Under Armour Stock Analysis: Is It Time to Buy, Sell, or Wait on the Sidelines?

February 28, 9:07 am

Under Armour’s stock (UA) is currently trading at $6.4, having dropped 25% over the last twelve months. It has been struggling to keep pace with industry titans such as Nike, Lululemon, and Adidas, amidst stiff competition and changing consumer preferences. Recent quarterly earnings have shown slow or even negative top-line growth, and its profit margin has come under pressure due to rising costs and heavy discounting.

At AltIndex, we combine fundamental analysis with alternative data - including web traffic, social media trends, and hiring activity - to shed light on a company’s momentum and potential turning points in its stock performance.

Fundamental Analysis

Revenue Growth and Profitability

After enjoying rapid expansion in its early days, Under Armour’s sales growth has stagnated. Annual revenue recently hovers around the mid-$5 billion range, reflecting minimal improvement over the past few years. North America - once the company’s growth engine - has exhibited declining sales, underscoring a potential shift in consumer preferences or brand fatigue in its core market.

On the profitability front, while the company’s gross margin has remained respectable at around the high 40% range, net margins are under pressure. Heavy discounting, higher input costs, and inventory challenges have led to diminishing returns. In recent quarters, Under Armour’s net income has barely stayed in positive territory, a notable decline from more robust results several years ago.

Competitive Landscape and Brand Position

Under Armour faces fierce competition from market leaders Nike and Adidas, as well as rapidly growing athleisure-focused brands like Lululemon. Its market share in athletic apparel and footwear is estimated at roughly 4%, which places it a distant fourth behind more entrenched rivals. This relatively small share means Under Armour must continue investing in product innovation and marketing to stay visible.

Historically, the company’s identity has revolved around performance gear - think training and on-field apparel. Yet, consumer trends have strongly favored athleisure, blending style and comfort for everyday wear. While Under Armour is taking steps to pivot more toward fashion-oriented lines and women’s apparel (seeking a bigger slice of the market), it still lags behind leading lifestyle brands. Successful execution on this strategy could unlock a significantly larger audience but is far from guaranteed.

Financial Health and Debt

Despite a challenging retail environment, Under Armour has reduced its debt level in recent years. Its current long-term debt stands around $1.2–1.4 billion, with a healthy debt-to-equity ratio (~0.28), down from higher levels a few years ago. However, servicing that debt requires steady cash flow, which is at risk if sales remain anemic.

The company’s recent legal settlement of $434 million adds another financial wrinkle, although most of it was funded through existing credit lines and on-hand cash. While these moves removed a legal overhang, they also draw down resources that could have gone toward marketing, innovation, or expanding key product lines.

Ongoing Strategic Shifts

Under Armour has embarked on multiple strategic shifts in hopes of reinvigorating growth:

Direct-to-Consumer (DTC) Emphasis: By bolstering e-commerce and brand-owned stores, the company aims to improve its margins and gather better customer data.

International Expansion: Outside North America, certain markets in Europe and Asia have shown modest year-over-year growth, highlighting potential for broader global reach.

Athleisure and Lifestyle Focus: A push into everyday activewear is intended to capture the booming athleisure trend, expand the women’s category, and compete head-on with lifestyle-focused peers.

While these strategies could position Under Armour for a turnaround, they hinge on consistent execution, compelling product offerings, and savvy marketing to regain consumer mindshare.

AltIndex’s Alternative Data Insights on Under Armour

At AltIndex, we track companies digital footprint, also known as Alternative Data, to predict company performance and trends.

Web Traffic and Mobile Apps

In today’s digital era, web traffic is a leading indicator of consumer interest and potential sales growth - especially as Under Armour shifts toward a Direct-to-Consumer model. A sustained decline in site visits can signal flagging interest in the brand’s products or less effective online marketing campaigns. For a company aiming to bolster e-commerce sales and gather first-party customer data, falling traffic could undermine its entire digital growth strategy.

According to our estimates, UnderArmour.com saw a spike in web traffic in December - likely due to holiday shopping - but a drop in January. Moreover, our data suggests that Under Armour’s site traffic lags far behind Nike, Lululemon, and Skechers. Mobile app downloads are also down an estimated 30% over the last three months.

