Looking to compare Alpha picks against AltIndex?

Discover top stock picking services in our review and see how AltIndex stands out with advanced analytics, smart insights, and stock alerts.

Sign up

No credit card required. Cancel at any time.

Alpha picks Review

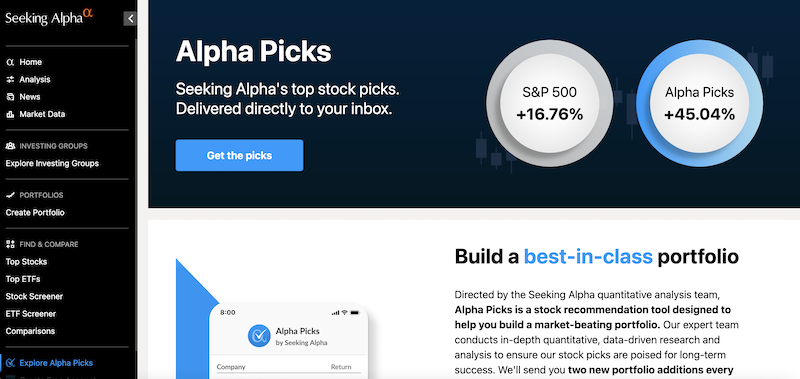

This review of Seeking Alpha's Alpha Picks service highlights its role as a stock recommendation tool that emphasizes a methodical and data-driven approach to portfolio management. Subscribers of this service receive two new portfolio additions each month, chosen based on thorough quantitative analysis and research. Alpha Picks is specifically tailored for investors who prioritize a systematic, data-focused strategy in stock selection.

A critical point of review for Alpha Picks is its market performance. The service has notably outperformed the market by 20% since its launch. The underlying methodology of these stock selections is grounded in an extensive review of company fundamentals, valuation, momentum, analyst estimates, and profitability. This comprehensive approach is designed to pinpoint stocks with potential for growth and provide timely sell alerts when their ratings change, thus aiding subscribers in skillfully navigating the market.

Exclusive benefits are a part of the Alpha Picks subscription package. One significant feature is the access to webinars led by the quant team, which shed light on their analysis methods and strategies. Furthermore, the service maintains transparency by offering up-to-date performance reports, enabling subscribers to monitor the effectiveness and logic behind the stock choices.

Seeking Alpha's Alpha Picks is founded on the philosophy of aiding subscribers in creating a portfolio that consistently beats the market, devoid of subjective or emotional influences. This goal is in line with Seeking Alpha?s wider aim to equip investors with superior, data-centric investment tools. By eliminating subjective biases from investment decisions, Alpha Picks strives to provide a more reliable and stable approach to stock market investment.

To conclude this review, Seeking Alpha's Alpha Picks service melds rigorous quantitative analysis with expert insights, intending to assist investors in achieving above-market returns. Its commitment to focusing on company fundamentals, coupled with exclusive expert webinars and comprehensive performance reviews, renders it an invaluable asset for investors seeking a disciplined, data-driven methodology in portfolio development.

At Altindex, we have:

