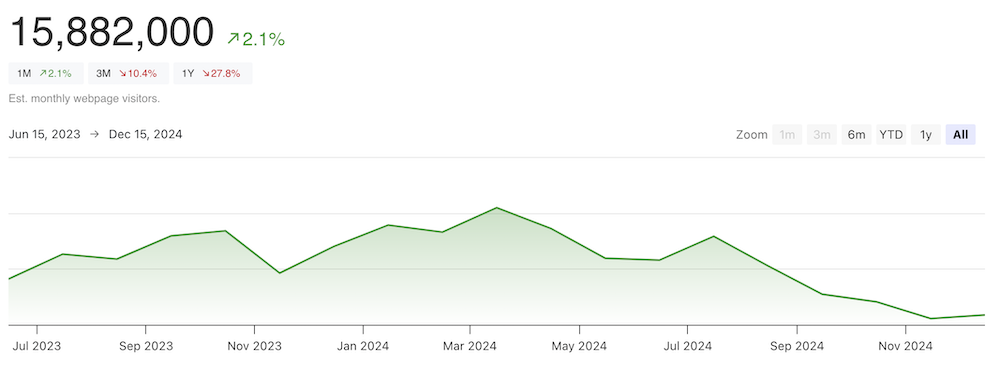

- Web Traffic: Traffic to Zoom's main site, zoom.us, has plummeted 35% compared to last year.

- Insider Selling: The CEO sold shares worth approximately $40 million in the past two months, signaling possible concerns about the company's valuation.

- Social Media Decline: Zoom has been losing followers across platforms like Instagram, Threads, and TikTok, a potential red flag for brand momentum.

- Earnings: While Q3 revenue showed a slight quarter-over-quarter increase (1.3%, reaching $1.18B), growth is insufficient to justify its high market cap.

Zoom’s stagnating user growth and declining engagement make it a potential short candidate for investors cautious about overvalued tech stocks.

2. Choice Hotels International (CHH)

Current Price: $141

Market Cap: $7.9B

AI Score: 39

Despite a 24% year-over-year stock increase, several key metrics indicate Choice Hotels might struggle to sustain its valuation:

- Revenue Decline: The company’s Q4 revenue of $428 million is down 1.7% compared to the previous quarter.

- Web Traffic: Website visits have hit an all-time low, down 10% year-over-year.

- App Downloads: Booking app downloads have dropped a staggering 50% over the past year.

- Insider Selling: Both the CEO and CHRO sold shares recently, suggesting a lack of confidence in the stock.

- Employee Sentiment: Employee business outlook is down 18% year-over-year, reflecting internal challenges.

While the hospitality industry has seen a rebound in travel demand, Choice Hotels' weak digital engagement and insider sell-offs raise concerns about its long-term prospects.

3. CarMax (KMX)

Current Price: $80.7

Market Cap: $12.1B

AI Score: 39

CarMax, a major player in the used car market, faces headwinds despite a 16% year-over-year rise in its stock price:

- Web Traffic: Visits to CarMax’s website are down 27% year-over-year.

- App Downloads: Downloads of the company's mobile apps have fallen 23%, nearing an all-time low.

- Debt Burden: As of November 2024, the company reported $18.67 billion in debt, which significantly overshadows its market value.

- Investor Sentiment: Online forums reflect a bearish sentiment score of 43 out of 100.

Est. Web traffic to carmax.com over time

With declining customer engagement and a hefty debt load, CarMax’s valuation appears vulnerable, making it an attractive target for short sellers.

Key Takeaways for Investors

When considering shorting stocks, always factor in alternative data signals like app downloads, web traffic, insider activity, and sentiment trends. While these three stocks show potential for shorting, it’s crucial to stay updated on market conditions and company developments. Remember, shorting carries inherent risks, so ensure your portfolio is diversified and consider consulting a financial advisor before making investment decisions.

To stay updated on ideas for stocks to shorts, visit Best Stocks to Short

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.