Hiring and Employee Sentiment

The number of open positions at Under Armour has declined by 41% in just three months, down to 466 openings. Employee sentiment, as measured by outlook ratings in employee reviews, has also declined by 7.5% over the past year.

A sharp drop in open positions can indicate cost-cutting or a more cautious growth stance. While prudent downsizing may improve margins in the short run, it can also limit innovation and customer service if key roles go unfilled. Meanwhile, negative employee sentiment often translates into lower productivity, weaker customer engagement, and higher turnover - factors that can hamper a brand’s ability to compete effectively.

Social Media Popularity

Social media channels are essential for modern brand building, community engagement, and direct-to-consumer marketing. Social Media platforms has typically been leading platforms for fashion and athleisure trends, so losing followers there could signal waning appeal among core demographics.

Instagram: Despite having 8.3 million followers on Instagram, Under Armour lost 25,000 followers over the past two months.

Twitter: A similar trend, with net losses in follower count.

TikTok: Conversely, Under Armour gained 15,000 new followers on the platform, bringing its total to 745,000 followers.

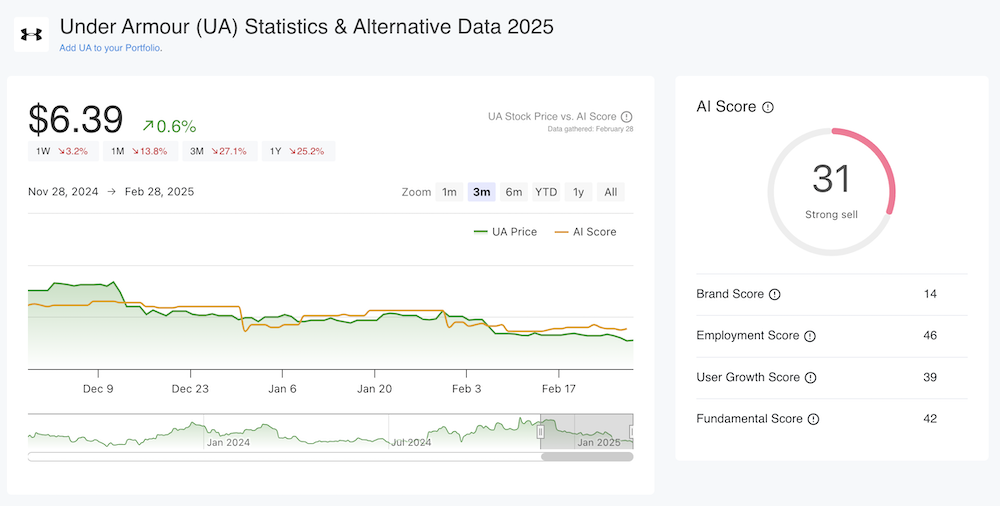

Under Armour Stock Price & AI Score

Is Under Armour a Buy or a Sell?

With the stock at $6.85 (down 26% year-over-year), Under Armour is trading near multi-year lows. For bullish investors, this could present a value opportunity - the share price might rebound if management successfully revamps the product line, invests in marketing, and regains footing in the digital space. That said, negative alternative data (falling website traffic, app downloads, social media followers, and employee outlook) underscores significant execution risks.

Bull Case: If Under Armour leverages its sports pedigree, invests strategically in new product categories (like women’s apparel and athleisure), and reengages digitally, the stock could see an upside from these depressed levels.

Bear Case: Under Armour may continue losing market share if brand interest keeps slipping and if recent restructuring efforts don’t yield growth. In this scenario, the stock may languish or decline further.

For risk-tolerant, long-term investors, Under Armour could be a speculative buy if you believe a turnaround is likely. However, for more conservative investors, the stock’s negative momentum - especially as flagged by alternative data - makes it a probable sell until the company’s fundamental and digital engagement metrics show meaningful improvement.

Disclaimer: The information provided is for educational and informational purposes only and should not be construed as financial or investment advice. All investments involve risk, and you should conduct your own research or consult a qualified professional before making any investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.