Workiva's Ascending Trajectory: Alternative Data Signals a Growth Opportunity

October 11, 6:43 am

Workiva Inc. (NYSE: WK), the world's leading cloud platform for assured, integrated reporting, is poised to release its financial results for the third quarter ended September 30, 2024, following the market close on November 6, 2024. As anticipation builds, investors are keen to understand how this enterprise software company continues to assert its presence in a niche yet expansive market.

A Stock Ready for Revaluation

Currently trading at $78 per share, Workiva's stock has experienced an 11% increase in the last month, although it remains down 17% year-to-date. This dip presents a potential entry point for investors seeking growth stocks with solid fundamentals. Despite operating in the less glamorous realm of compliance-focused finance and ERP software, Workiva addresses a substantial Total Addressable Market (TAM) of $25 billion. The company's consistent mid-teens growth underscores its ability to penetrate this market effectively.

Financial Highlights: Beating Expectations and Raising Guidance

In the second quarter, Workiva reported a 15% year-over-year revenue increase, reaching $177.5 million and surpassing Wall Street's expectations of $175.2 million. Notably, the company's subscription revenue grew by 18% year-over-year, while professional services revenue saw an 8% decline. This shift indicates a favorable revenue mix, emphasizing the scalability and recurring nature of subscription-based models.

Building on this momentum, Workiva has raised its full-year revenue expectations to $727-$729 million, up from the previous guidance of $719-$723 million. This adjustment represents a robust 15-16% year-over-year growth rate, signaling management's confidence in sustained performance.

Strategic Moves and Insider Confidence

Workiva's management has demonstrated its belief in the company's undervaluation by initiating a new $100 million share buyback program. Although this represents approximately 3% of the company's current market cap, it reflects a strategic move to enhance shareholder value.

Adding to this confidence, Martin Vanderploeg, the former CEO, has invested an estimated $750,000 in purchasing shares over the past few weeks. Insider buying is often a strong indicator of a company's promising future, aligning leadership interests with those of shareholders.

Alternative Data Insights: Unveiling Growth Signals

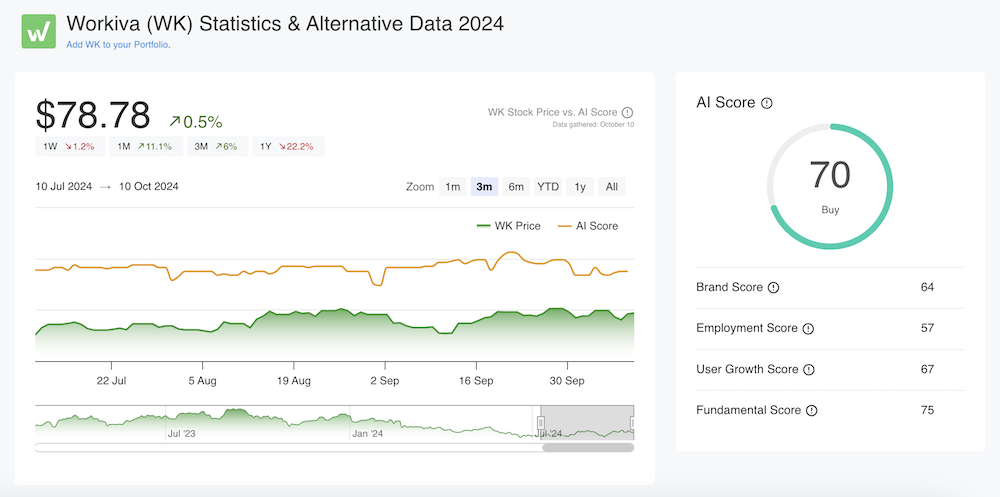

At AltIndex, Workiva boasts an AI score of 70, generating a "buy" signal. This assessment is bolstered not only by the company's solid financials but also by several compelling alternative data insights.

Workiva Stock Price & AI Score

- Analyst Sentiment: Approximately 88% of analysts have a buy rating on Workiva's stock, reflecting a strong consensus on its growth potential.

- Employee Outlook: According to popular review sites, 81% of employees feel positive about the company's future. High employee morale often correlates with enhanced productivity and company performance.

- Social Media Momentum: Workiva's social media presence is on the rise. Instagram followers have increased by 15% year-over-year to 2,830, and YouTube subscribers have surged by 36% year-over-year to 3,270. While the absolute numbers are modest, the growth rates suggest increasing brand engagement and customer interest.

- Web Traffic Surge: Perhaps the most striking signal is the 300% year-over-year increase in web traffic to workiva.com, totaling an estimated 771,000 visitors. This significant uptick indicates heightened interest in Workiva's offerings and could translate into future customer acquisition.

The Stickiness Factor and Market Positioning

Workiva's solutions are deeply integrated into clients' financial processes, making them indispensable and challenging to replace. The company's ability to maintain healthy net retention rates—even as other software companies face declines due to client headcount reductions—highlights the value and stickiness of its offerings.

With a strategic focus on expanding sales capacity, Workiva is well-positioned to capitalize on its growth trajectory. Trading at approximately 5x next year's revenue, the stock offers a compelling valuation relative to its growth prospects.

Conclusion: A Growth Stock on the Rise?

Workiva presents a unique blend of solid financial performance, strategic insider actions, positive analyst and employee sentiment, and encouraging alternative data signals. For investors seeking a growth stock with strong fundamentals and untapped potential, Workiva warrants serious consideration. As the company continues to execute on its strategy and penetrate its vast TAM, there is ample room for upward re-rating, making now an opportune time to invest.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.