C3.ai Stock Plunges: AltIndex’s Alternative Data Insights Point to a Troubled Path Ahead

September 5, 9:02 am

Shares of C3.ai, a leader in enterprise artificial intelligence software, plummeted by nearly 15% on Thursday, following a weaker-than-expected earnings report. The company's subscription revenue, a critical component of its business, came in at $73.5 million, falling short of LSEG's estimate of $79.1 million. This shortfall highlights the difficulties C3.ai is facing as its pilot customers are slow to convert to full-paying subscribers. High interest rates and economic uncertainty have further compounded the issue, leading enterprises to adopt a more cautious approach to spending.

For the first quarter, C3.ai reported total revenue of $87.2 million, beating expectations of $86.9 million and reflecting a 21% year-over-year increase. However, despite this growth, the market remains concerned about the sustainability of the company’s business model and the pressure on gross margins. According to management, the higher mix of pilot programs, which come with a greater cost of revenue, is weighing on profitability. Moreover, the company’s investment in sales, research and development, and marketing is expected to put further pressure on operating margins in the short term.

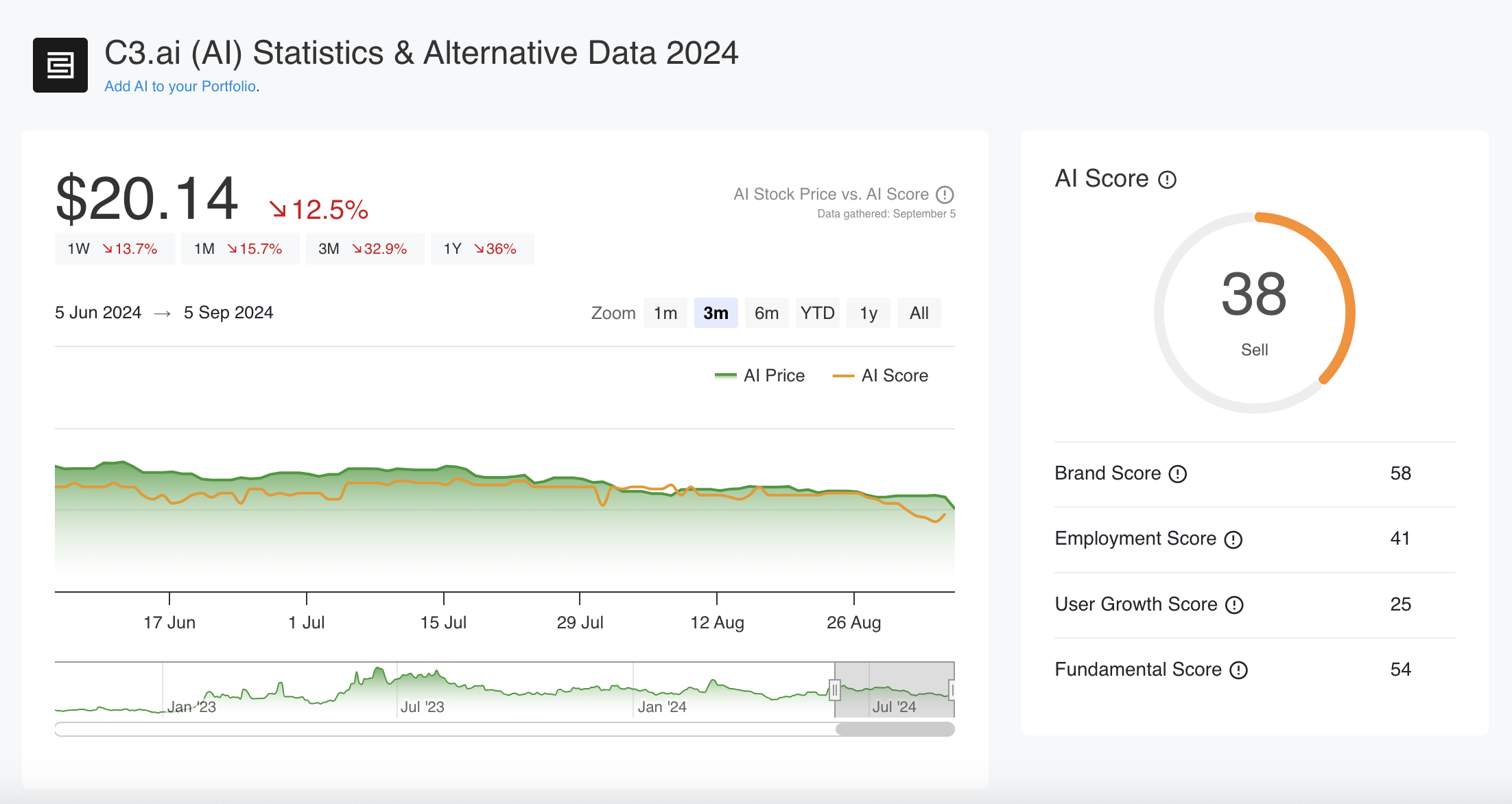

A dropping AI Score

At AltIndex, we foresaw this stock price decline due to troubling signals detected by our AI-powered alternative data analysis. Over the past several weeks, our AI score for C3.ai has been steadily dropping. This is largely attributed to a combination of worrisome financials, negative sentiment across online stock forums, and a significant drop in business outlook from employees.

C3.ai Dashboard with Price and AI Score

The employee outlook data is particularly concerning. Two years ago, over 80% of employees held a positive view of the company’s future, but today, that number has dropped to just 47%. Employee reviews paint a grim picture, with complaints about poor work-life balance, high attrition rates, and ineffective management. One employee review even stated, "The morale at C3 is low, and it's so sad because great people are working here who have to deal with this archaic company every day".

History has shown a correlation between a company’s stock performance and the morale of its employees. When the internal outlook dims, it often manifests in the company’s overall performance. And while CEO Thomas Siebel has remained optimistic, insisting that the company is in good health and that the market is overreacting, our alternative data indicates several significant challenges ahead.

What's next?

For investors with a higher risk tolerance, C3.ai’s stock price dip could be seen as an opportunity. However, from an alternative data perspective, it’s clear that this is not yet a straightforward "buy." With declining employee sentiment, financial pressure, and slow customer conversion, C3.ai has obstacles to overcome before it can be considered a reliable long-term investment.

At AltIndex, we will continue to monitor these trends, providing our users with the most up-to-date insights to help guide their investment decisions. For now, the data suggests caution, as the path to recovery for C3.ai remains uncertain.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.