2 Quantum Stocks to Consider: Why D-Wave Quantum and Quantum Computing Might Still Have Room to Run

June 6, 12:11 pm

Quantum stocks have had a spectacular run over the past year. While many sectors in tech have seen a rebound, few have performed with the kind of explosive returns seen in quantum computing companies. Quantum Computing Inc. (QUBT), D-Wave Quantum Inc. (QBTS), and Rigetti Computing (RGTI) are all up over 1,000% in the last 12 months.

But this isn't just a speculative bubble. There's substance behind the surge. Investors are betting big on a future where quantum technology could upend everything from pharmaceuticals to cybersecurity, artificial intelligence, and advanced materials. And when you dig into the numbers and alternative signals, two companies stand out as top picks right now: D-Wave Quantum and Quantum Computing Inc.

Why Quantum Stocks Are Booming

Quantum computing is often described as the next major leap in information technology. Unlike classical computers that use bits (0s and 1s), quantum computers use qubits, which can exist in multiple states simultaneously. This gives them the potential to solve problems that are intractable for today’s most powerful supercomputers.

As the technology matures, institutional investors and governments are pouring billions into the sector. Major tech firms like Google, IBM, and Microsoft are racing to build scalable quantum systems, while startups are finding niches in hardware, software, and quantum-as-a-service platforms. The total addressable market is expected to exceed $100 billion in the next two decades.

But There Are Risks

Quantum computing is still early-stage. Most companies in the space are unprofitable and burning cash. Many will fail. Technologies could take years, even decades, to fully commercialize. Regulatory hurdles, competition from Big Tech, and the uncertainty around which quantum approach will win (gate-based vs. annealing, for example) all present serious risks.

That’s why investor due diligence is critical. Fortunately, our AI-driven signals can help cut through the noise. We analyze everything from job postings and employee growth to social media trends and analyst sentiment. Let’s look at what the data says about the two most promising quantum stocks today.

1. D-Wave Quantum (QBTS)

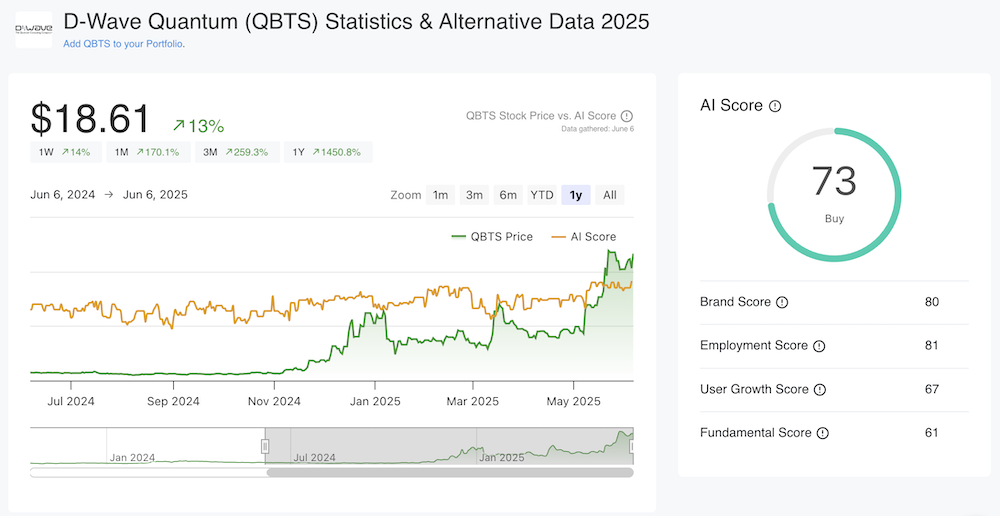

D-Wave Quantum Stock Price & AI Score

3-month performance: +256.8%

AI Score: 73 (Buy)

Analyst Rating: 100% Buy

Twitter Follower Growth (YoY): +42%

D-Wave Quantum is a Canadian company and a pioneer in quantum annealing, a type of quantum computing optimized for solving complex optimization problems. Unlike many peers who are years away from delivering real-world applications, D-Wave already has commercial customers across logistics, finance, and manufacturing.

According to our data, D-Wave’s fundamentals are improving. Revenue is up year over year, and the company is expanding aggressively - evidenced by a spike in job postings and headcount. This kind of internal growth is a strong signal that D-Wave is scaling operations in response to demand. Our AI model rates it a “Buy” based on these factors.

Social sentiment is also trending up. Their Twitter following has grown by 42% in the last year, a sign that D-Wave is attracting interest from both the tech community and investors. Combine that with full buy ratings from analysts, and you have a company with momentum on multiple fronts.

Recent Developments:

- Signed contracts with companies in logistics and national defense.

- Expanded cloud-based quantum computing offerings.

- Growing partner ecosystem including NEC and Deloitte.

In short, D-Wave is not just a research lab - it’s building a real business with real customers. Among all quantum stocks, it stands out as one of the few already generating traction in the enterprise market.

2. Quantum Computing Inc. (QUBT)

3-month performance: +167%

AI Score: 60 (Borderline Buy)

Instagram Follower Growth (YoY): +38.4%

Twitter & YouTube Growth (YoY): Over 100%

Quantum Computing Inc. is a U.S.-based company developing quantum software and hardware solutions designed to make quantum computing more accessible for practical applications in healthcare, logistics, and AI. While its fundamentals are not as strong as D-Wave’s, the company is seeing a huge increase in investor and public interest.

QUBT’s revenue growth and employee expansion are not as robust, but our alternative data shows strong social signals. Over the last year, the company’s Instagram following has grown by 38.4%, and its YouTube and Twitter audiences have more than doubled. This kind of organic growth suggests that the brand is gaining mindshare - a valuable asset in an emerging industry.

While it’s still early for QUBT in terms of execution, the company is investing in building a tech stack that bridges classical and quantum computing. If successful, this strategy could position it well as demand for hybrid computing systems increases.

Recent Developments:

- Released a new quantum photonic chip prototype.

- Formed partnerships to explore quantum AI applications.

- Increased investor visibility through media and conference appearances.

For investors with a higher risk tolerance, Quantum Computing Inc. may represent a speculative bet on the future of accessible, cloud-delivered quantum solutions. The company’s rising visibility suggests it could benefit from momentum-based trading as the quantum narrative grows stronger.

The Bottom Line

The quantum space is heating up. With government support, enterprise adoption, and retail investor interest growing, companies like D-Wave and Quantum Computing could see significant upside in the coming years. While the sector remains high-risk, the potential reward - especially for early movers - is considerable.

D-Wave stands out as the more mature, commercially validated play with strong financial and alternative data signals. Quantum Computing Inc. offers a higher-risk, higher-reward opportunity riding the wave of public enthusiasm and technological ambition.

To stay updated on more Quantum stocks, visit Best Quantum Stocks.

Disclaimer: The information provided is for educational and informational purposes only and should not be construed as financial or investment advice. All investments involve risk, and you should conduct your own research or consult a qualified professional before making any investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.