How AltIndex Predicted Dollar Tree's Downfall with Alternative Data Insights

September 4, 4:01 pm

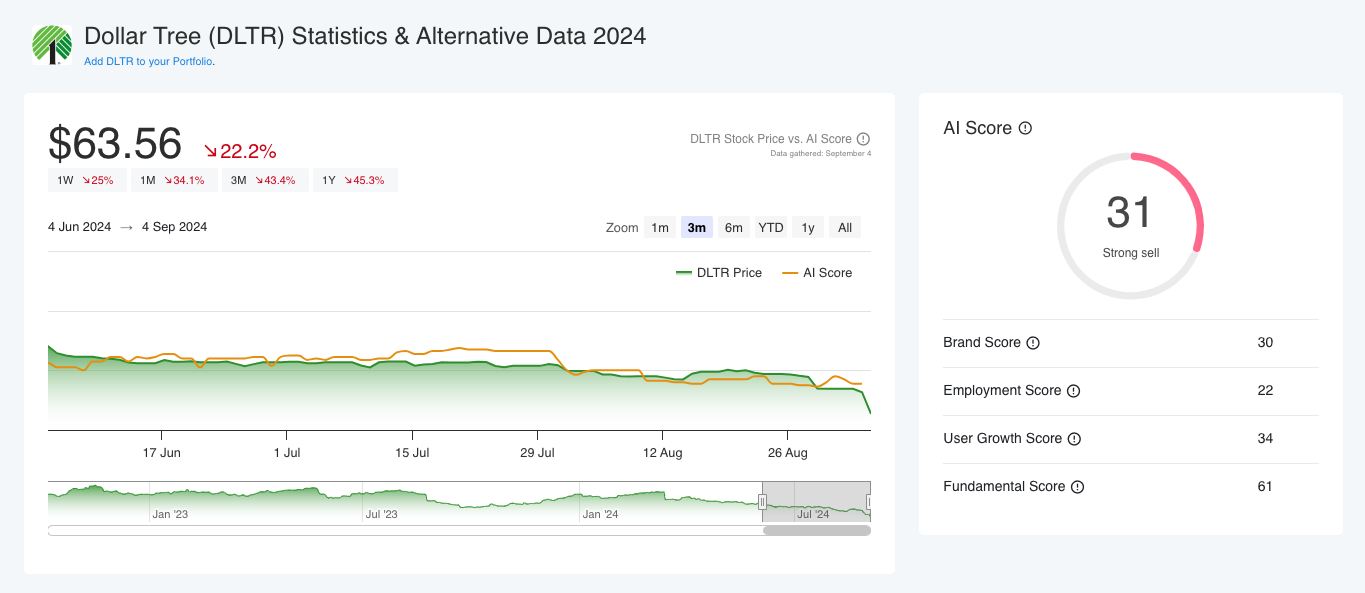

At AltIndex, we specialize in using alternative data to help investors make more informed decisions. In the case of Dollar Tree (DLTR), we identified the red flags early, and our AI score dropped well before the broader market reacted. Here's how we foresaw the retailer's downturn, which has since resulted in a significant decline in stock price.

The AI Score Signals a Sell

In late July, our AI score for Dollar Tree dropped from 51 to 37, triggering a sell signal. At that time, the stock was trading at around $105 per share. This drop wasn't an arbitrary signal—it was based on a confluence of factors that our algorithms picked up, even as traditional financial analysts were still recommending a hold or buy.

Dollar Tree Dashboard with Price and AI Score

What the Data Showed

Several key indicators contributed to the falling AI score:

Social Media Stagnation: Dollar Tree saw almost no growth in its social media presence, with single-digit growth on Facebook over the past 12 months and a decline in Twitter followers. Social media trends often mirror brand health, and in this case, the company’s flatlining presence hinted at reduced customer engagement.

Decreased Web Traffic: Perhaps the most concerning data point was a 25% year-over-year drop in web traffic. This decline indicated that fewer customers were visiting Dollar Tree’s site, signaling waning interest in the brand—critical information for investors focused on growth potential.

Employee Sentiment : Internally, things were also deteriorating. Employee sentiment fell, as revealed through our alternative data sources tracking company reviews and insider feedback. A drop in employee morale often signals deeper operational challenges that can negatively impact performance.

Forum Sentiment: Discussions on online stock forums echoed these concerns, with sentiment dropping as well. These forums serve as a valuable tool for gauging investor perception and outlook, and when they turn negative, it often signals a broader shift in market sentiment.

Financial Struggles Confirmed

The company’s most recent earnings report confirmed many of these concerns. Dollar Tree missed both earnings and revenue expectations for its fiscal second quarter ended August 3. The retailer reported earnings per share of 97 cents, falling short of the $1.04 expected, and revenue of $7.38 billion, missing the $7.49 billion expected by analysts.

What stood out most was the company's decision to cut its full-year outlook. Dollar Tree now expects net sales between $30.6 billion and $30.9 billion, down from its previous guidance of $31 billion to $32 billion. It also slashed its earnings per share outlook to between $5.20 and $5.60, down from the previous range of $6.50 to $7. These revisions reflect growing pressures on Dollar Tree’s middle- and higher-income customer base, a crucial driver of its overall revenue.

The Market Reacts

Today, Dollar Tree shares plummeted over 22% following the earnings release and downward revisions. The stock has now dropped almost 40% since AltIndex issued the sell signal in July, giving short-selling investors a meaningful opportunity to profit.

What’s Next for Dollar Tree?

Looking ahead, alternative data continues to paint a cautious picture for Dollar Tree. With no significant improvement in social media engagement, a continued downward trend in web traffic, and stagnant employee sentiment, it’s difficult to see a catalyst for a stock rebound in the near future. Investors should remain wary, as the company struggles to adapt to its shifting customer base and operational pressures.

AltIndex will continue to monitor these signals, but for now, the sell signal remains in place. Our AI score shows that there is still considerable risk for those looking to buy into Dollar Tree at these lower levels.

Sign up

At AltIndex, our members receive stock alerts with buy and sell signals directly through our weekly newsletters, keeping them ahead of the market. By using alternative data insights like the ones that predicted Dollar Tree’s downfall, you can stay informed about critical trends before traditional data points catch up. Sign up today to get access to more alternative data insights to stay ahead of the curve.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.