Looking to compare Zacks investment research against AltIndex?

Discover top stock picking services in our review and see how AltIndex stands out with advanced analytics, smart insights, and stock alerts.

Sign up

No credit card required. Cancel at any time.

Zacks investment research Review

Zacks Investment Research, known for its independent research and trading tools, caters to investors by focusing on the impact of earnings estimate revisions on stock prices. This review highlights the company's approach and offerings, emphasizing its effectiveness in guiding investment decisions.

Central to Zacks' offerings is the Zacks Rank, a quantitative stock-rating system that assists investors in identifying the best stocks to buy and sell, primarily based on earnings estimates. Since its inception in 1988, the Zacks Rank system has more than doubled the performance of the S&P 500, boasting an average annual gain of +23.96%. This impressive track record underscores the effectiveness of Zacks' methodology in stock selection.

Zacks provides a comprehensive range of products and services, offering professional-grade research, analysis, and recommendations. These services cover various types of investments, including equity, mutual funds, ETFs, and more, making it a versatile resource for diverse investment needs.

Additionally, Zacks offers a free membership option, which grants access to a selection of its tools and insights. Members can benefit from features like the Price Response Indicator, the Most Accurate Estimate, the Earnings ESP (Earnings Surprise Prediction), and more. These tools are designed to provide valuable insights into stock performance and earnings potential, aiding investors in making more informed decisions.

To summarize this review, Zacks Investment Research provides investors with a robust set of tools and analysis, centered on the powerful influence of earnings estimate revisions. With its proven Zacks Rank system and a range of professional-grade services, Zacks stands out as a valuable resource for investors looking to enhance their investment strategy with data-driven insights.

At Altindex, we have:

40k+

registered members

100+

unique daily stock alerts

High

win-rate on AI Stock picks

100k+

daily insights

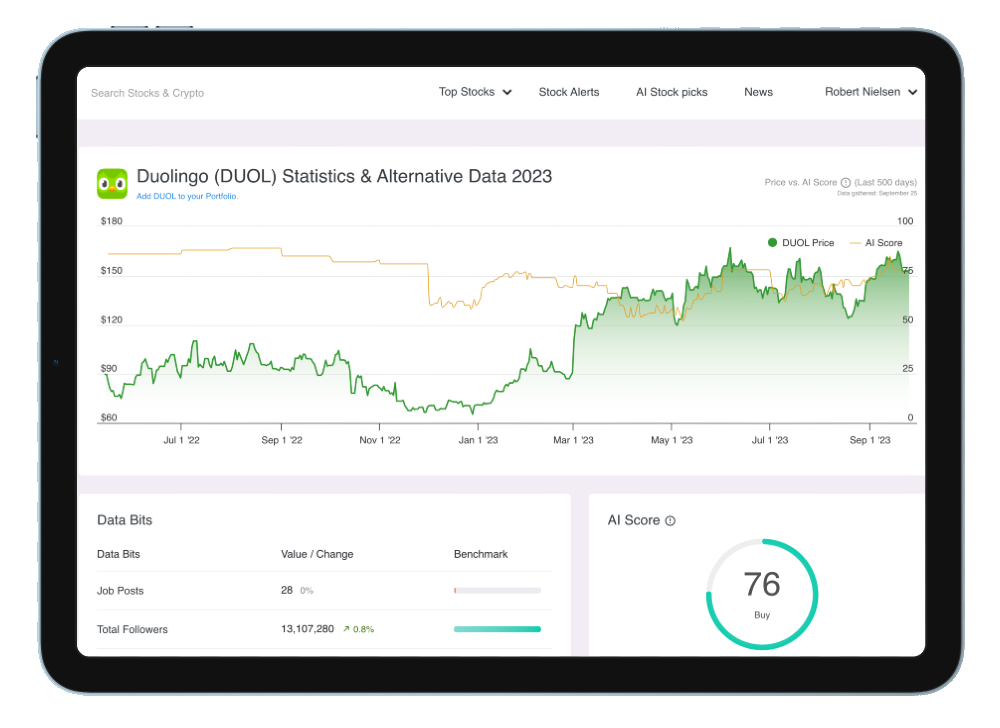

At AltIndex, we employ a comprehensive approach to investment analysis that involves downloading and analyzing all impactful data related to a company's performance. Track stock prices, alternative data insights and stock signals and make more informed investments.

How do AltIndex compare to Zacks investment research

AltIndex and Zacks Investment Research represent different approaches to providing financial insights and investment tools in the stock market.

AltIndex focuses on offering mid to long-term investment insights through a combination of traditional and alternative data, including social media trends and consumer behavior. Utilizing advanced algorithms with a 75% win rate, it analyzes thousands of stocks daily, offering investors actionable buy or sell signals. This approach suits retail investors seeking in-depth, data-driven market analysis for long-term investment strategies. AltIndex's free access makes it particularly appealing for a broad investor base looking for comprehensive market insights.

Zacks Investment Research, on the other hand, is known for its independent research and trading tools, with a particular emphasis on the impact of earnings estimate revisions on stock prices. The cornerstone of Zacks' offerings is the Zacks Rank, a quantitative stock-rating system that helps investors identify the best stocks to buy and sell based on earnings estimates. Since its inception in 1988, the Zacks Rank system has achieved impressive performance, more than doubling the S&P 500's return with an average annual gain of +23.96%. Zacks provides a wide range of products and services, including research, analysis, and recommendations covering various investment types like equity, mutual funds, and ETFs. It also offers a free membership with access to tools such as the Price Response Indicator and the Earnings ESP, aiding investors in making informed decisions.

While AltIndex is tailored for investors seeking detailed investment insights for longer-term strategies using a diverse range of data sources, Zacks Investment Research caters to those looking for a data-driven approach to stock selection, primarily based on earnings estimates. AltIndex offers a broader market perspective for long-term investments, whereas Zacks provides tools and analysis focused on identifying stock performance potential, particularly in the short to medium term. Each platform serves its audience with specialized tools and methodologies, addressing different aspects of stock market investing.

Join AltIndex Today!

Just finished reading our comprehensive review? Take your next step into a world of informed investing with AltIndex. Our platform offers unparalleled insights and tools that set us apart from the rest. Don't just read about the competition — experience the AltIndex difference for yourself.

Sign up now and start making smarter investment decisions!

Sign up

AltIndex revolutionizes investing with advanced alternative data analytics, smart insights, and stock alerts, presented in an easy-to-use dashboard powered by comprehensive company data from across the internet.

Legal Disclaimer

The information provided by AltIndex is solely for informational purposes and not a substitute for professional financial advice. Investing in financial markets carries inherent risks, and past performance doesn't guarantee future results. It's crucial to do your research, consult with financial experts, and align your financial objectives and risk tolerance before investing. AltIndex creators and operators are not liable for any financial losses incurred from using this information. Users should exercise caution, seek professional advice, and be prepared for the risks involved in trading and investing in financial assets, only investing what they can afford to lose. The information in this application, derived from publicly available data, is believed to be reliable but may not always be accurate or current. Users should verify information independently and not solely rely on this application for financial decisions. By using AltIndex, you acknowledge that it doesn't offer financial advice and agree to consult a qualified financial advisor before making investment decisions.

© 2025 AltIndex. All rights reserved.

Top Stocks

Trending Stocks

Trending Stocks on WallStreetBets

Trending Stocks on Reddit

Top Stocks

Top Stock Performers Today

Bottom Stock Performers Today

Best Airlines Stocks

Best Bank Stocks

Best Semiconductor Stocks

Best Energy Stocks

Best Fintech Stocks

Best Robotics Stocks

Best Insurance Stocks