Looking to compare Gorilla trades against AltIndex?

Discover top stock picking services in our review and see how AltIndex stands out with advanced analytics, smart insights, and stock alerts.

Sign up

No credit card required. Cancel at any time.

Gorilla trades Review

Gorilla Trades, an online stock picking service founded in 1999 by former Wall Street money manager Ken Burmen, offers a unique approach to stock investment. This service, aimed at both beginners and experts, is designed to assist users in achieving their financial goals with confidence and ease. Burmen developed Gorilla Trades based on a proprietary formula he discovered for identifying stocks with high growth potential, which he successfully utilized to generate substantial profits in the stock market.

The core of Gorilla Trades is its proprietary system that rigorously scans thousands of stocks daily, selecting only those that meet its stringent criteria. These chosen stocks, known as GorillaPicks, are delivered to subscribers' inboxes each night, complete with detailed trading instructions. This systematic approach to stock selection is a key feature of Gorilla Trades service, offering a structured and data-driven strategy for investment.

One of the distinctive aspects of Gorilla Trades is its comprehensive guidance on not just what stocks to buy, but also when to buy them, setting stop loss levels, timing for harvesting profits, and reinvesting strategies. The service continually monitors and adjusts stop loss levels to safeguard capital and secure gains. This review of Gorilla Trades highlights its focus on both stock selection and investment strategy, offering a holistic approach to stock market investing.

With over two decades of experience and a global subscriber base, Gorilla Trades boasts a proven track record. The service claims an average annual return of 21.7% since its inception, significantly outperforming the S&P 500's average of 8.9% during the same period. This performance is a testament to the effectiveness of the Gorilla Trades system and forms a crucial part of any review considering its capabilities.

Beyond being a stock picking service, Gorilla Trades also serves as an educational platform. Subscribers gain insights into various investment strategies, portfolio management, risk control, and emotional discipline in investing. These learning resources are invaluable for anyone looking to enhance their investment skills.

To summarize this review, Gorilla Trades emerges as a comprehensive tool for stock market investment, combining a unique stock selection system with educational resources. This service caters to a wide range of investors, from novices to seasoned market participants, offering tools and insights for informed and strategic investing.

At Altindex, we have:

50.000+

registered members

100+

unique daily stock alerts

High

win-rate on AI Stock picks

100k+

daily insights

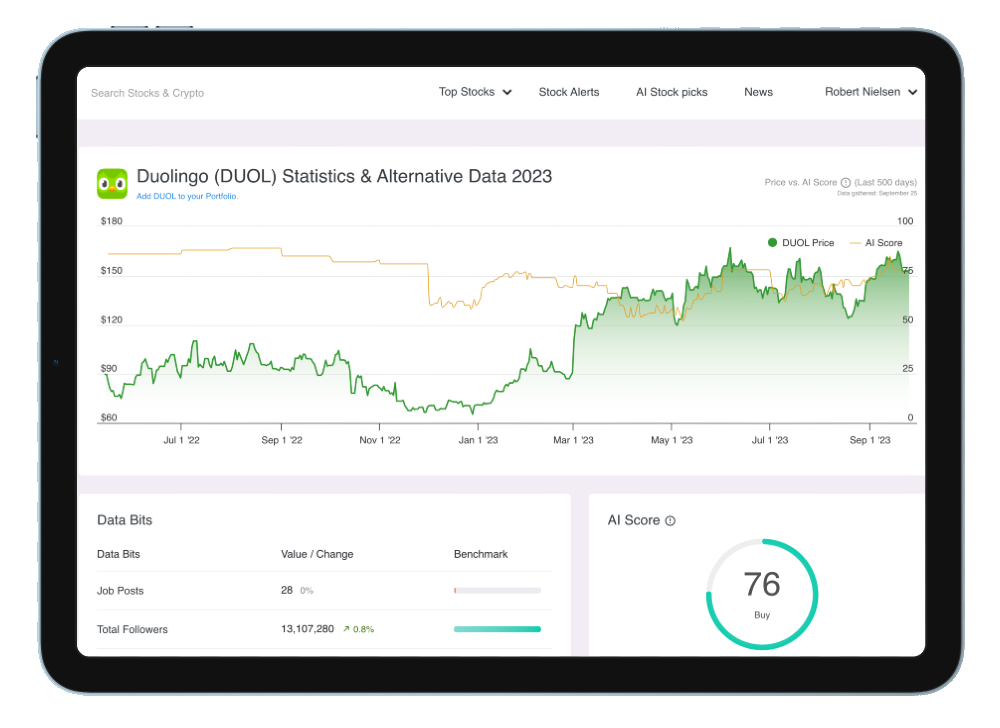

At AltIndex, we employ a comprehensive approach to investment analysis that involves downloading and analyzing all impactful data related to a company's performance. Track stock prices, alternative data insights and stock signals and make more informed investments.

How do AltIndex compare to Gorilla trades

AltIndex and Gorilla Trades offer distinct services for stock market investors, each with its unique approach.

AltIndex is geared towards mid to long-term investors, providing insights using a mix of traditional and alternative data, including social media trends and consumer behavior. It stands out for its advanced algorithms with a 75% win rate, analyzing thousands of stocks daily for actionable buy or sell signals. The platform is accessible for free, appealing to retail investors seeking comprehensive, data-driven market analysis for longer-term investment strategies.

Gorilla Trades, founded by former Wall Street money manager Ken Burmen, targets both beginner and expert investors with its online stock picking service. It utilizes a proprietary formula to identify high-growth potential stocks, known as GorillaPicks, accompanied by detailed trading instructions. The service focuses on a holistic investment approach, offering guidance on when to buy, set stop losses, and strategies for profit-taking. With a proven track record and a focus on educational resources, Gorilla Trades is ideal for investors looking for structured stock selection and portfolio management advice.

In summary, while AltIndex offers data-rich insights for long-term investment planning, Gorilla Trades provides a more focused stock picking service with comprehensive investment strategy guidance and education, catering to active portfolio management.

Join AltIndex Today!

Just finished reading our comprehensive review? Take your next step into a world of informed investing with AltIndex. Our platform offers unparalleled insights and tools that set us apart from the rest. Don't just read about the competition — experience the AltIndex difference for yourself.

Sign up now and start making smarter investment decisions!

Sign up

AltIndex revolutionizes investing with advanced alternative data analytics, smart insights, and stock alerts, presented in an easy-to-use dashboard powered by comprehensive company data from across the internet.

Legal Disclaimer

The information provided by AltIndex is solely for informational purposes and not a substitute for professional financial advice. Investing in financial markets carries inherent risks, and past performance doesn't guarantee future results. It's crucial to do your research, consult with financial experts, and align your financial objectives and risk tolerance before investing. AltIndex creators and operators are not liable for any financial losses incurred from using this information. Users should exercise caution, seek professional advice, and be prepared for the risks involved in trading and investing in financial assets, only investing what they can afford to lose. The information in this application, derived from publicly available data, is believed to be reliable but may not always be accurate or current. Users should verify information independently and not solely rely on this application for financial decisions. By using AltIndex, you acknowledge that it doesn't offer financial advice and agree to consult a qualified financial advisor before making investment decisions.

© 2025 AltIndex. All rights reserved.

Top Stocks

Trending Stocks

Trending Stocks on WallStreetBets

Trending Stocks on Reddit

Top Stocks

Top Stock Performers Today

Bottom Stock Performers Today

Best Airlines Stocks

Best Bank Stocks

Best Semiconductor Stocks

Best Energy Stocks

Best Fintech Stocks

Best Robotics Stocks

Best Insurance Stocks