Looking to compare Thinknum against AltIndex?

Discover top stock picking services in our review and see how AltIndex stands out with advanced analytics, smart insights, and stock alerts.

Sign up

No credit card required. Cancel at any time.

Thinknum Review

Thinknum is a unique and innovative financial data platform that provides users with a wealth of alternative data, which is especially valuable in the world of investment and market analysis. In this review, we'll delve into the features and capabilities that make Thinknum stand out in the crowded field of financial data services.

Firstly, Thinknum's robust data collection methodology is commendable. It aggregates data from a variety of non-traditional sources, such as social media, company websites, and other public domains. This approach enables users to access a diverse range of data points, from job listings and social media mentions to web traffic and supply chain data. This vast array of data is what sets Thinknum apart, offering investors and analysts insights that are not typically available through traditional financial data services.

Another highlight in this review is Thinknum's user-friendly interface and analytical tools. The platform is designed with usability in mind, ensuring that even those with limited technical expertise can navigate it easily. Users can create custom dashboards, generate reports, and perform complex data analyses with relative ease. This accessibility is a significant advantage, as it democratizes access to sophisticated market analysis tools.

Moreover, Thinknum is known for its real-time data tracking capability. This feature is particularly useful for investors and analysts who need up-to-the-minute information to make informed decisions. The speed and accuracy of Thinknum's data updates provide a competitive edge in a fast-paced market environment.

In conclusion, Thinknum stands out as a powerful tool in the realm of financial data and analysis. With its unique data sources, user-friendly interface, and real-time tracking capabilities, it offers a comprehensive solution for market analysts and investors. This review underscores the platform's value in providing alternative data, which is becoming increasingly crucial in today's data-driven investment landscape.

At Altindex, we have:

40k+

registered members

100+

unique daily stock alerts

High

win-rate on AI Stock picks

100k+

daily insights

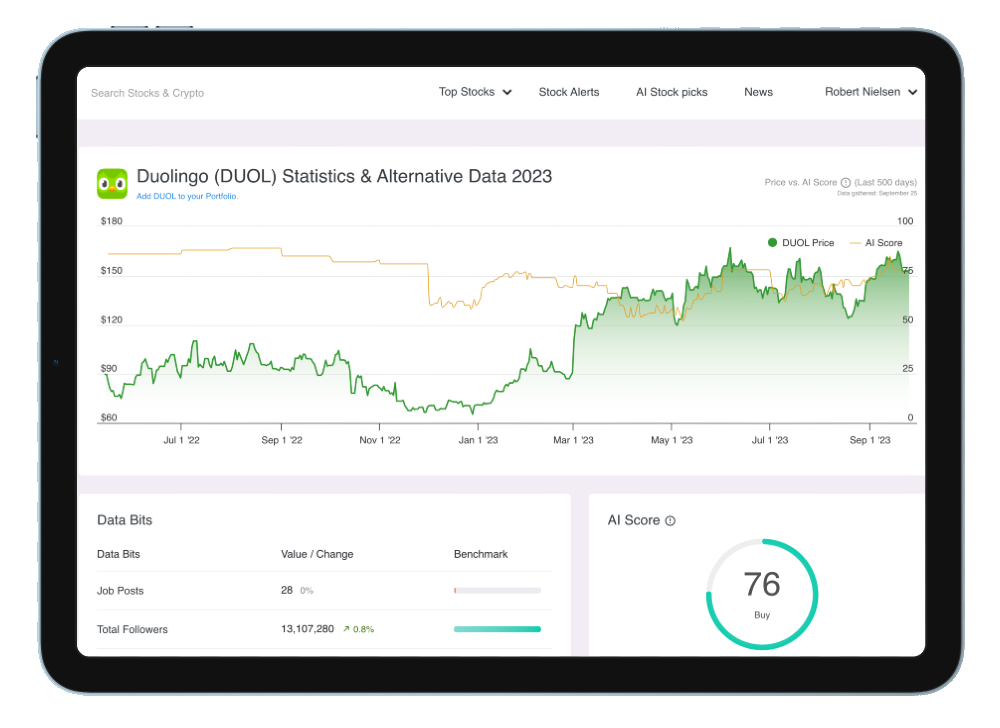

At AltIndex, we employ a comprehensive approach to investment analysis that involves downloading and analyzing all impactful data related to a company's performance. Track stock prices, alternative data insights and stock signals and make more informed investments.

How do AltIndex compare to Thinknum

AltIndex and Thinknum offer distinct but complementary services in the financial analysis and investment research sector, each with a unique approach to providing market insights.

AltIndex specializes in mid to long-term investment insights, leveraging a mix of traditional and alternative data, including social media trends and consumer behavior. Its advanced algorithms, boasting a 75% win rate, analyze thousands of stocks daily to provide actionable buy or sell signals. This approach is particularly beneficial for retail investors seeking comprehensive, data-driven market analysis for long-term strategies. AltIndex's free access makes it attractive to a broad range of investors looking for in-depth market insights.

Thinknum, conversely, is a financial data platform renowned for its collection of alternative data. It aggregates data from various non-traditional sources, like social media, company websites, and other public domains, offering a diverse range of data points. This includes job listings, social media mentions, web traffic, and supply chain data. Thinknum's real-time data tracking capability is a significant advantage for investors and analysts who require timely information to make informed decisions. The platform's user-friendly interface and the breadth of unique data sources provide users with insights not typically available through traditional financial data services.

While AltIndex caters to investors seeking detailed insights for long-term investment planning using a data-rich approach, Thinknum is tailored for those who need comprehensive, alternative data sources for real-time market analysis and investment decision-making. AltIndex offers a broader market perspective for long-term investments, whereas Thinknum provides a tool for financial professionals and market analysts seeking real-time tracking and a wide array of non-traditional data. Each platform serves its respective audience with specialized tools and methodologies, addressing different needs in the financial information and analysis landscape.

Join AltIndex Today!

Just finished reading our comprehensive review? Take your next step into a world of informed investing with AltIndex. Our platform offers unparalleled insights and tools that set us apart from the rest. Don't just read about the competition — experience the AltIndex difference for yourself.

Sign up now and start making smarter investment decisions!

Sign up

AltIndex revolutionizes investing with advanced alternative data analytics, smart insights, and stock alerts, presented in an easy-to-use dashboard powered by comprehensive company data from across the internet.

Legal Disclaimer

The information provided by AltIndex is solely for informational purposes and not a substitute for professional financial advice. Investing in financial markets carries inherent risks, and past performance doesn't guarantee future results. It's crucial to do your research, consult with financial experts, and align your financial objectives and risk tolerance before investing. AltIndex creators and operators are not liable for any financial losses incurred from using this information. Users should exercise caution, seek professional advice, and be prepared for the risks involved in trading and investing in financial assets, only investing what they can afford to lose. The information in this application, derived from publicly available data, is believed to be reliable but may not always be accurate or current. Users should verify information independently and not solely rely on this application for financial decisions. By using AltIndex, you acknowledge that it doesn't offer financial advice and agree to consult a qualified financial advisor before making investment decisions.

© 2025 AltIndex. All rights reserved.

Top Stocks

Trending Stocks

Trending Stocks on WallStreetBets

Trending Stocks on Reddit

Top Stocks

Top Stock Performers Today

Bottom Stock Performers Today

Best Airlines Stocks

Best Bank Stocks

Best Semiconductor Stocks

Best Energy Stocks

Best Fintech Stocks

Best Robotics Stocks

Best Insurance Stocks