The alternative data investment strategy that outperforms the S&P 500

June 15, 6:57 am

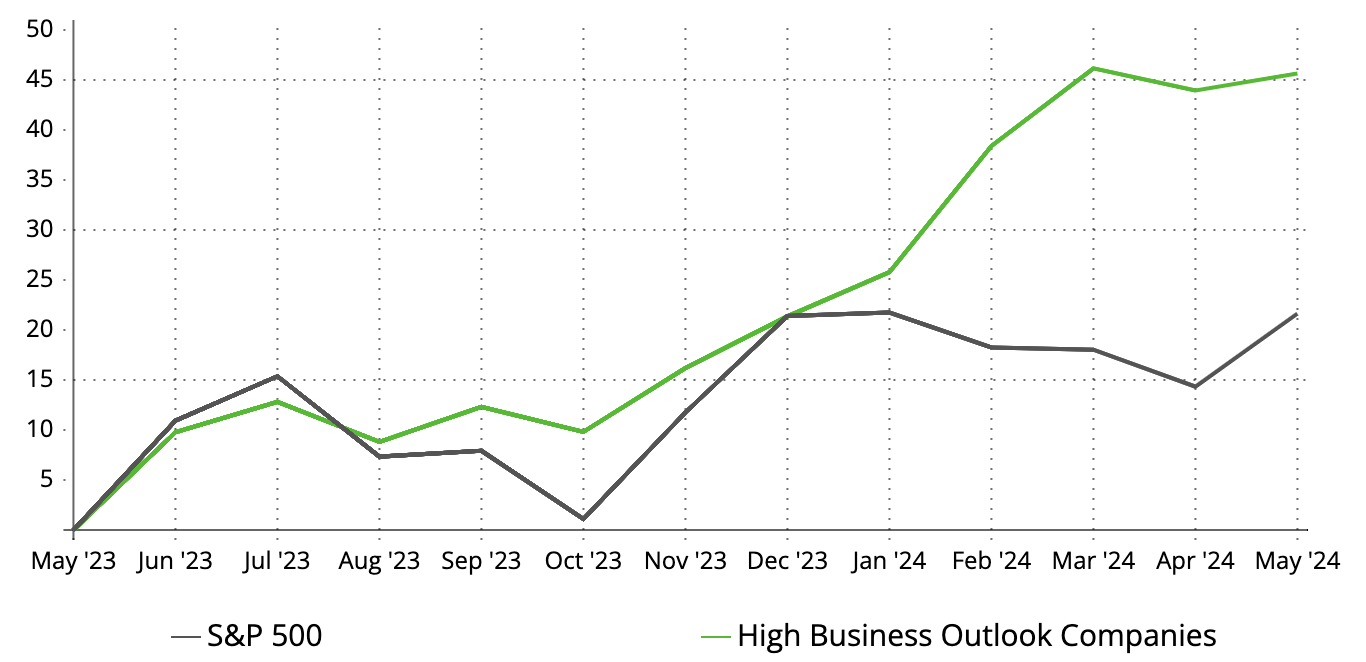

Over the past year, the S&P 500 has shown impressive growth with gains of 25%. However, a distinct investment strategy has been consistently outpacing this traditional benchmark. At AltIndex, we leverage alternative data from thousands of companies, and our analysis reveals that those with a high business outlook - derived from employee reviews on platforms like Glassdoor and Indeed - tend to outperform others in the stock market.

Companies with High Outlook Up 45%

In the last twelve months, companies with a predominantly positive business outlook (where over 80% of employee reviews reflect positive sentiments) have experienced an average stock price increase of 45%. This correlation isn't merely coincidental. Employees are often privy to the inner workings of their companies, including strategic direction and operational health. A positive employee sentiment typically indicates a robust internal environment, which can translate into higher productivity and, ultimately, better financial performance.

Change in Price of stocks in the S&P 500 vs companies with a high Business Outlook

For instance, Nvidia’s stock has surged by 219%, ServiceNow by 67%, and E.L.F. Beauty by 88.5%. These companies not only enjoyed high business outlook ratings but also significant stock price increases, reflecting the direct impact of internal morale on financial success.

| Company | Business Outlook May '23 | Change in Price | |

|---|---|---|---|

|

NvidiaNVDA |

96 / 100 | 219% |

|

MakeMyTripMMYT |

87 / 100 | 209% |

|

AudioEyeAEYE |

87 / 100 | 207% |

|

E.L.F CosmeticsELF |

84 / 100 | 88% |

|

ServiceNowNOW |

92 / 100 | 62% |

Moreover, a historical perspective reinforces the efficacy of this strategy. Consider two years ago, when the S&P 500 saw a modest increase of just 2% year over year, in contrast, companies identified by AltIndex as having a high business outlook achieved an average stock price rise of 10%.

High Outlooks Don't Always Guarantee Success

However, this strategy, while potent, is not without its risks. Among the companies that met our criteria for a positive business outlook, 73% saw their stock prices increase, whereas 27% experienced declines. For example, Expensify's business outlook dropped from 91 to 81, Nauticus Robotics dramatically fell from 100 to 21, and Vuzix decreased from 88 to 68. These declines in employee sentiment were mirrored by corresponding drops in stock prices, highlighting the predictive value of deteriorating internal perceptions but also that this strategy is not bullet proof.

Always look underneath the data

While employee reviews are a powerful indicator of a company’s potential, the validity of this data depends heavily on the volume of reviews. A substantial number of reviews help ensure that the business outlook is not only more accurate but also less susceptible to manipulation and more representative of the company as a whole.

The Power of Alternative Data

In the dynamic world of investing, alternative data provides a crucial edge by uncovering insights that traditional financial metrics might miss. At AltIndex, we specialize in leveraging this kind of data - Business Outlook derived from employee reviews being just one example - to deepen our understanding of a company’s potential. This allows our members to craft investment strategies that are not only data-driven but also highly responsive to trends that conventional analysis may overlook.

By joining AltIndex, you'll gain access to these valuable insights and stay ahead of the curve. Sign up today and empower yourself with the tools (such as our Stock screener where you can filter on Business outlook) to make more informed investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.