50.000+

registered members

100+

unique daily stock alerts

High

win-rate on AI Stock picks

100k+

daily insights

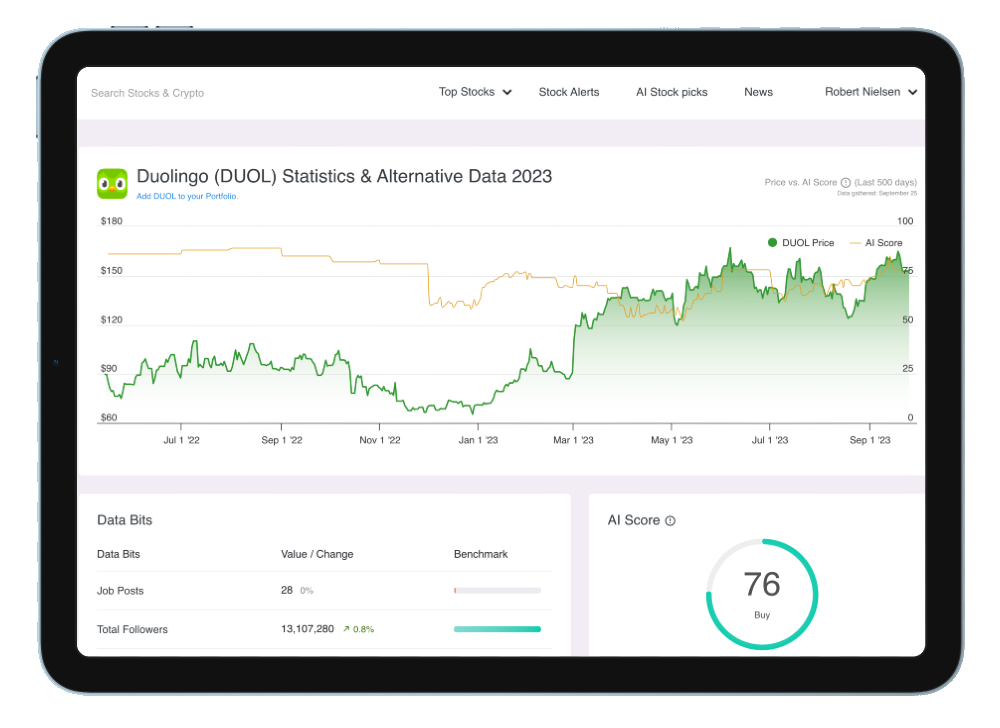

At AltIndex, we employ a comprehensive approach to investment analysis that involves downloading and analyzing all impactful data related to a company's performance. Track stock prices, alternative data insights and stock signals and make more informed investments.

How do AltIndex compare to Alpha picks

AltIndex and Seeking Alpha's Alpha Picks represent two distinct approaches to stock market investing, each catering to different investor needs and preferences.

AltIndex specializes in providing mid to long-term investment insights using a blend of traditional and alternative data, such as social media trends and consumer behavior. Its advanced algorithms, with a notable 75% win rate, analyze thousands of stocks daily, offering actionable buy or sell signals. This service is particularly appealing to retail investors seeking in-depth, data-driven market analysis for longer-term investment strategies. The platform's accessibility for free adds to its appeal for a broad investor base.

In contrast, Seeking Alpha's Alpha Picks service offers a methodical and data-centric approach to stock selection, ideal for investors who prefer a systematic strategy. Subscribers receive two new portfolio additions each month, based on rigorous quantitative analysis of company fundamentals, valuation, momentum, analyst estimates, and profitability. This multi-faceted approach has enabled Alpha Picks to reportedly outperform the market by 20% since its inception. The service also offers exclusive benefits like webinars hosted by the quant team and transparent performance reports, providing subscribers with insights into the analysis process and the success of the stock selections. Alpha Picks' philosophy is to build a market-beating portfolio, removing subjective biases to ensure a more reliable and consistent investment process.

While AltIndex is geared towards providing comprehensive market insights for long-term investment planning using diverse data sources, Alpha Picks focuses on disciplined, data-focused stock selection for portfolio building, backed by expert insights and performance analysis. AltIndex suits those seeking a broader market perspective for long-term investments, whereas Alpha Picks caters to investors looking for a structured approach to outperform the market with a curated portfolio.

Join AltIndex Today!

Just finished reading our comprehensive review? Take your next step into a world of informed investing with AltIndex. Our platform offers unparalleled insights and tools that set us apart from the rest. Don't just read about the competition — experience the AltIndex difference for yourself.

Sign up now and start making smarter investment decisions!

Sign up

AltIndex revolutionizes investing with advanced alternative data analytics, smart insights, and stock alerts, presented in an easy-to-use dashboard powered by comprehensive company data from across the internet.

Legal Disclaimer

The information provided by AltIndex is solely for informational purposes and not a substitute for professional financial advice. Investing in financial markets carries inherent risks, and past performance doesn't guarantee future results. It's crucial to do your research, consult with financial experts, and align your financial objectives and risk tolerance before investing. AltIndex creators and operators are not liable for any financial losses incurred from using this information. Users should exercise caution, seek professional advice, and be prepared for the risks involved in trading and investing in financial assets, only investing what they can afford to lose. The information in this application, derived from publicly available data, is believed to be reliable but may not always be accurate or current. Users should verify information independently and not solely rely on this application for financial decisions. By using AltIndex, you acknowledge that it doesn't offer financial advice and agree to consult a qualified financial advisor before making investment decisions.

© 2025 AltIndex. All rights reserved.

Top Stocks

Trending Stocks

Trending Stocks on WallStreetBets

Trending Stocks on Reddit

Top Stocks

Top Stock Performers Today

Bottom Stock Performers Today

Best Airlines Stocks

Best Bank Stocks

Best Semiconductor Stocks

Best Energy Stocks

Best Fintech Stocks

Best Robotics Stocks

Best Insurance Stocks